- United States

- /

- Healthcare Services

- /

- NYSE:DVA

Can DaVita's Pattern of Revenue Outperformance Shape Its Broader Growth Narrative? (DVA)

Reviewed by Simply Wall St

- DaVita Inc. recently reported its quarterly earnings, with analysts having anticipated year-on-year revenue growth of 5.3% to US$3.36 billion and adjusted earnings of US$2.75 per share.

- Over the past two years, DaVita consistently surpassed Wall Street’s revenue forecasts, outpacing consensus estimates each quarter on average by 1.7%.

- We’ll explore how DaVita’s ongoing pattern of beating revenue projections could influence its investment narrative ahead of future results.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

DaVita Investment Narrative Recap

Belief in DaVita as an investment hinges on the company's ability to maintain steady volume growth in kidney treatments, driven by demographic trends, even as it manages margin headwinds from regulatory, operational, and reimbursement risks. The latest earnings release reinforces DaVita’s consistency in surpassing revenue targets, yet softer net income highlights that expense pressures remain a central theme. While the results confirm the short-term catalyst of reliable revenue performance, they do not alter the biggest current risk: regulatory changes and ongoing legal costs related to recent cybersecurity incidents.

Among recent company updates, the repricing and expansion of DaVita’s senior secured term loan facilities in July 2025 is especially relevant. Increased borrowing capacity could enhance DaVita’s financial flexibility to manage margin volatility and fund continued investments in patient care and digital security, both of which are essential to earnings resilience as reimbursement and compliance challenges persist.

By contrast, investors should be paying close attention to how cybersecurity-related legal and regulatory costs could affect DaVita’s margins over the coming quarters…

Read the full narrative on DaVita (it's free!)

DaVita's outlook forecasts $14.8 billion in revenue and $958.2 million in earnings by 2028. This is based on annual revenue growth of 4.4% and an increase in earnings of $98.6 million from the current $859.6 million.

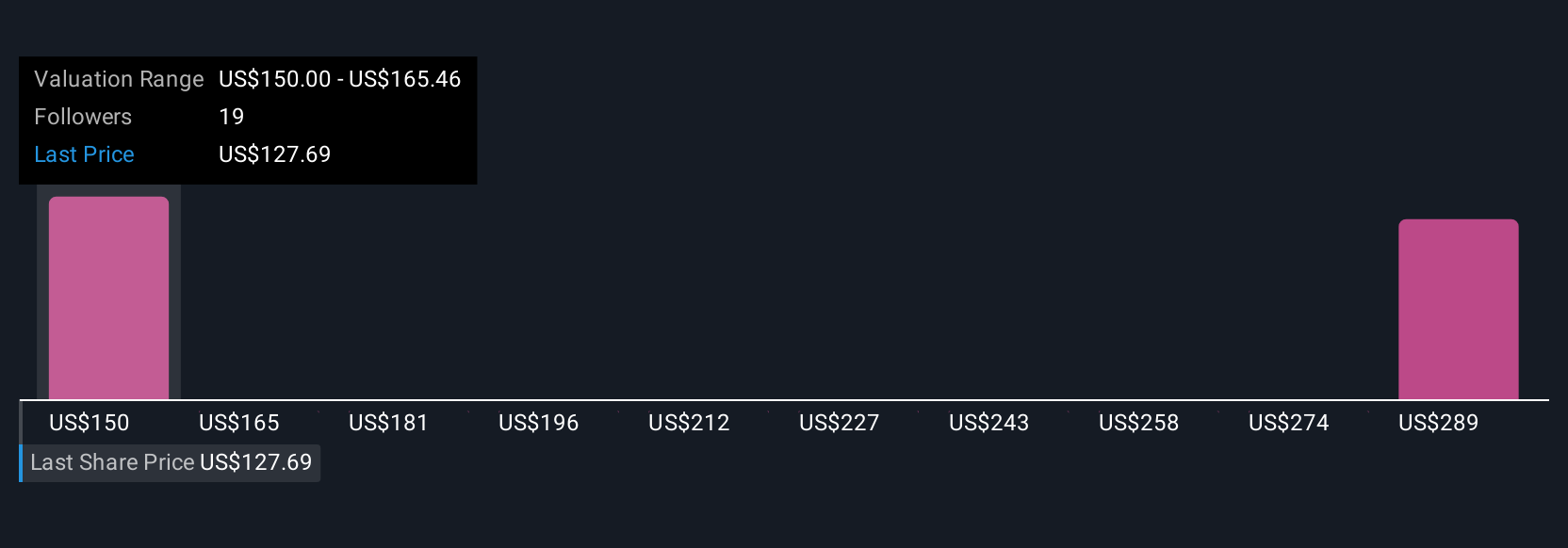

Uncover how DaVita's forecasts yield a $160.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Three independent fair value estimates from the Simply Wall St Community span US$112.83 to US$160.50 per share. As you weigh these viewpoints, remember the earnings consistency risks posed by rising regulatory and compliance expenses.

Explore 3 other fair value estimates on DaVita - why the stock might be worth 20% less than the current price!

Build Your Own DaVita Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DaVita research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DaVita research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DaVita's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVA

DaVita

Provides kidney dialysis services for patients suffering from chronic kidney failure in the United States.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives