- United States

- /

- Healthcare Services

- /

- NYSE:EHC

Encompass Health (EHC): Assessing Valuation as Investor Focus Builds Before Earnings and Expansion Updates

Reviewed by Simply Wall St

Encompass Health (NYSE:EHC) is on investors’ radar this week as the company prepares to release earnings. After topping revenue and earnings guidance last quarter, further growth is projected. This has added interest to recent expansion moves.

See our latest analysis for Encompass Health.

The past year has seen Encompass Health’s share price accelerate, climbing sharply with a 36.8% year-to-date share price return. The three-year total shareholder return stands at an impressive 138%. Recent initiatives, such as expanding their rehabilitation network in Florida and completing a new tranche of share buybacks, have kept investor sentiment positive and the company’s momentum firmly in place.

Curious where else strong healthcare momentum is building? Now’s a great time to discover more opportunities with our See the full list for free..

With shares already logging double-digit gains this year and trading within 10% of analysts’ price targets, investors may wonder if the market has already accounted for Encompass Health’s future growth or if a buying opportunity remains.

Most Popular Narrative: 9.7% Undervalued

The current fair value, according to the most widely followed narrative, sits at $139.08. This represents a premium compared to the last close of $125.63. This gap reflects confidence in the company’s ability to deliver on its growth blueprint and underscores the drivers propelling its expansion and returns.

The surge in the 65-plus population and persistent undersupply of inpatient rehabilitation beds are driving high and still-unmet demand for Encompass Health's core services. Ongoing hospital openings and bed expansions position the company to capture significant incremental patient volume, supporting higher revenue growth for years to come.

Want to know how demographic tailwinds and strategic moves translate into that hefty valuation? The secret is a bold bet on accelerating hospital growth and a future profit multiple rarely seen in the sector. See how ambitious forecasts power this price target, what critical assumptions lie beneath, and which numbers matter most.

Result: Fair Value of $139.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor shortages and challenges from rapidly evolving care models could pose hurdles to Encompass Health’s ambitious growth story in the years ahead.

Find out about the key risks to this Encompass Health narrative.

Another View: Traditional Valuation Metrics

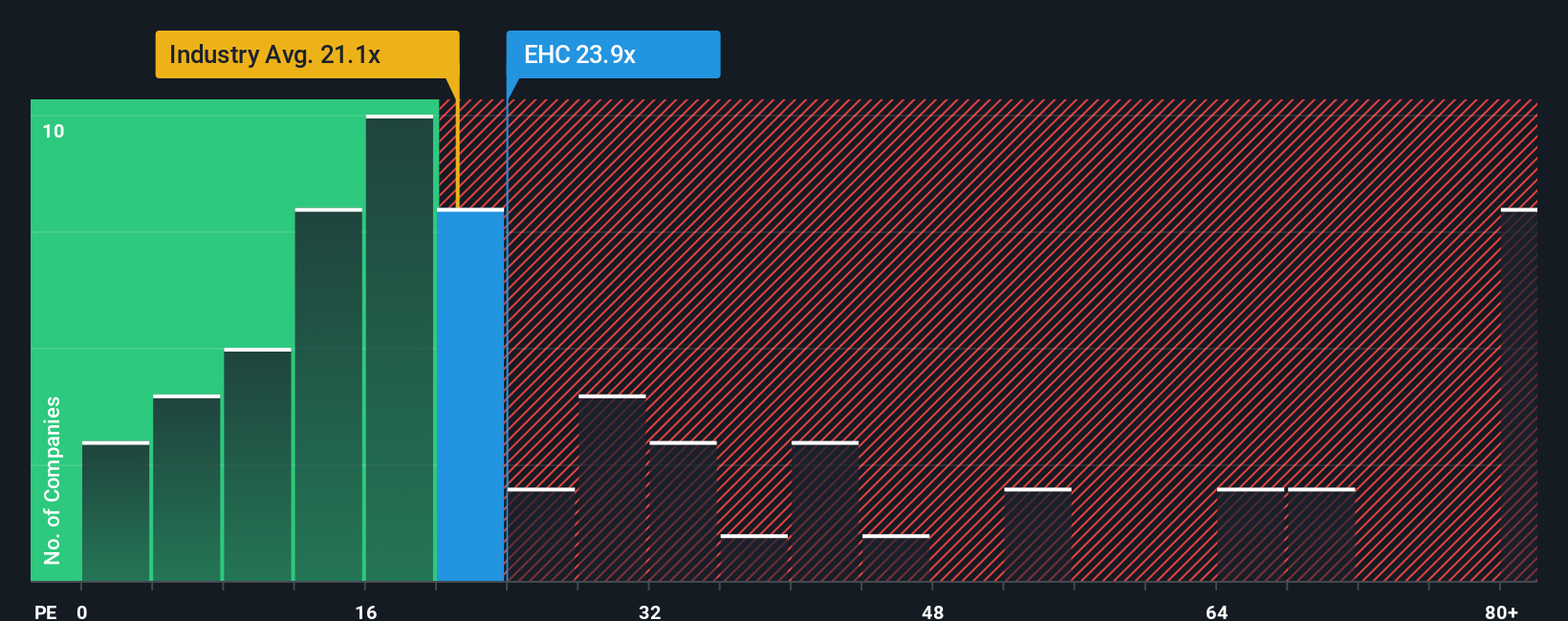

While the most popular narrative highlights a 9.7% undervaluation, a look at current price-to-earnings ratios tells a less bullish story. Encompass Health trades at 24.2x, higher than both industry peers (17.9x) and its fair ratio of 21.4x. This gap suggests valuation risk, especially if future growth expectations fall short. Could the optimism priced in today fade if the market shifts focus?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Encompass Health Narrative

If you see things differently or would rather dive into the numbers on your own, you can build a personalized narrative in just a few minutes with Do it your way.

A great starting point for your Encompass Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Missed out on this healthcare opportunity? Don’t let the next winner pass you by. Simply Wall Street’s powerful screener reveals stocks many investors overlook, each offering its own edge and upside potential.

- Uncover high-yield potential by tapping into these 21 dividend stocks with yields > 3% that have consistently delivered returns above 3%.

- Seize tomorrow’s opportunities with these 26 AI penny stocks making headlines for their breakthroughs in artificial intelligence across industries.

- Capitalize on undervalued gems by checking out these 854 undervalued stocks based on cash flows selected for attractive valuations based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Encompass Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EHC

Encompass Health

Provides post-acute healthcare services in the United States and Puerto Rico.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives