- United States

- /

- Medical Equipment

- /

- NYSE:EW

A Fresh Look at Edwards Lifesciences (EW) Valuation Following Rosen Law Firm's Fiduciary Investigation

Reviewed by Simply Wall St

Rosen Law Firm has begun investigating potential breaches of fiduciary duties by Edwards Lifesciences leadership. This move may prompt investors to pay closer attention to how the company manages its internal governance and oversight.

See our latest analysis for Edwards Lifesciences.

Edwards Lifesciences has been under the spotlight recently, with the latest news around governance investigations coming on the heels of generally steady performance. The share price sits at $76.10, and while the moves over one day or one month have not been dramatic, the stock’s total shareholder return over the past year is an impressive 9.7%. Momentum appears to be building over the longer term, even as the company navigates market shifts and ongoing industry reforms.

If the current climate in medtech has you curious about other healthcare innovators making waves, take the next step and explore See the full list for free.

With a share price trading at a notable discount to analyst targets and steady financial growth metrics, investors are left to wonder whether Edwards Lifesciences is attractively undervalued or if the market has already priced in its future trajectory.

Most Popular Narrative: 13.3% Undervalued

With a fair value set at $87.73, the latest narrative sees Edwards Lifesciences trading well below this mark, as shares last closed at $76.10. The current optimism around new product launches, coupled with the company’s strong global footprint, has fueled discussion about its next growth phase.

The expected approval of the early TAVR indication in the second quarter, along with policy and guideline changes in the U.S. and globally, represents a multiyear growth opportunity that could significantly enhance revenue streams in the future. The planned launch of the transcatheter tricuspid valve EVOQUE in 2024 is anticipated to uniquely position Edwards to gain market share and increase revenues as it becomes the first company to develop and offer this therapy.

Curious what bold projections are behind this valuation? One key growth driver stands out: its future revenue surge and margin outlook are anything but ordinary. Find out which numbers the market-watchers are betting on to power this price target. The narrative’s hidden levers might surprise you.

Result: Fair Value of $87.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariffs and intensifying global competition could weigh on Edwards Lifesciences’ margins. It is vital for investors to monitor these evolving challenges.

Find out about the key risks to this Edwards Lifesciences narrative.

Another View: Looking Through a Different Lens

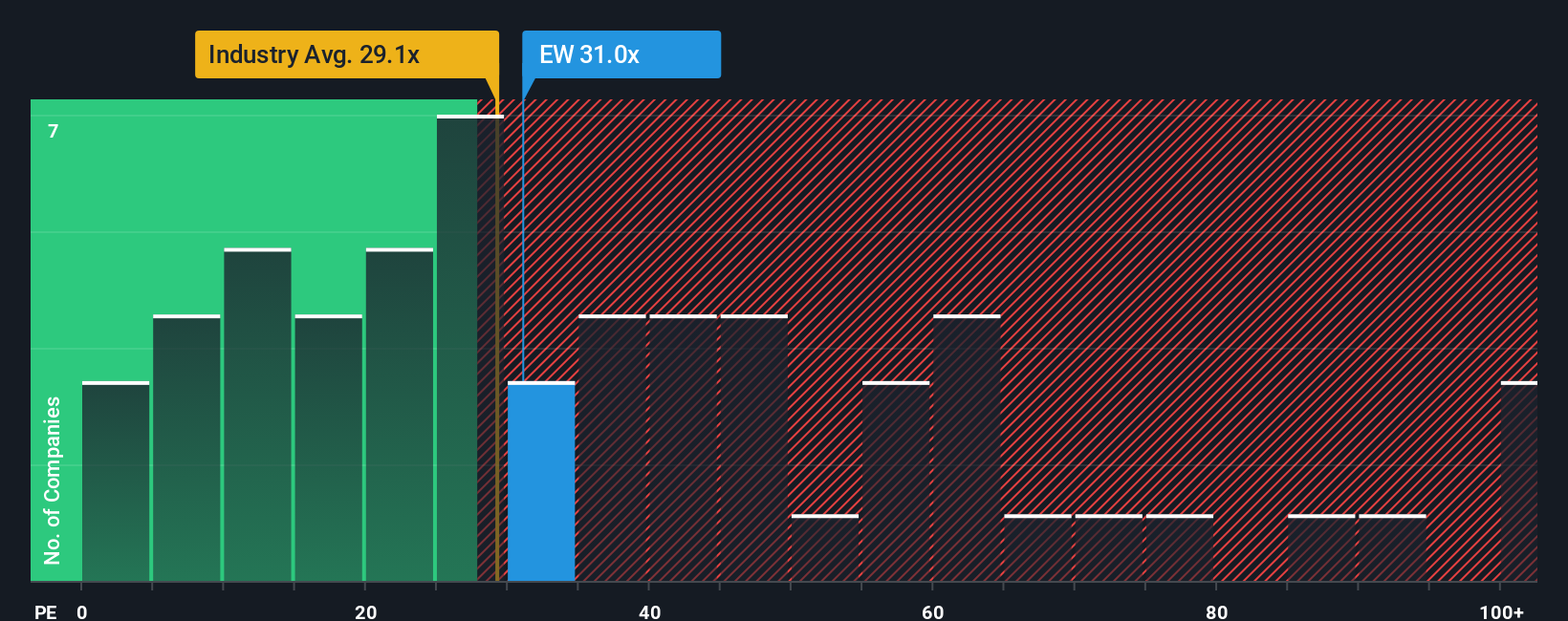

While analyst narratives point to upside, a glance at the company’s price-to-earnings ratio reveals a more complex picture. Edwards Lifesciences trades at 31.6x earnings, which is just under its peer average of 32.1x, but notably higher than the industry average of 29.7x and above its fair ratio of 24.9x. This suggests the market may be assigning a higher risk or expecting more growth than fundamentals alone justify. Could this premium signal hidden strengths, or does it leave less room for error ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Edwards Lifesciences Narrative

If you see the story differently or want to dig into the data yourself, it takes just a few minutes to craft your own view and weigh in with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Edwards Lifesciences.

Looking for More Investment Ideas?

Don’t let the next opportunity slip through your fingers. Put your investing instincts to work and seize your edge with these handpicked ideas:

- Supercharge your portfolio’s tech exposure by targeting the innovators shaping tomorrow. Start with these 27 AI penny stocks to pinpoint leaders in artificial intelligence.

- Tap into high-yield potential and safeguard your income stream with these 17 dividend stocks with yields > 3%, designed for investors seeking robust returns from strong dividend payers.

- Capitalize on value-driven momentum and catch market outliers before others notice by using these 876 undervalued stocks based on cash flows for overlooked stocks trading below their worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edwards Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EW

Edwards Lifesciences

Provides products and technologies to treat advanced cardiovascular diseases in the United States, Europe, Japan, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives