- United States

- /

- Healthtech

- /

- NYSE:DOCS

Is Doximity’s Stock Surge in 2025 Justified After Digital Tools Expansion?

Reviewed by Bailey Pemberton

If you've been scratching your head over Doximity's recent stock moves, you're certainly not alone. Investors are watching closely as the shares close at $68.5, and recent price action has prompted plenty of curiosity. Over the past year, the stock has surged an impressive 65.4%, with a robust gain of 27.9% year-to-date. However, there has been some short-term turbulence too, with shares down 7.9% over the last month, although just edging up 0.7% in the last week.

A lot of this movement can be traced back to evolving industry news and shifting investor sentiment. For example, Doximity has recently expanded its suite of digital tools, positioning itself further ahead in the healthcare communications niche. This innovation narrative seems to be underpinning some of the enthusiasm fueling longer-term gains, while concerns about increasing competition may be driving more jittery patches.

So is Doximity actually undervalued right now, or is its price running ahead of reality? Our valuation score, determined by whether a company passes six key undervaluation checks, stands at 1. That means Doximity is seen as undervalued in just one out of six standard metrics, suggesting a nuanced story when it comes to its true worth.

Next up, we will take a closer look at the specific valuation criteria that go into that score. But stick around, as there is a more insightful approach to valuation on the horizon that could help you make even better sense of where Doximity stands.

Doximity scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Doximity Discounted Cash Flow (DCF) Analysis

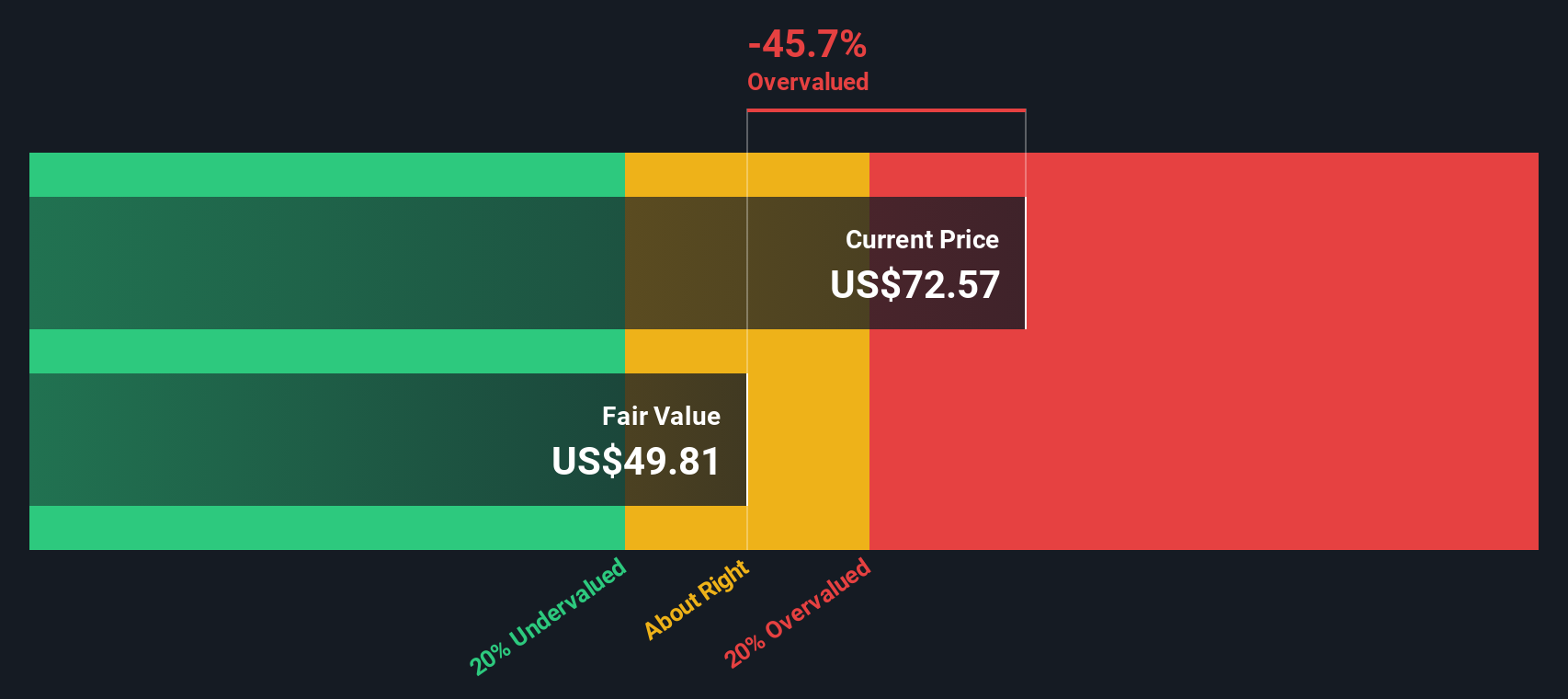

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting future free cash flows and discounting them back to today's dollars. The goal is to determine what Doximity may be worth now, based on how much cash it is projected to generate for shareholders in the future.

Doximity's most recent annual Free Cash Flow is $286.3 Million, and the DCF analysis uses both analyst forecasts and extrapolation to project that figure well into the next decade. For the next few years, analyst estimates have Doximity's FCF increasing, while Simply Wall St extends these projections further out. By 2030, Free Cash Flow is expected to reach $478.1 Million, suggesting a healthy growth rate over the interval.

Based on this model, Doximity's estimated fair value comes in at $49.91 per share. With shares currently trading at $68.50, this implies the stock is about 37.3% above its intrinsic value and is considered significantly overvalued by DCF standards.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Doximity may be overvalued by 37.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Doximity Price vs Earnings

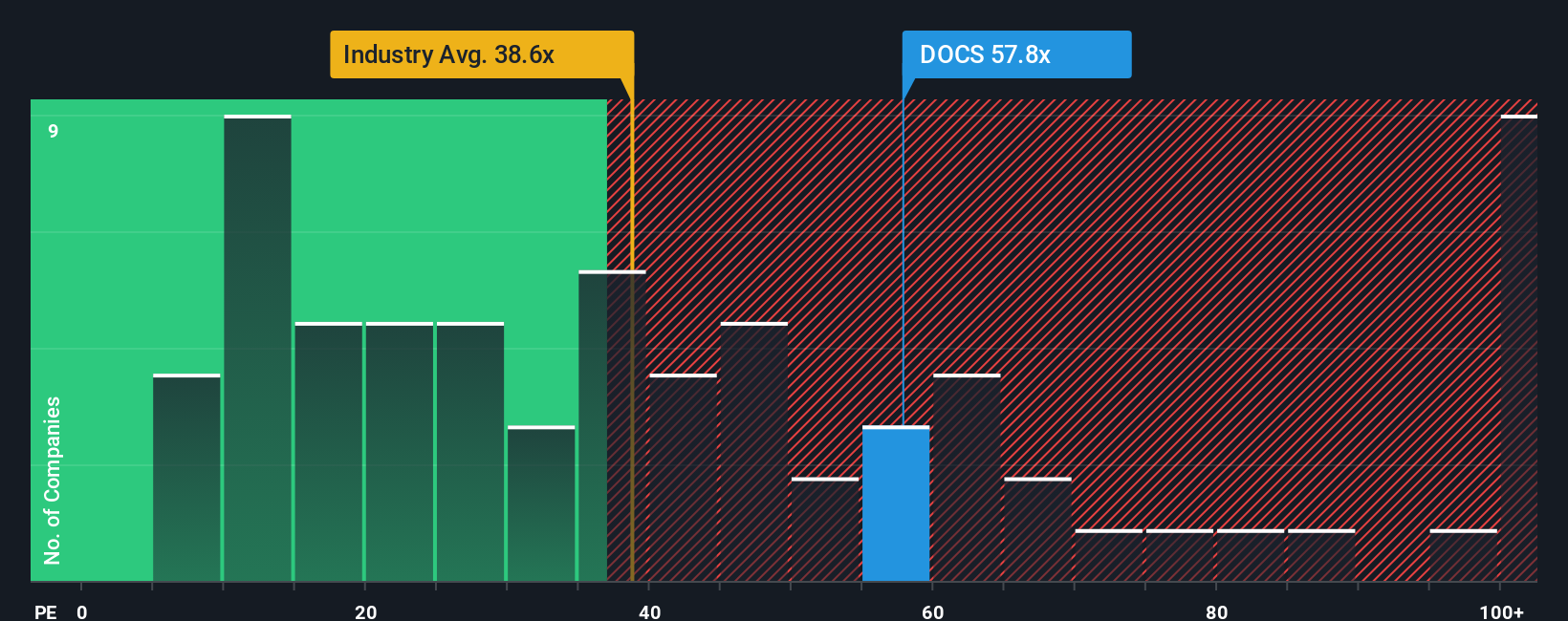

The Price-to-Earnings (PE) ratio is a key metric for valuing profitable companies like Doximity, as it shows how much investors are willing to pay for each dollar of current earnings. Since profits are a central driver for shareholder returns, the PE ratio makes it easy to compare valuation levels across the sector.

It is important to note that what constitutes a “normal” or “fair” PE ratio depends on expectations for a company’s growth, as well as the risks it faces. Higher growth companies often command higher multiples, while greater risks or slowing momentum can push the acceptable range lower.

Currently, Doximity trades at a PE of 54.6x. That is quite close to its peer group average of 55.7x and notably higher than the healthcare services industry average of 37.9x. Simply Wall St’s Fair Ratio for Doximity is 33.0x, a figure specifically tailored to reflect its earnings outlook, sector, margins, market size, and risk profile.

The Fair Ratio goes beyond a basic peer or industry comparison because it customizes the benchmark based on Doximity’s unique qualities rather than relying on averages. By blending details on the company’s growth, margins, and market cap with the broader industry context, the Fair Ratio provides a more balanced sense of what Doximity’s valuation should be.

Looking at these numbers side by side, Doximity’s actual PE of 54.6x is meaningfully higher than its Fair Ratio of 33.0x, suggesting the market is pricing in more optimism than what is justified by the fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Doximity Narrative

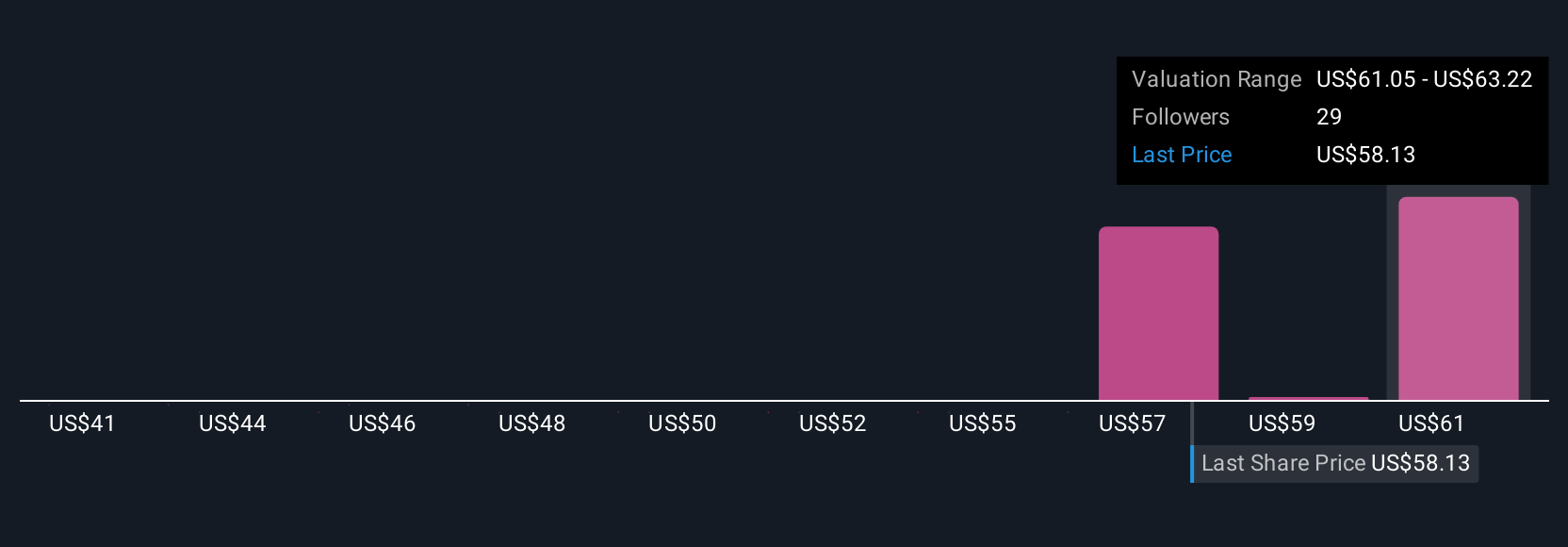

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company: your view on where Doximity is headed, backed by your own assumptions for future revenue, earnings, and profit margins. In other words, it is your forecast of Doximity’s business and how that links to what you believe is a fair value for the stock.

Narratives connect the company’s story, real-world drivers, and your expectations directly to a financial forecast, giving you a clear, personalized sense of whether Doximity is worth buying or selling at today’s price. This tool is designed to be approachable, and millions of investors on Simply Wall St’s Community page are already using Narratives to compare their view against the consensus in real time.

The real advantage? Narratives update dynamically. When Doximity issues new guidance, news breaks, or fresh numbers come in, you and others can instantly refine your model and see how your fair value estimate changes versus the market price. For example, some investors might set a bullish Narrative on Doximity, forecasting rapid adoption of new AI tools and setting a fair value near $80. Others take a more cautious approach, citing margin risks and slower growth, and set their fair value much lower, around $55.

Do you think there's more to the story for Doximity? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCS

Doximity

Operates as a digital platform for medical professionals in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion