- United States

- /

- Healthtech

- /

- NYSE:DOCS

Does Possible US Software Export Controls to China Change the Bull Case for Doximity (DOCS)?

Reviewed by Sasha Jovanovic

- Earlier this week, news broke that the Trump administration is considering imposing new restrictions on software exports to China, raising concerns about future US-China trade relations and regulatory risks for technology firms.

- This development has heightened uncertainty across the software industry, potentially affecting companies like Doximity that may have exposure, directly or indirectly, to global technology trade disruptions.

- We'll examine how the prospect of tighter US software export controls to China could influence Doximity's investment narrative and growth outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Doximity Investment Narrative Recap

To be a shareholder in Doximity, you need to believe in its ability to expand as a leading digital platform for medical professionals, propelled by adoption of AI workflow tools and resilient demand from healthcare and pharmaceutical clients. The newly proposed US software export controls targeting China do not appear to present a material, near-term risk to Doximity’s core US-focused business or its most significant catalyst, continued rollout and adoption of AI tools like Scribe, although regulatory volatility remains a background concern for the wider sector.

Doximity’s recent update on share repurchases, over 4.1 million shares bought back for US$198.32 million since May 2024, most directly reflects management’s confidence in the business and is less relevant to the immediate effects of international trade policy moves. This action supports the company’s earnings per share and may bolster shareholder value amid a period of rapid AI product expansion, which continues to anchor its growth outlook and remains central to the upcoming catalysts.

However, investors should not overlook the different kind of policy risk that stems from...

Read the full narrative on Doximity (it's free!)

Doximity's narrative projects $805.8 million in revenue and $280.5 million in earnings by 2028. This requires 11.0% yearly revenue growth and a $45.4 million earnings increase from $235.1 million today.

Uncover how Doximity's forecasts yield a $70.72 fair value, a 6% upside to its current price.

Exploring Other Perspectives

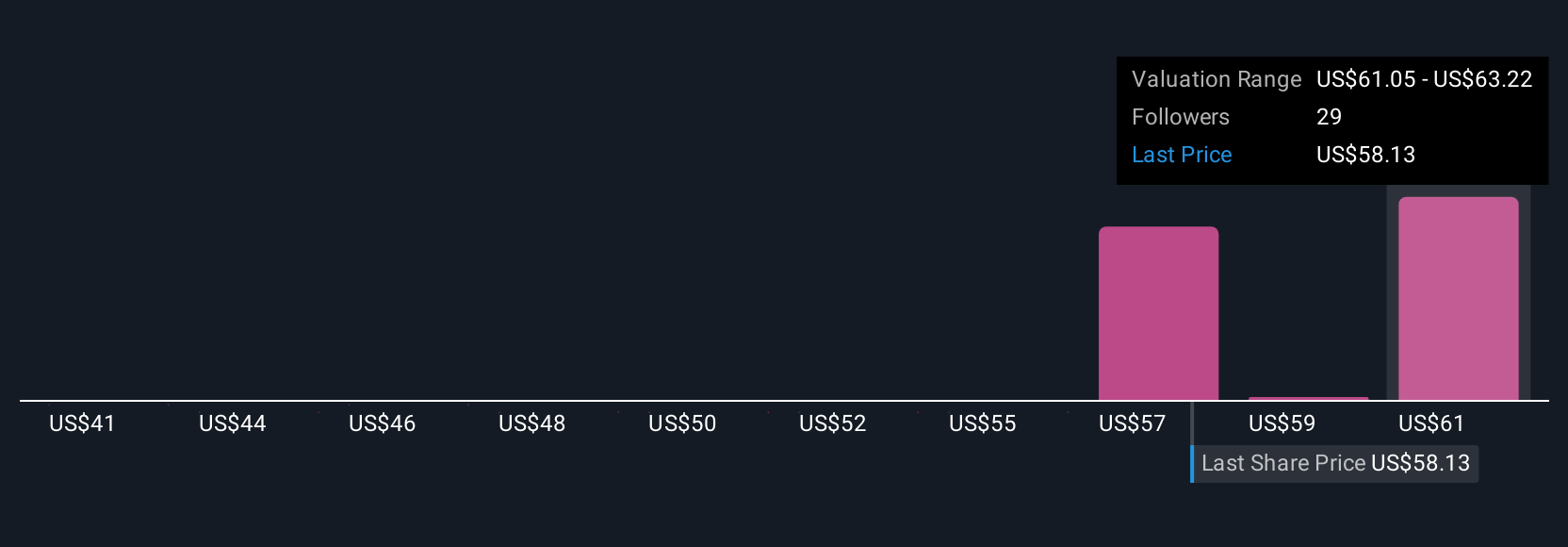

You’ll find seven fair value estimates from the Simply Wall St Community, ranging from US$41.46 to US$78.58 per share. While community opinions are diverse, management’s decision to offer advanced AI features for free in the near term may weigh on near-term growth and influences how participants view future potential, consider exploring several viewpoints before forming your own perspective.

Explore 7 other fair value estimates on Doximity - why the stock might be worth as much as 18% more than the current price!

Build Your Own Doximity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Doximity research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Doximity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Doximity's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCS

Doximity

Operates as a digital platform for medical professionals in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives