- United States

- /

- Healthtech

- /

- NYSE:DOCS

How Slower Expected Earnings Growth at Doximity (DOCS) May Shift Its Investment Story

Reviewed by Simply Wall St

- Doximity recently reported strong business fundamentals, including a return on equity far above the industry average and substantial five-year net income growth, despite a pullback in its stock price.

- A key insight is that Doximity has reinvested all its profits back into the business, but analysts now anticipate its future earnings growth to slow.

- We will examine how shifting expectations for Doximity’s future earnings growth may affect the company's longer-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Doximity Investment Narrative Recap

To be a Doximity shareholder today, you need to believe that the company can sustain its high profitability and that demand for its digital healthcare solutions remains robust, even as growth rates begin to normalize. The most important short term catalyst, ongoing adoption of new products, is not materially changed by the recent update on earnings growth expectations, while the biggest current risk is that revenue momentum could slow if share gains falter or the broader market stalls.

Among recent company announcements, Doximity’s guidance for fiscal 2026 stands out. Management expects revenue to grow to between US$619 million and US$631 million, representing single-digit percentage growth. This guidance fits the new narrative that future growth is likely to be steadier but slower, making new product launches and industry tailwinds increasingly important for upside.

By contrast, investors should also be mindful of how Doximity’s customer concentration exposes it to sudden shifts in client relationships or contract renewals...

Read the full narrative on Doximity (it's free!)

Doximity's outlook anticipates $763.6 million in revenue and $305.9 million in earnings by 2028. This is based on a forecast yearly revenue growth rate of 10.2% and an $82.7 million increase in earnings from the current $223.2 million.

Uncover how Doximity's forecasts yield a $63.22 fair value, a 8% upside to its current price.

Exploring Other Perspectives

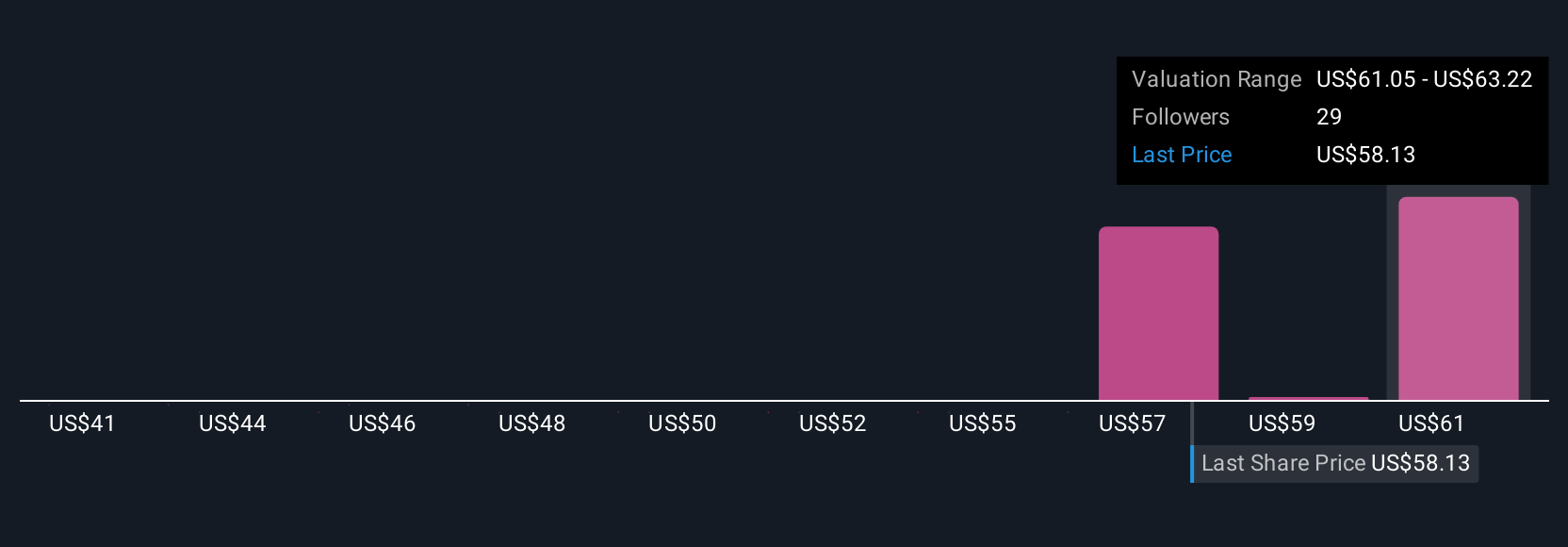

Simply Wall St Community members provided six fair value estimates for Doximity, ranging from US$41.46 to US$63.22. With ongoing revenue growth now forecast to be in the single digits, you can see how market viewpoints vary widely on the company’s prospects.

Explore 6 other fair value estimates on Doximity - why the stock might be worth as much as 8% more than the current price!

Build Your Own Doximity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Doximity research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Doximity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Doximity's overall financial health at a glance.

No Opportunity In Doximity?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCS

Doximity

Operates as a digital platform for medical professionals in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives