- United States

- /

- Medical Equipment

- /

- NYSE:GMED

Globus Medical (GMED): Assessing Valuation After Q3 Beat, Upgraded Guidance, and Analyst Optimism

Reviewed by Simply Wall St

Globus Medical (GMED) just delivered third quarter results that caught many investors’ attention, highlighted by notable margin expansion and growth in its U.S. Spine segment. Management quickly responded by raising full-year guidance.

See our latest analysis for Globus Medical.

Backed by strong Q3 earnings and a guidance upgrade, Globus Medical’s share price surged nearly 45% over the past month. Momentum has clearly shifted in the company’s favor, building on a steady 4.1% total shareholder return over the last year as recent results and strategic moves gain investors’ attention.

If you’re curious where opportunity lies next, now is an ideal time to broaden your search and discover See the full list for free.

But after such a dramatic rally, does Globus Medical still have room to run, or has the market already priced in the company’s recent momentum and future growth prospects? Is there a true buying opportunity here?

Most Popular Narrative: 4.9% Undervalued

Globus Medical's most widely followed narrative assigns a fair value of $88.80, a notch above the last close at $84.45. With the share price nearly matching this optimistic outlook, the market seems to be weighing up robust recent results alongside a relatively small discount to fair value.

Successful integration and synergy capture from the NuVasive and Nevro acquisitions are providing opportunities for increased cross-selling, cost efficiencies, and realization of deferred tax assets, which are expected to drive margin expansion, boost earnings, and enhance recurring cash flows in upcoming years.

What financial rocket fuel could power this premium? The narrative hinges on bold assumptions about how future growth and expanding margins could justify a richer valuation multiple than the industry norm. The numbers behind this outlook might surprise you. Find out exactly what they are and how they shape this eye-catching fair value.

Result: Fair Value of $88.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, headwinds such as unpredictable sales cycles and integration challenges from recent acquisitions could disrupt momentum and have an impact on earnings growth going forward.

Find out about the key risks to this Globus Medical narrative.

Another View: What Do the Earnings Ratios Say?

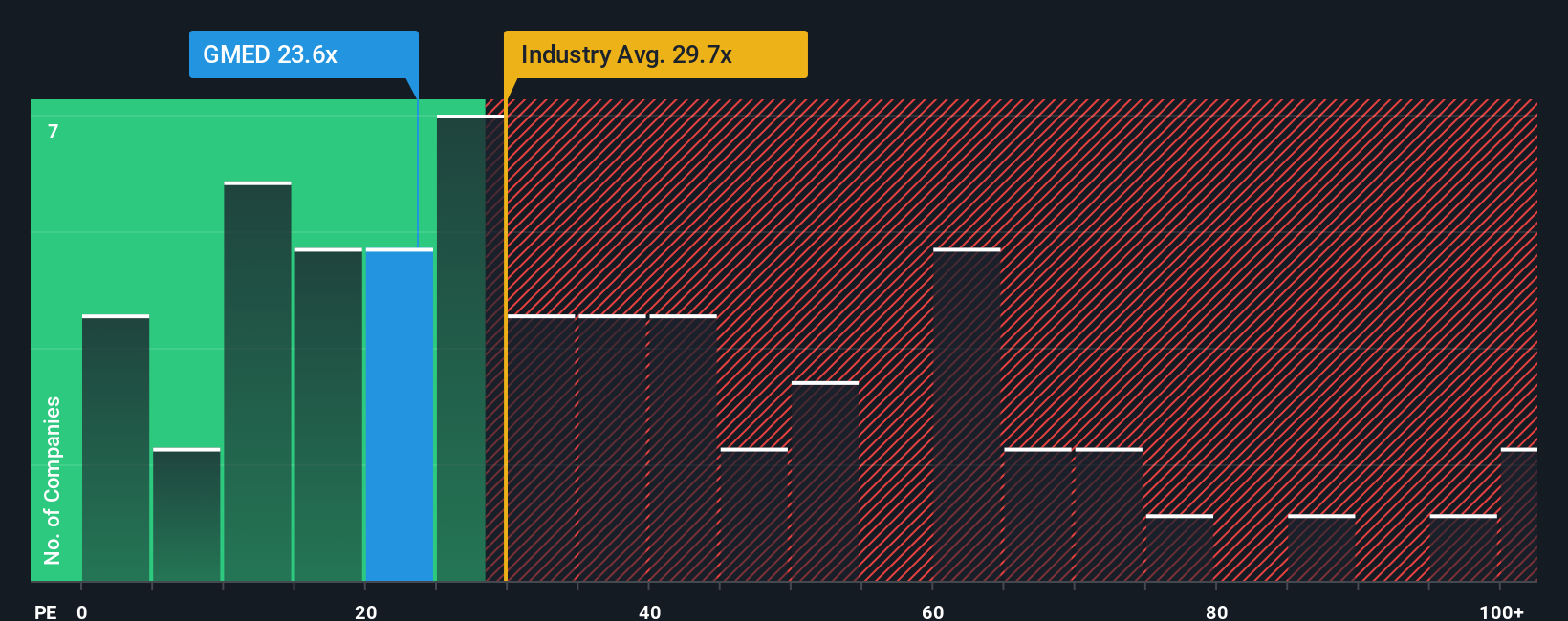

Looking at Globus Medical’s price-to-earnings ratio, the stock currently trades at 26.7 times, slightly below the industry average of 27.3 times and far below its peer group at 65.3 times. However, it still stands above its own fair ratio of 23.7 times, suggesting some valuation risk remains. Could this premium be justified, or are investors pushing too far ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Globus Medical Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft your own view and data-driven story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Globus Medical.

Looking for More Smart Investment Ideas?

Expand your investing edge—great opportunities don’t wait around. Whether you want growth, stability, or new tech trends, step up and catch tomorrow’s winners today.

- Maximize income potential and access market-leading yields by checking out these 16 dividend stocks with yields > 3%. These consistently deliver over 3% returns.

- Capture emerging opportunities in artificial intelligence by following these 24 AI penny stocks. These are shaping the next wave of innovation and breakthroughs.

- Seize undervalued gems that the market may have overlooked with these 878 undervalued stocks based on cash flows. These offer compelling value based on strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GMED

Globus Medical

A medical device company, develops and commercializes healthcare solutions for patients with musculoskeletal disorders in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives