- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Does the Recent Pharmacy Partnership Signal a New Value Opportunity for Hims & Hers Health?

Reviewed by Bailey Pemberton

- Wondering if Hims & Hers Health is a hidden gem or just generating buzz? Let’s dig into what’s driving all the talk about its value.

- This stock has delivered a 46.7% gain year-to-date and a whopping 91.4% in the past year, but it has seen some turbulence lately, dropping 41.1% over the past month.

- Part of these rapid price moves stems from recent headlines, including the company’s expansion into new telehealth categories and partnerships with retail pharmacies. Investors are weighing whether this story is about fast growth, evolving risks, or a bit of both.

- On our six-point value check, Hims & Hers Health scores 2 out of 6 for being undervalued. There is room for debate on whether it is truly a bargain. Coming up, we will delve into how traditional valuation methods stack up for Hims & Hers Health and introduce a more insightful way to look at its value story.

Hims & Hers Health scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hims & Hers Health Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them back to today’s dollars. This method provides a way to assess what the company’s shares could be worth based on expected performance, rather than just recent headlines or market sentiment.

For Hims & Hers Health, current free cash flow stands at $189.4 Million. Analysts expect this to see substantial growth, with projections estimating free cash flow could rise to $704.4 Million by 2035. It is important to note that analyst estimates only extend about five years out. Projections beyond that are extrapolated using broader trends and company guidance.

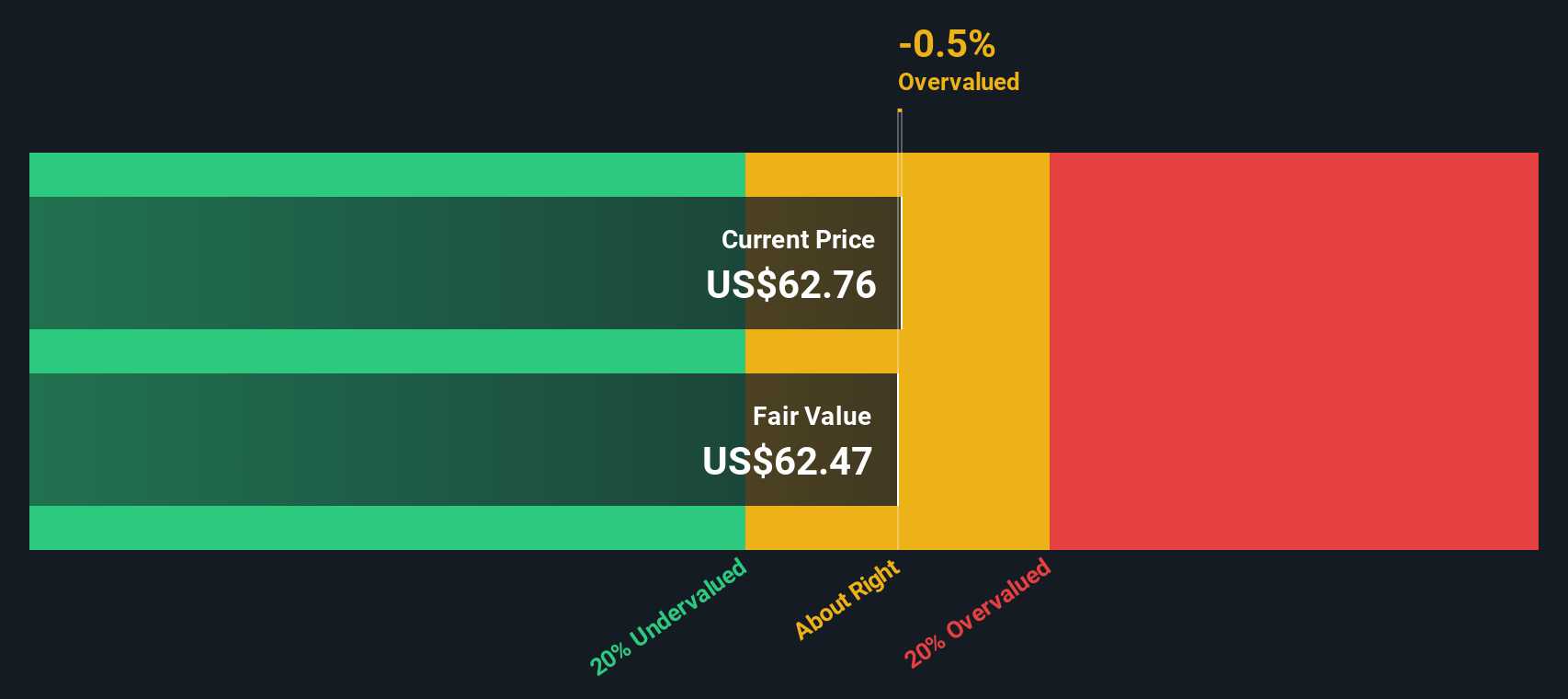

After taking all these future cash flows into consideration and discounting them with the DCF method, the estimated intrinsic value for Hims & Hers Health comes to $57.99 per share. At present, the DCF model implies the stock is trading at a 36.2% discount to this value, suggesting it is significantly undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hims & Hers Health is undervalued by 36.2%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Hims & Hers Health Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for companies that are profitable or expected to sustain profitability, such as Hims & Hers Health. It helps investors assess how much they are paying for each dollar of the company’s earnings, which is especially meaningful once a business has moved past early-stage unprofitability into consistent positive earnings.

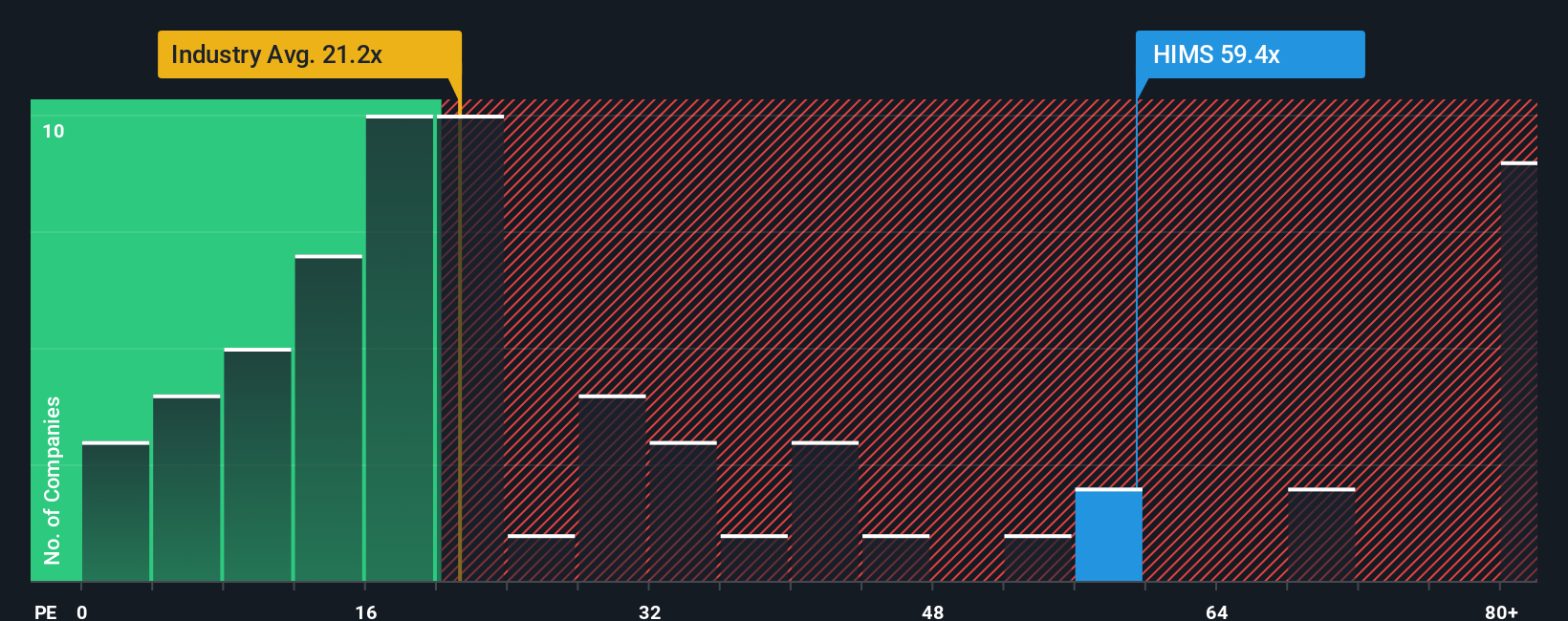

When evaluating what might be considered a “normal” or “fair” PE ratio, it is important to remember that higher growth prospects or lower risks generally justify a higher multiple. Conversely, companies facing more uncertainty or slower growth typically see lower PE ratios. Benchmarks such as the broader Healthcare industry average (21.6x) and the average among peers (28.7x) provide useful context, but do not capture the unique characteristics of each business.

Hims & Hers Health currently trades at a PE ratio of 62.9x. At first glance, this is well above industry norms and peer averages, signaling that investors are expecting significant future growth. However, Simply Wall St’s proprietary “Fair Ratio” takes a more holistic approach by factoring in not just earnings growth, but also unique risks, profit margins, market cap, and the overall industry landscape. For Hims & Hers Health, the Fair Ratio is 46.4x, which is meaningfully lower than the current multiple. Because this actual PE is much higher than the Fair Ratio, it suggests the stock is trading above what would be considered fair value based on its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hims & Hers Health Narrative

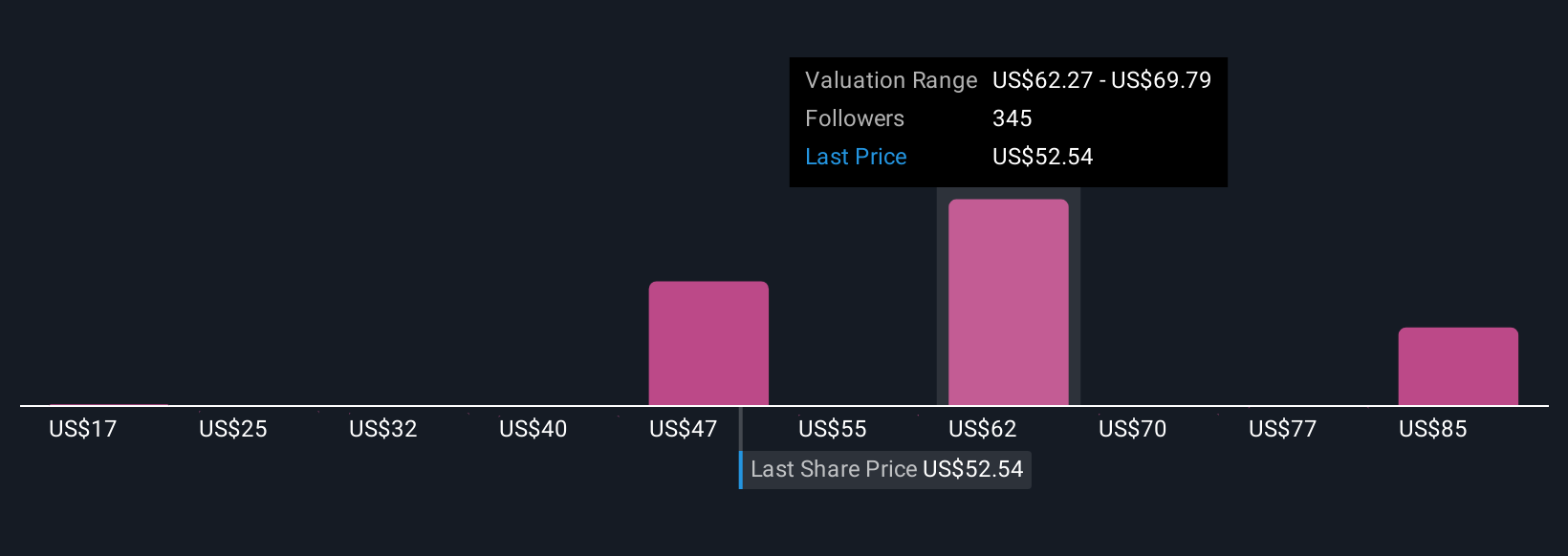

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized story about a company, connecting your expectations for its future, such as revenue growth, margins, and risk, to a specific fair value, all backed by your reasoning and forecasts. Narratives make it easy to link the qualitative story you believe to the quantitative numbers you input, so you can clearly see how your view of Hims & Hers Health stacks up against the current price.

On Simply Wall St’s Community page, millions of investors use Narratives as their go-to decision tool. By comparing your Fair Value (from your Narrative) to today’s market price, you can draw conclusions on whether it is time to buy, hold, or sell. Narratives also update automatically when something significant changes, such as a new partnership or earnings release, so your outlook stays fresh and relevant. For example, one investor’s Narrative might forecast a high valuation for Hims & Hers Health by incorporating rapid growth and high margins, while another may be far more cautious by factoring in regulatory risks and industry competition, resulting in the platform’s highest and lowest fair values of $114 and $28 per share, respectively.

Do you think there's more to the story for Hims & Hers Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives