- United States

- /

- Healthtech

- /

- NYSE:DOCS

A Fresh Look at Doximity (DOCS) Valuation Following Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for Doximity.

After a tough run, Doximity’s share price is down 26.6% for the month and 24.7% over the past quarter. Recent momentum has definitely faded despite steady revenue growth. However, the one-year total shareholder return of just under 1% still beats out negative price returns, and the long-term three-year total shareholder return of 56.5% shows the stock has outperformed over the longer haul.

If you’re tracking innovation in the healthcare space, it’s worth exploring new opportunities in the industry with our See the full list for free..

With shares trading roughly 39% below analyst price targets and healthy financial growth, the question is whether Doximity is genuinely undervalued, or if the market has already accounted for all future upside in its current price.

Most Popular Narrative: 30.2% Undervalued

Doximity’s most popular narrative values the shares well above today’s close of $49.62, with analysts seeing significant upside based on their growth expectations. The calculations use a 7.88% discount rate and blend revenue, margin, and future earnings estimates to set fair value.

The expanded adoption of AI-powered workflow tools (Scribe, Doximity GPT, and Pathway AI) is expected to further entrench Doximity as a core clinician productivity suite. This is anticipated to drive frequency of platform use, deepen customer retention, and ultimately lead to higher average revenue per user (ARPU) over time, supporting long-term revenue and margin expansion.

Curious about the driving force behind Doximity’s bold valuation gap? Find out which future metrics support this optimistic outlook, including cutting-edge earnings targets. The most revealing assumptions are hidden in plain sight. See what’s under the hood of this narrative before the market does.

Result: Fair Value of $71.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty and heavy reliance on pharmaceutical marketing budgets could quickly test even the most optimistic outlook for Doximity’s future growth.

Find out about the key risks to this Doximity narrative.

Another View: Is the Market Multiple Telling a Different Story?

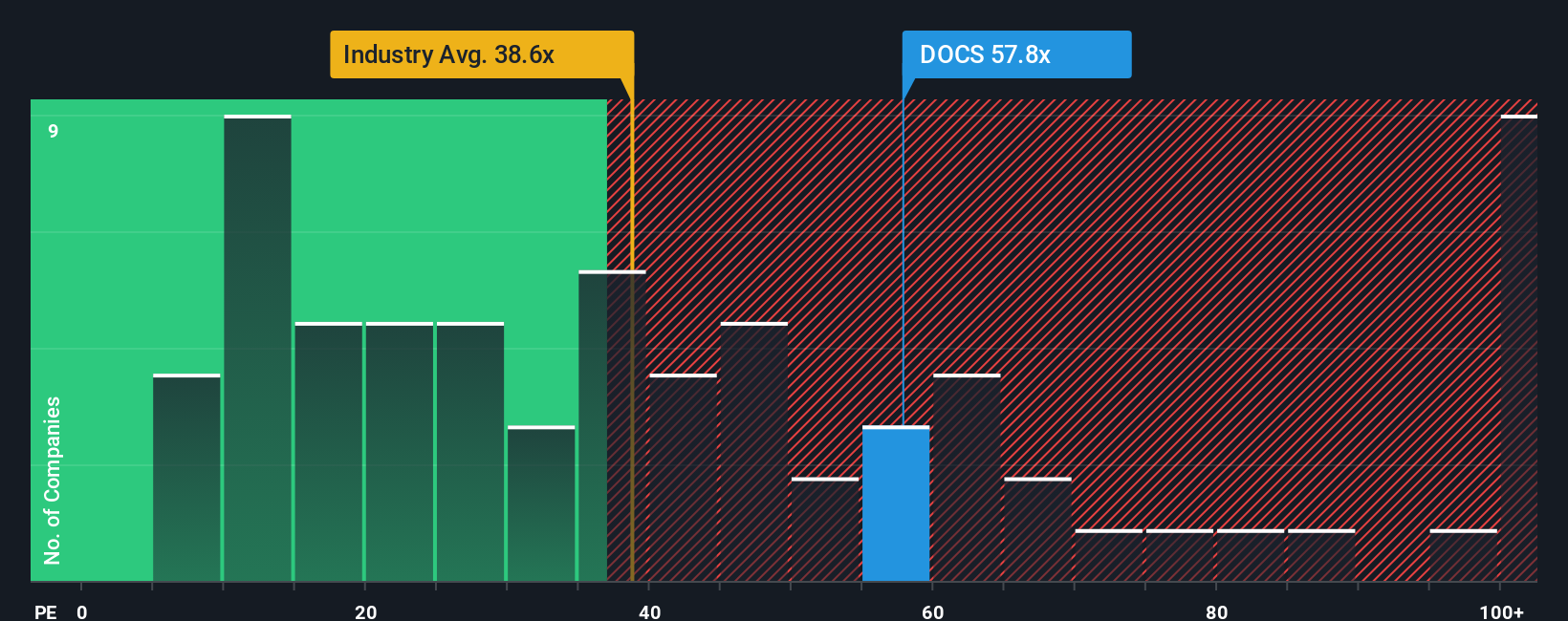

Looking at Doximity’s price-to-earnings ratio, we see it trading at 36.9x, which is higher than the global healthcare industry average of 34.8x and well above its own fair ratio of 25.1x. While this suggests Doximity is expensive on this metric, it is valued well below its peer average of 68.5x. This creates both risk if investor sentiment shifts and potential upside if strong growth returns. Which path will reality take?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Doximity Narrative

If you’re not convinced by these perspectives or want to dive deeper on your own, you can shape your own view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Doximity.

Looking for More Investment Ideas?

Expand your watchlist with stocks positioned for tomorrow’s trends. Don’t let overlooked opportunities slip by. Make sure you’re acting where others hesitate.

- Unlock growth with these 25 AI penny stocks transforming industries through artificial intelligence and machine learning.

- Capture income potential by reviewing these 16 dividend stocks with yields > 3% delivering attractive yields and reliability in uncertain markets.

- Gain an edge by checking out these 3585 penny stocks with strong financials offering high upside for bold investors ready to spot early movers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCS

Doximity

Operates as a digital platform for medical professionals in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives