- United States

- /

- Healthcare Services

- /

- NYSE:DVA

Is Now the Right Time to Reconsider DaVita After Its 18.9% Drop in 2025?

Reviewed by Bailey Pemberton

- If you’ve ever wondered whether DaVita is trading at a bargain or sitting above its true worth, you’re not alone. Figuring out the real value behind the ticker is on every investor’s mind right now.

- The stock has seen plenty of movement lately, with shares slipping 1.7% over the last week, 3.5% over the past month, and taking a larger 18.9% dip year-to-date. Yet over the last three years, DaVita has actually surged 72.0%.

- Some of this volatility follows ongoing chatter about healthcare reimbursement trends and potential policy changes in the dialysis industry, which have sent ripple effects through investor expectations. At the same time, evolving market sentiment has kept DaVita’s share price on investors’ radar despite fewer headlines grabbing attention.

- Right now, DaVita scores a 5 out of 6 on our valuation checks, which is a strong showing compared to many peers. Let’s break down the different valuation methods investors are using, and stick around for a smarter way to think about value that you might not expect.

Find out why DaVita's -24.2% return over the last year is lagging behind its peers.

Approach 1: DaVita Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and then discounting those projected values back to the present using a required rate of return. The idea is to find out what the business is really worth today, based on its ability to generate cash in the future.

For DaVita, the DCF uses the 2 Stage Free Cash Flow to Equity method. The company generated about $1.28 billion in free cash flow over the last twelve months. Analysts forecast a slight dip next year, estimating $1.07 billion in free cash flow for 2025. Looking further ahead, ten-year projections (extrapolated by Simply Wall St) show modest annual growth, with free cash flow reaching roughly $1.52 billion by 2035. All cash flows are in US dollars.

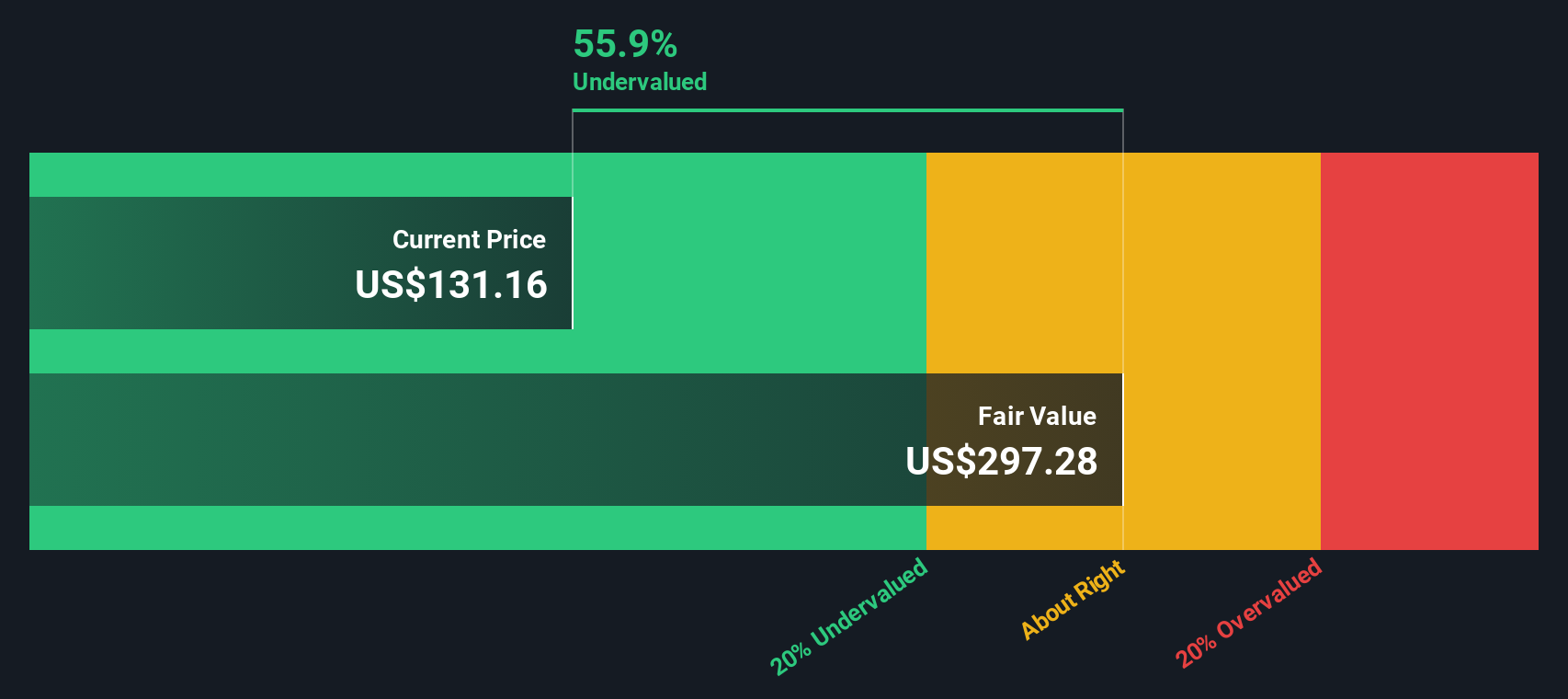

After factoring in these cash flows and discounting them appropriately, the DCF model arrives at an estimated intrinsic value per share of $352.26. This value indicates DaVita is trading at a 65.5% discount to its calculated fair value, which suggests it may be significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DaVita is undervalued by 65.5%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: DaVita Price vs Earnings (PE)

For profitable companies like DaVita, the Price-to-Earnings (PE) ratio is one of the most practical valuation tools. It measures how much investors are paying for each dollar of earnings, which offers a quick snapshot of how the market values a company’s profitability. The “right” PE ratio is not static; it can change depending on growth expectations, overall risk, and broader market sentiment. As a result, higher-growth or lower-risk companies often deserve higher PE multiples.

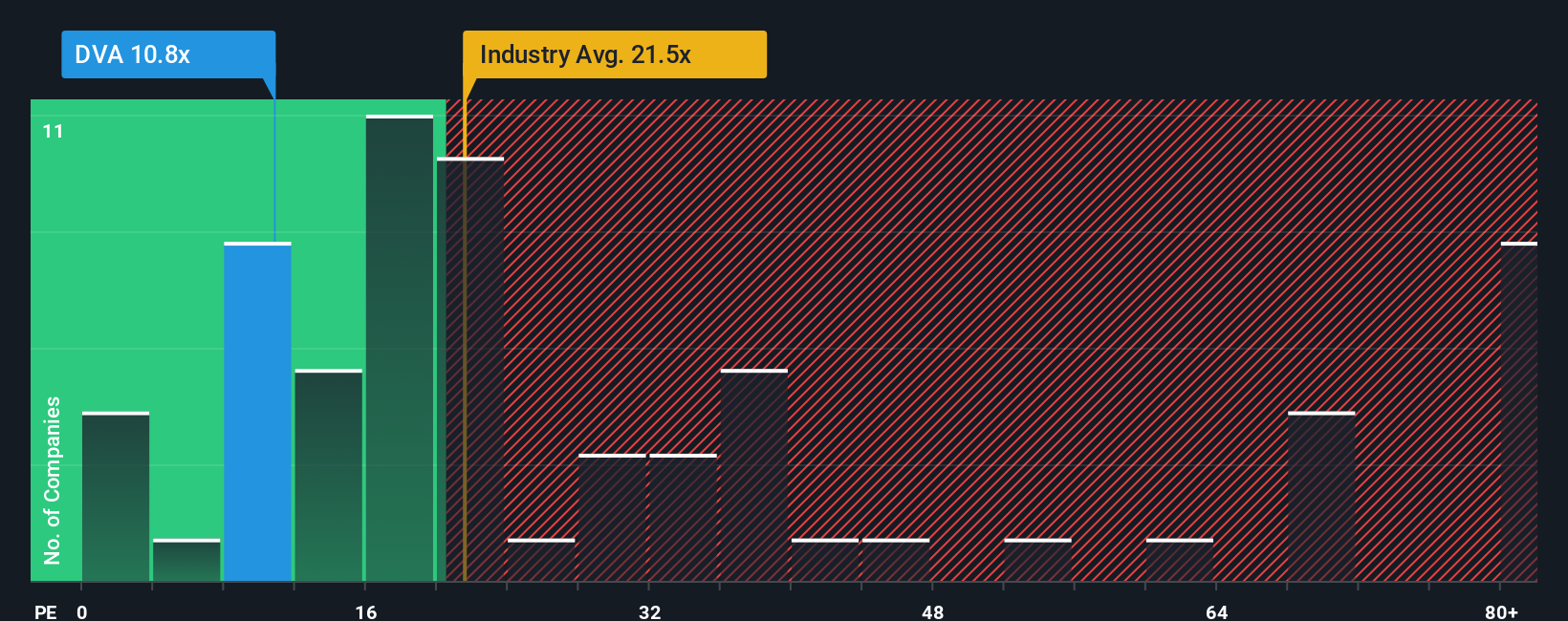

DaVita is currently trading at a PE ratio of 11.1x. To put this in perspective, the healthcare industry average sits higher at 21.6x, and DaVita’s peer group commands an even loftier 32.3x. On the surface, this might suggest that DaVita is undervalued compared to its sector and rivals.

However, Simply Wall St’s proprietary “Fair Ratio” approach gives deeper insight. The Fair Ratio takes into account not just the company’s industry, but also its earnings growth, profit margins, market cap, and specific risks. This helps build a realistic multiple for DaVita’s unique profile. In DaVita’s case, the Fair Ratio is 21.1x, which is still significantly above its current PE multiple.

Because the current PE is notably lower than this tailored Fair Ratio, the analysis points toward DaVita being undervalued based on the preferred multiple.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DaVita Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative, in simple terms, is your personal story behind the numbers. It is how you connect your expectations (like future revenue, earnings, and profit margins) with your view of what DaVita is truly worth.

Narratives offer an accessible and dynamic approach to valuation. Instead of relying only on formulas or analyst estimates, you can create your own forecast based on what you believe will shape DaVita's future. Narratives directly link your story to a financial forecast and translate this into a fair value that updates whenever new news, earnings, or company data emerges, making them responsive and relevant in real time.

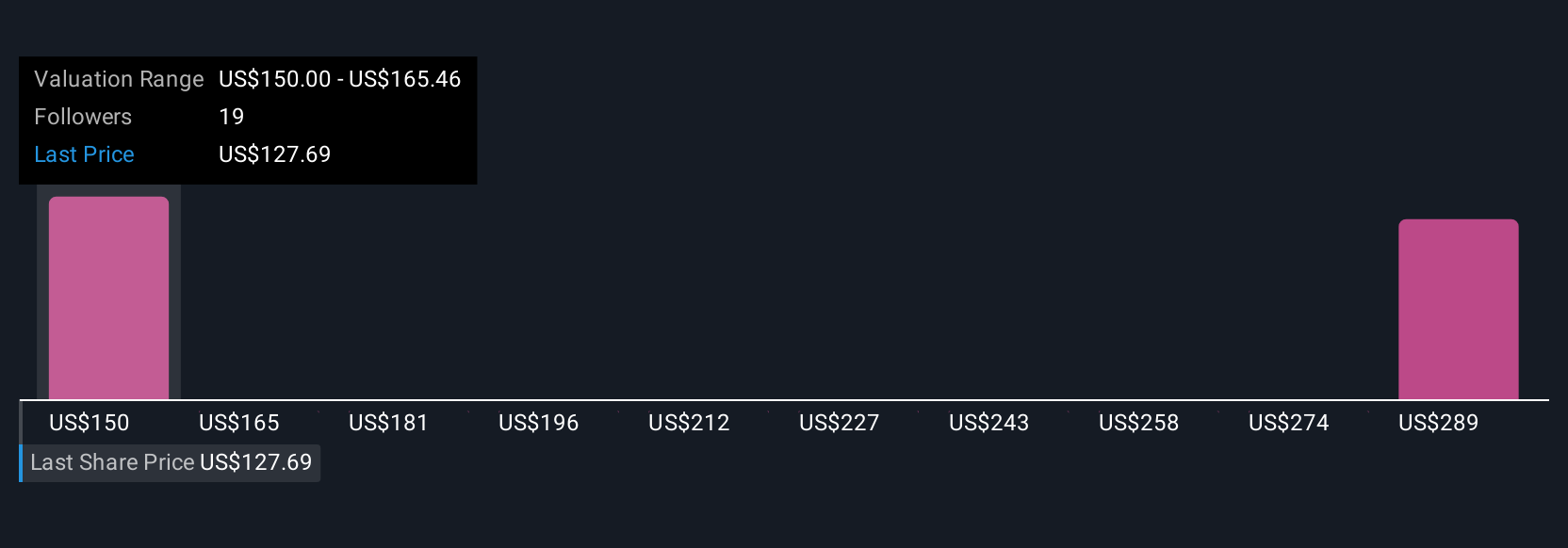

This tool is available on Simply Wall St’s Community page, where millions of investors use Narratives to share perspectives and help guide their buy or sell decisions by continuously comparing their Fair Value with the current Price. For example, one DaVita Narrative might see major upside from international expansion and operational innovation (leading to a fair value of $186), while another focuses on risks from policy headwinds and operational setbacks (with a fair value closer to $137). Narratives empower you to invest with confidence by combining your insights with the latest information.

Do you think there's more to the story for DaVita? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVA

DaVita

Provides kidney dialysis services for patients suffering from chronic kidney failure in the United States.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives