- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

A Fresh Look at Hims & Hers Health (HIMS) Valuation Following Strong Q3 Growth and Expansion Moves

Reviewed by Simply Wall St

Hims & Hers Health is in the spotlight after reporting third-quarter results that beat revenue expectations. This was driven by a surge in subscribers and a stronger push into personalized and international health offerings.

See our latest analysis for Hims & Hers Health.

Shares of Hims & Hers Health have been on a wild ride lately. After reporting Q3 revenue growth and record subscriber counts, the stock has seen a sharp pullback, with a 1-month share price return of -28.7%. Still, momentum over the longer haul remains firmly positive, as evidenced by an impressive 1-year total shareholder return of 41% and a staggering 575% total return for investors over three years. Despite some short-term volatility tied to mixed profit metrics and revised guidance, the company’s strength in personalization, digital care, and international expansion continues to build the long-term growth story.

If you're curious about what other healthcare innovators are capturing attention right now, it’s a great moment to discover fresh ideas with our See the full list for free.

With shares down sharply in the past month despite another quarter of strong revenue growth and rising subscriber numbers, investors are left to ponder whether Hims & Hers Health is trading at a discount or if continued growth is already reflected in the price. Is there still a buying opportunity, or has the market fully priced in the company’s next chapter?

Most Popular Narrative: 54.7% Undervalued

With Hims & Hers Health's last close of $39.02 far below the fair value estimate of $86.09 according to BlackGoat's widely followed narrative, the debate over the company's upside potential intensifies. This situation invites a closer look at why many see far more value than the current stock price suggests.

Hims is building the infrastructure for personalised, direct-to-consumer healthcare across diagnostics, treatment, and prevention, similar to what Amazon did for retail and Spotify for music. The company is growing fast, generating free cash flow, and scaling efficiently, with rising margins, high retention, and zero debt.

What is fueling this significant valuation? The narrative’s key elements are a combination of sharply rising profits, platform economics, and a profit margin projection that could put some tech darlings to shame. Take a look inside to see which financial bets are powering this bold price target.

Result: Fair Value of $86.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory scrutiny over compounding practices and changing partnerships with major pharmaceutical companies could quickly reshape Hims & Hers Health's growth outlook.

Find out about the key risks to this Hims & Hers Health narrative.

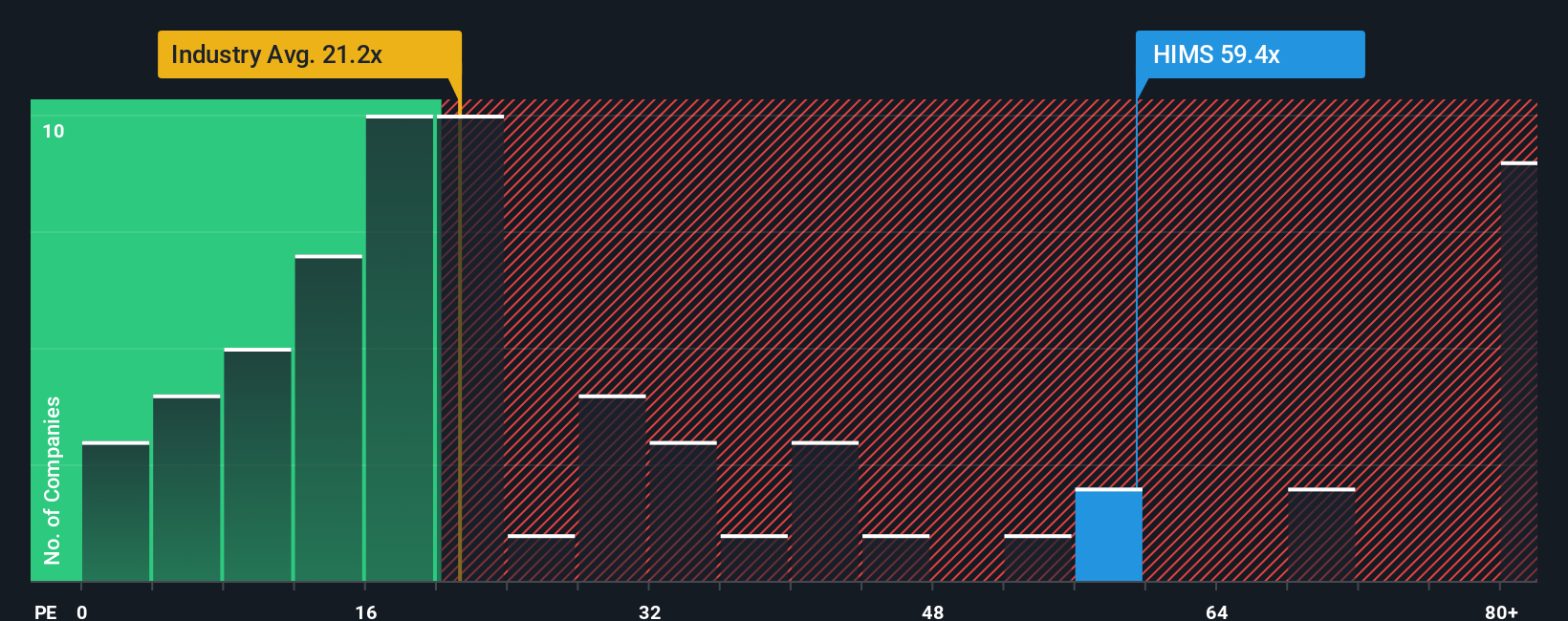

Another View: Focusing on Earnings Multiples

While discounted cash flow points to Hims & Hers Health being undervalued, the picture changes when we look at the price-to-earnings ratio. The company’s P/E sits at 66.4x, far higher than peers at 29.7x and the industry average of 21.9x. That is also well above its fair ratio of 47.8x, raising questions about valuation risk. Could the market be overly optimistic, or is Hims & Hers Health’s premium justified by its growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hims & Hers Health Narrative

Feel free to dive deeper and shape your own perspective. Forming a personal view can take just a few minutes with the tools available. Do it your way

A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Tap into unique sectors and trends confidently with these expert-curated stock lists, each offering a fresh path for your portfolio.

- Capture long-term value and spot bargain opportunities by checking out these 864 undervalued stocks based on cash flows that stand out for strong fundamentals and growth potential.

- Jump on the artificial intelligence wave and uncover these 25 AI penny stocks poised for breakthroughs in machine learning, automation, and real-world innovation.

- Spot rising stars that offer solid financials with these 3574 penny stocks with strong financials, where small caps could become tomorrow’s big winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives