- United States

- /

- Medical Equipment

- /

- NYSE:HAE

Analyst Upgrade After Q4 Revenue Dip Might Change the Case for Investing in Haemonetics (HAE)

Reviewed by Simply Wall St

- Haemonetics Corporation was recently upgraded by analysts from Hold to Buy, following the release of Q4 2025 earnings that showed a 9% revenue decline largely due to a planned CSL transition and portfolio streamlining.

- This change in analyst sentiment comes as the company is expected to deliver an 11.12% increase in earnings per share over the next five years, highlighting confidence in its long-term growth strategies despite short-term revenue headwinds.

- We'll now examine how increased analyst confidence in Haemonetics' profit outlook may influence the company’s broader investment case.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Haemonetics Investment Narrative Recap

To be a Haemonetics shareholder right now, you largely have to believe in the company’s ability to pivot from near-term revenue headwinds to long-term earnings growth, largely through its hospital segment and streamlined portfolio. While the analyst upgrade on the back of Q4 results signals confidence in upcoming EPS expansion, the impact on the most important near-term catalyst, hospital product adoption, appears minimal, as the downgrade was tied to a planned transition rather than operational weakness. The biggest risk continues to be margin pressure from lower plasma collections, which remains unchanged despite the recent news.

Among recent announcements, the $500 million share buyback program stands out as highly relevant. It reinforces management’s focus on returning value to shareholders and balancing dilution from equity grants, which is important as Haemonetics steers capital toward high-growth, high-margin initiatives, aligning with the company’s broader drive to offset cash flow pressures resulting from changes in its business mix.

Yet, in contrast to analyst optimism, investors should be aware that persistent challenges in plasma collections could...

Read the full narrative on Haemonetics (it's free!)

Haemonetics' outlook points to $1.5 billion in revenue and $258.5 million in earnings by 2028. This reflects a 4.0% annual revenue growth and a $90.8 million increase in earnings from the current $167.7 million.

Uncover how Haemonetics' forecasts yield a $92.45 fair value, a 22% upside to its current price.

Exploring Other Perspectives

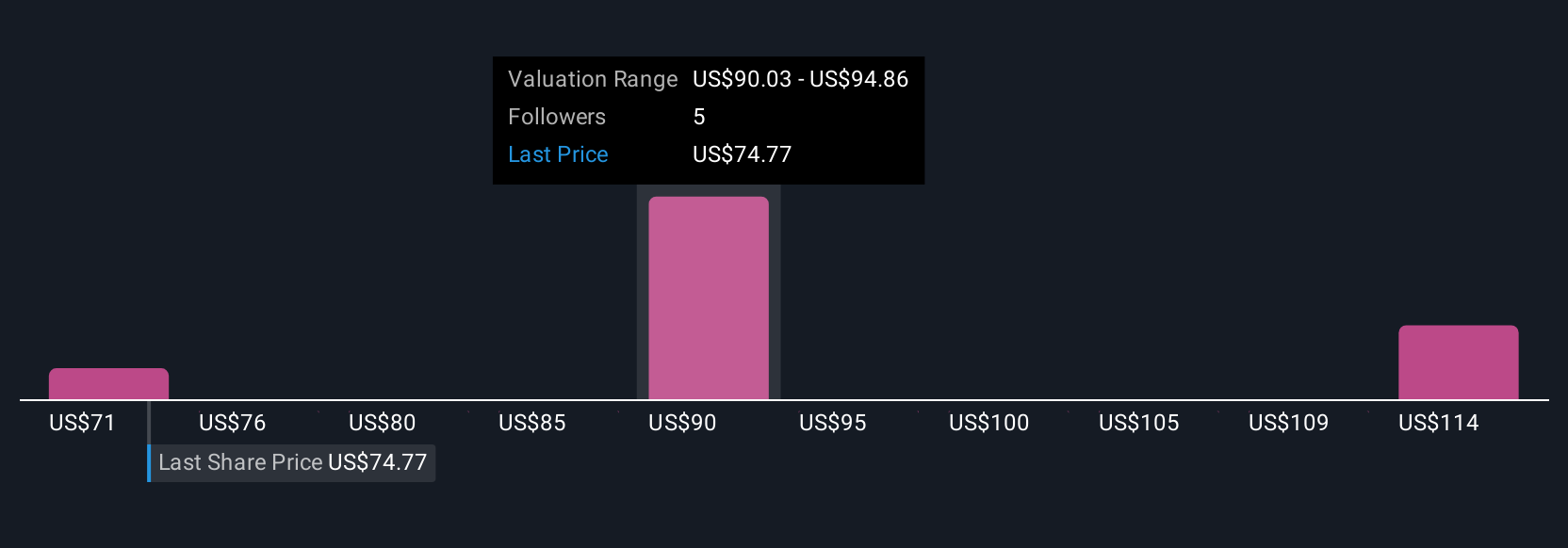

Private fair value estimates for Haemonetics from three Simply Wall St Community members span US$70.70 to US$118.30 per share. While hospital business expansion is cited as a growth catalyst, you will find investors in our community see a wide range of potential outcomes for this stock, consider multiple viewpoints.

Explore 3 other fair value estimates on Haemonetics - why the stock might be worth 6% less than the current price!

Build Your Own Haemonetics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Haemonetics research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Haemonetics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Haemonetics' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haemonetics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAE

Haemonetics

A medical technology company, provides a suite of hospital technologies solutions in the United States and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives