- United States

- /

- Healthcare Services

- /

- NYSE:HNGE

Hinge Health (HNGE): Evaluating Valuation Following Recent Share Price Decline and Growth-Loss Dynamics

Reviewed by Simply Wall St

Hinge Health (HNGE) shares have lagged in the past month, down 17%, with investor attention focused on the company’s latest results showing strong annual revenue growth but ongoing net losses. The disconnect between solid sales and negative earnings continues to shape its valuation.

See our latest analysis for Hinge Health.

Hinge Health’s 30-day share price return of -16.9% has extended a trend that has seen momentum fade in recent weeks; however, the stock remains up 9% year-to-date. Investors seem to be recalibrating expectations as growth and losses compete for the spotlight in a market that often revalues fast-moving healthcare names quickly.

Wondering what other healthcare innovators could surprise this year? Discover new opportunities with our curated See the full list for free..

The big question facing investors now is whether Hinge Health’s sharp decline has created an attractive entry point, or if the market has already factored in all foreseeable growth for this ambitious digital health company.

Price-to-Sales of 6x: Is it justified?

At its last close of $40.96, Hinge Health’s shares trade at 6 times sales, making it notably more expensive than the US healthcare industry average of 1.3x. This stands out in a sector known for rapid shifts in valuation, where significant growth or steep losses can quickly change comparisons.

The price-to-sales (P/S) ratio measures how much investors are willing to pay for each dollar of company revenue. For Hinge Health, a high P/S is often observed in rapidly expanding, disruptive healthcare firms, reflecting strong growth prospects but also creating pressure for the company to deliver future growth and margin improvement.

Despite being unprofitable today, Hinge Health’s 16.5% annual revenue growth forecast outpaces the US market average, which can partially justify a higher valuation. However, with a P/S significantly above sector norms, the market is clearly pricing in continued double-digit expansion. The current P/S of 6x is close to the estimated fair price-to-sales ratio of 6.2x, a level which models suggest the market could regard as justified if growth materializes as forecast.

Explore the SWS fair ratio for Hinge Health

Result: Price-to-Sales of 6x (ABOUT RIGHT)

However, ongoing net losses and a sharp 27% decline over 90 days could challenge bullish expectations if improvements do not materialize soon.

Find out about the key risks to this Hinge Health narrative.

Another View: What Does the DCF Model Say?

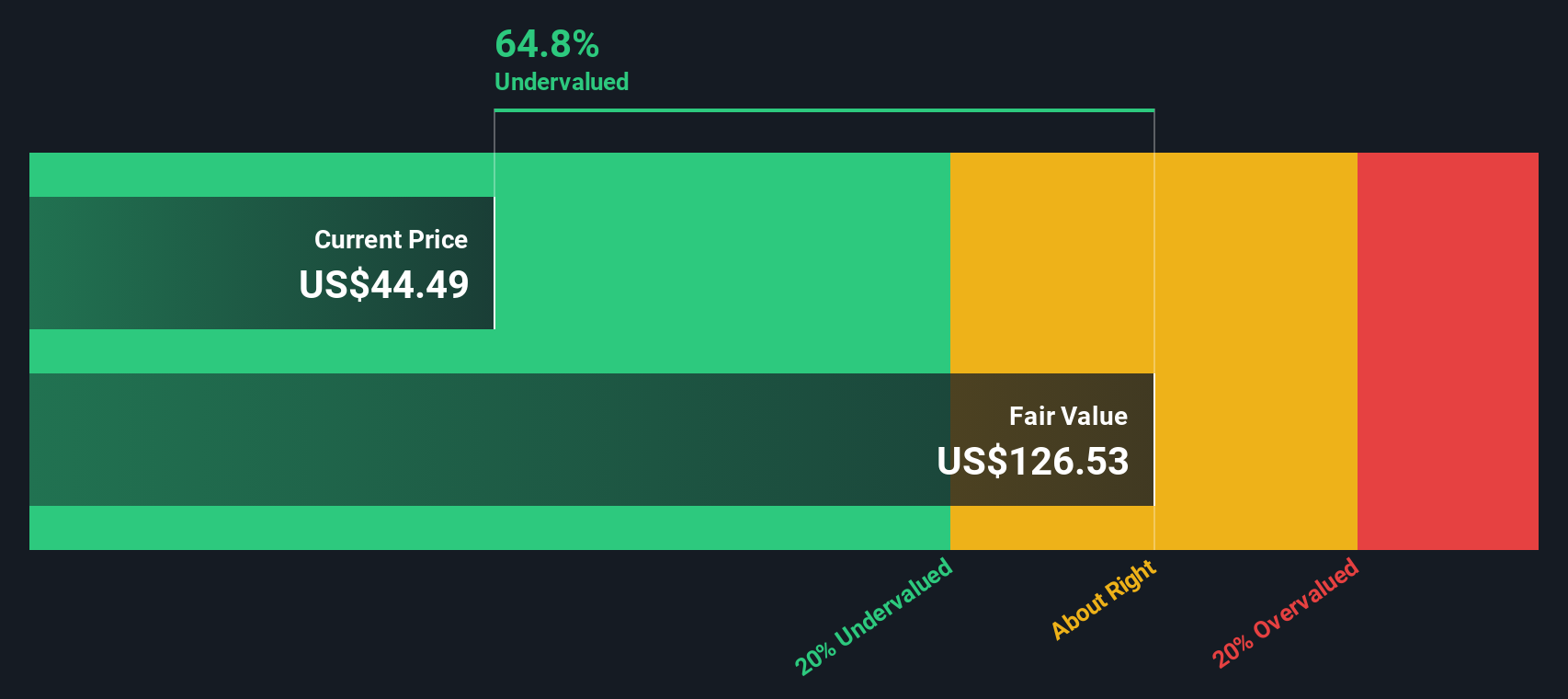

While Hinge Health appears fairly valued on a sales basis, our DCF model tells a different story. It estimates the stock’s fair value at $122.72, meaning shares could be trading at a significant discount to future cash flow expectations. Is the market missing something, or are risks holding this price back?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hinge Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hinge Health Narrative

If these conclusions do not quite fit with your own perspective or if you enjoy a hands-on approach, you can analyze the numbers yourself and shape your own narrative in just minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Hinge Health.

Looking for more investment ideas?

If you are serious about building a winning portfolio, you cannot afford to miss out on new opportunities that others overlook. Put the power of smart screening to work for you.

- Spot early movers among up-and-coming innovators by checking out these 3577 penny stocks with strong financials, which could be positioned for potential breakout growth.

- Gain an edge in artificial intelligence by targeting these 26 AI penny stocks, companies driving advancements across industries.

- Enhance your income potential and stay ahead of market trends with these 16 dividend stocks with yields > 3%, selections that have historically delivered strong yields and financial stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hinge Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HNGE

Hinge Health

Focuses on scaling and automating the delivery of healthcare services.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives