- United States

- /

- Healthcare Services

- /

- NYSE:HCA

Is HCA Healthcare Still Attractive After a 59% Rally in 2025?

Reviewed by Bailey Pemberton

- Curious if HCA Healthcare is still a buy after its huge run or if all the good news is already reflected in the price? Let's take a closer look together.

- HCA shares have climbed 9.1% over the past month, and 58.9% year-to-date, rewarding investors who stuck around through market ups and downs.

- Healthcare stocks have been on the move lately, with HCA at the center due to industry optimism around larger-scale hospital networks and policy shifts sparking renewed investor interest. As debates heat up about healthcare funding and hospital expansion, HCA has been frequently mentioned as a company well positioned to benefit from these broader changes.

- According to our valuation model, HCA scores a 5 out of 6 on our undervaluation checks. This sets the stage for a deeper look into how we measure value and whether there is a smarter approach than just numbers alone, which we will explore at the end of this article.

Approach 1: HCA Healthcare Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach helps determine what those future earnings are worth right now, using a set discount rate and cash flow projections.

For HCA Healthcare, current Free Cash Flow stands at approximately $7.7 Billion. Analysts have provided cash flow forecasts through 2029, with projected Free Cash Flow rising to about $8.2 Billion by that year. Simply Wall St extrapolates these numbers further out, and the 10-year outlook continues this uptrend, reflecting steady operational growth.

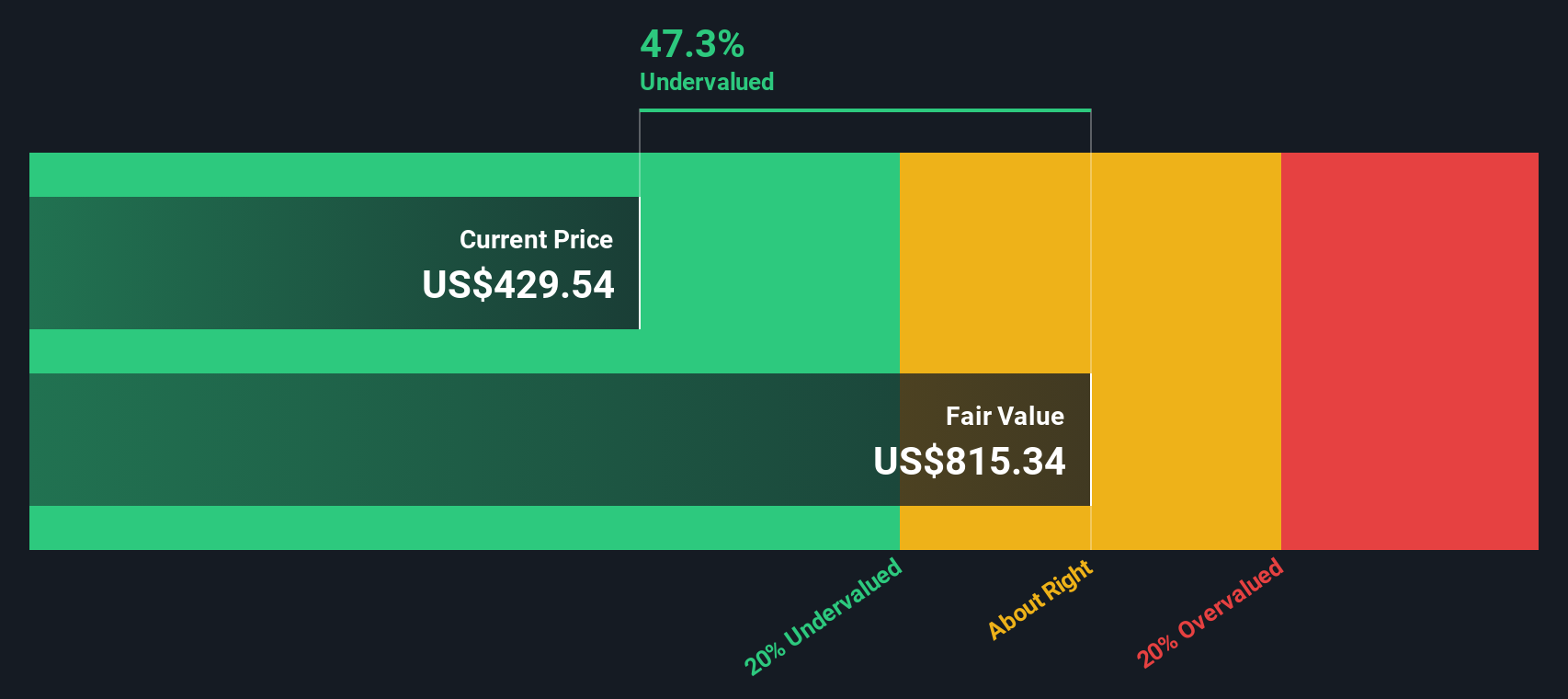

According to the DCF model, HCA Healthcare's fair value is estimated to be $906.83 per share. With the DCF indicating the stock trades at a 47.8% intrinsic discount, the analysis suggests HCA is notably undervalued compared to its projected future cash flows.

This sizeable margin between intrinsic and market value, reinforced by credible multi-year FCF projections, points to significant upside for investors who believe in the hospital network's continued momentum.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests HCA Healthcare is undervalued by 47.8%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: HCA Healthcare Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely respected tool for valuing profitable companies because it ties a company’s stock price to its bottom-line earnings, giving investors an at-a-glance sense of how much they’re paying for each dollar of profit. It is particularly useful for companies like HCA Healthcare, whose stable earnings make such comparisons meaningful.

It is important to remember that no two companies are exactly alike, so context matters. Higher growth prospects and lower risks tend to justify a higher PE ratio, while slower growth or elevated risks tend to pull it down. In healthcare, these multiples can swing based on changes in policy, competitive advantages, or long-term growth potential.

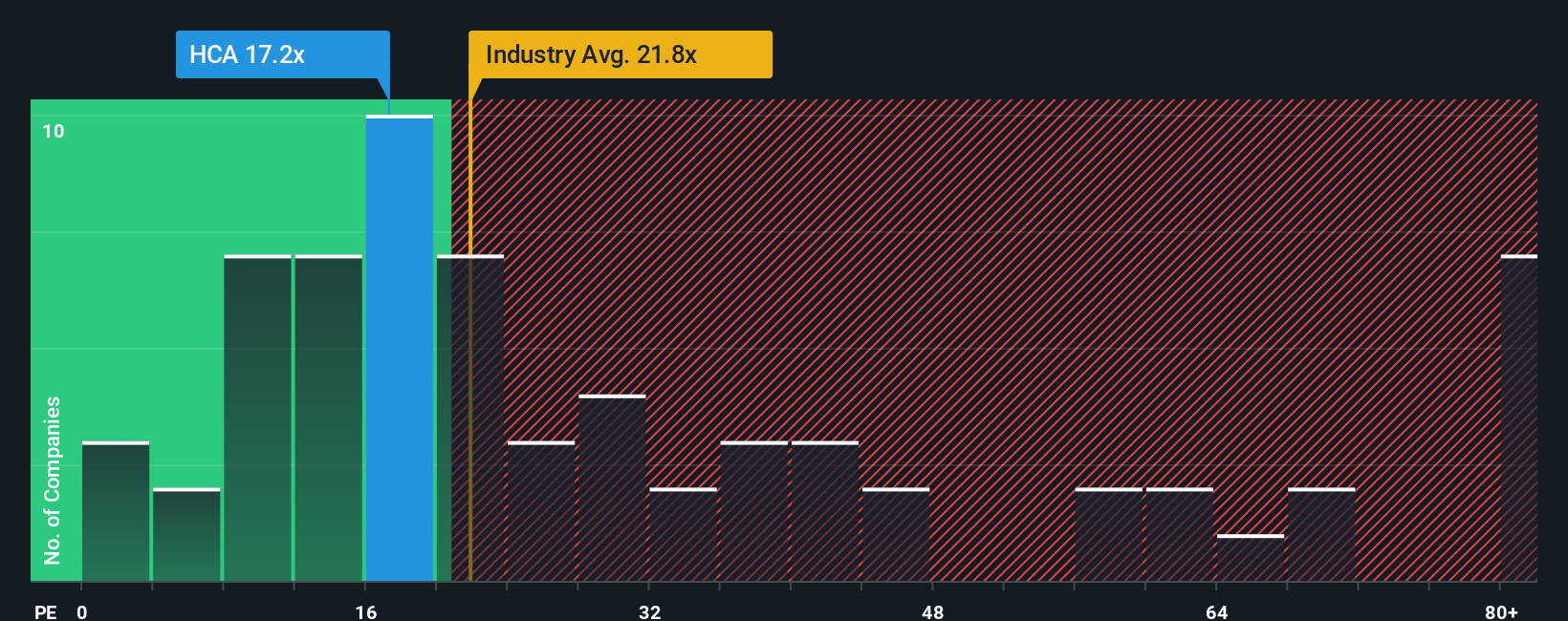

Right now, HCA Healthcare’s PE ratio is 17.02x. For comparison, the broader healthcare industry averages 21.46x and HCA’s direct peers trade around 19.71x. On the surface, HCA appears cheaper than both its industry and close competitors.

Simply Wall St’s proprietary “Fair Ratio” refines the analysis by factoring in not just industry and peer context, but also HCA’s specific growth potential, profit margins, market cap, and risk factors. It distills all these elements into a tailored benchmark, which for HCA is currently set at 29.11x. This figure is well above the company’s current multiple. The Fair Ratio serves as a stronger, more holistic yardstick than a simple industry or peer comparison.

Given that HCA's PE ratio of 17.02x is significantly below the Fair Ratio of 29.11x, the valuation suggests that the stock is notably undervalued based on earnings power and company-specific outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your HCA Healthcare Narrative

Earlier, we mentioned there is a smarter way to understand a company’s value than simply relying on models or multiples. This approach involves Narratives. A Narrative is your personalized story about where HCA Healthcare is headed, combining your take on its future revenue, profit margins, industry trends, and key risks to create your own fair value estimate. Narratives connect the dots between what’s happening on the ground, such as new technology investments or regulatory changes, your financial forecasts, and the actionable fair value that guides whether to buy or sell.

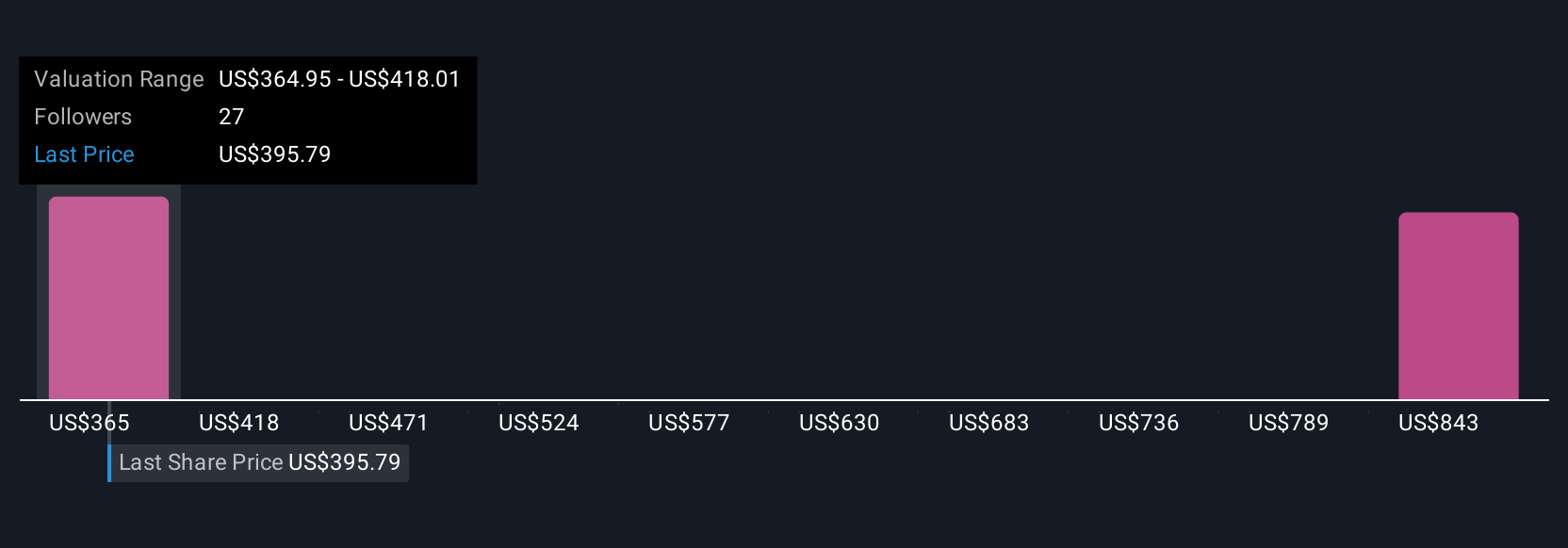

With Simply Wall St’s Community platform, anyone can create and update these Narratives easily, and millions of investors already do. You don’t need to be an expert to develop or adjust your viewpoint. Unlike static analysis, Narratives respond to breaking news and earnings updates. This means your investment thesis can evolve as the situation changes. For example, some investors hold a bullish Narrative for HCA Healthcare, expecting a fair value as high as $449.00 based on projections of profit margin improvement and steady revenue growth. Others take a more cautious view and estimate fair value as low as $333.00 due to regulatory and policy risks.

By comparing your Narrative’s fair value to HCA’s current price, you make better buy or sell decisions with confidence and clarity.

Do you think there's more to the story for HCA Healthcare? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCA Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCA

HCA Healthcare

Through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives