- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Menopause Care Expansion Could Be a Game Changer for Hims & Hers Health (HIMS)

Reviewed by Sasha Jovanovic

- Earlier this month, Hims & Hers Health, Inc. launched a new women’s health specialty offering personalized, affordable treatment plans for perimenopause and menopause via its Hers platform, now serving over half a million subscribers.

- This expansion addresses a significant gap in accessible menopause care and further strengthens the company's focus on breaking barriers to women's health services.

- We'll examine how the new menopause specialty could influence Hims & Hers Health’s investment narrative and growth strategy.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Hims & Hers Health Investment Narrative Recap

To be a shareholder in Hims & Hers Health today, you need to believe in its strategy of becoming the go-to digital platform for personalized health across diverse segments, driven by rapid subscriber growth and continuous expansion into underserved markets. While the launch of its new menopause offering increases platform breadth, it does not materially change the immediate catalyst, which remains user growth and retention within high-demand areas like weight loss, nor does it reduce the main risk of concentrated revenue exposure in these competitive categories.

Among recent developments, the FDA warning letter on compounded semaglutide is highly relevant, as it points to ongoing regulatory scrutiny of the company's fastest-growing weight loss segment. With regulatory vigilance and changing rules posing persistent challenges, this continues to be a key risk to watch in the context of margin pressure and product expansion efforts.

On the other hand, with growing regulatory oversight in categories like compounded medications, investors should be aware that ...

Read the full narrative on Hims & Hers Health (it's free!)

Hims & Hers Health's outlook anticipates $3.3 billion in revenue and $261.3 million in earnings by 2028. This reflects an annual revenue growth rate of 18.3% and a $67.7 million increase in earnings from the current level of $193.6 million.

Uncover how Hims & Hers Health's forecasts yield a $47.42 fair value, a 3% downside to its current price.

Exploring Other Perspectives

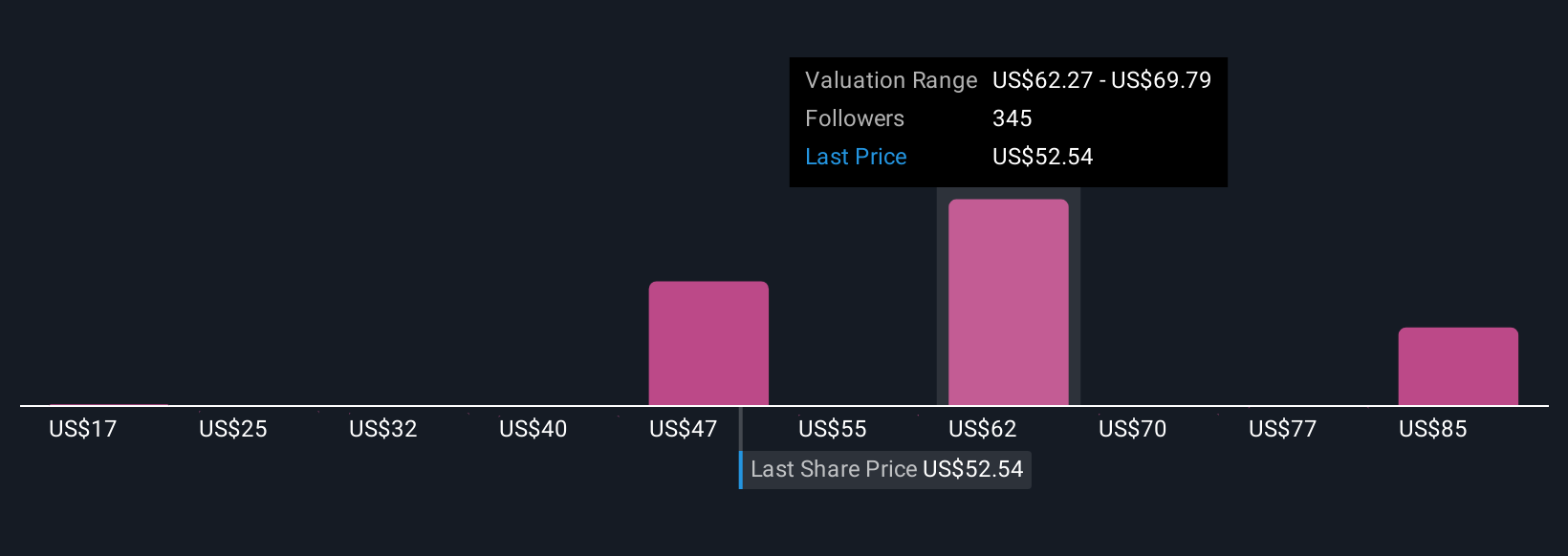

Fair value estimates for Hims & Hers from 34 Simply Wall St Community members range from US$41.38 to US$97.04 per share. Despite expanding into women's health, regulatory hurdles in core segments still shape differing performance outlooks, consider various viewpoints for a fuller picture.

Explore 34 other fair value estimates on Hims & Hers Health - why the stock might be worth 15% less than the current price!

Build Your Own Hims & Hers Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hims & Hers Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hims & Hers Health's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives