- United States

- /

- Healthcare Services

- /

- NYSE:DGX

Did Higher Sales and a Mixed Outlook Just Shift Quest Diagnostics’ (DGX) Investment Narrative?

Reviewed by Simply Wall St

- In the past week, Quest Diagnostics reported higher quarterly sales and net income for the second quarter of 2025, raised its full-year revenue guidance, and disclosed a US$24 million impairment charge related to a potential business exit.

- An important insight is that while the company increased its 2025 revenue outlook, it slightly lowered its expected diluted earnings per share for the year.

- We'll examine how the updated revenue guidance, despite a lower EPS range, may influence Quest Diagnostics' investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Quest Diagnostics Investment Narrative Recap

To be a shareholder in Quest Diagnostics, you need confidence in the continued rise of advanced diagnostic and preventive healthcare testing, paired with the efficiency gains from automation and digital integration. The recent update, where revenue guidance increased but EPS guidance edged slightly lower, suggests that while growth remains supported by volume and innovation trends, near-term margin pressures and business exits appear manageable, with no material impact to the most important short-term catalyst: growth in higher-margin specialized tests. Risks tied to government reimbursement rates and public healthcare policy changes remain front-of-mind for the business, but these latest company disclosures do not fundamentally change the core bullish thesis or its top risks in the short run.

Among this week’s updates, Quest’s reporting of its Q2 2025 impairment charge, the US$24 million write-off tied to a potential business exit, stands out because it clarifies that management continues to actively reshape the portfolio in pursuit of higher returns. While not large enough to materially affect overall results, it does highlight ongoing efforts to optimize business mix, supporting the primary catalyst of margin and revenue expansion through focus on higher-value specialty diagnostics over time.

However, the risk that reimbursement pressures could unexpectedly accelerate, impacting Quest’s pricing power and earnings, is something investors should keep in mind as...

Read the full narrative on Quest Diagnostics (it's free!)

Quest Diagnostics is projected to reach $11.9 billion in revenue and $1.3 billion in earnings by 2028. Achieving these targets would require annual revenue growth of 4.1% and a $355 million increase in earnings from the current $945 million.

Uncover how Quest Diagnostics' forecasts yield a $188.19 fair value, a 10% upside to its current price.

Exploring Other Perspectives

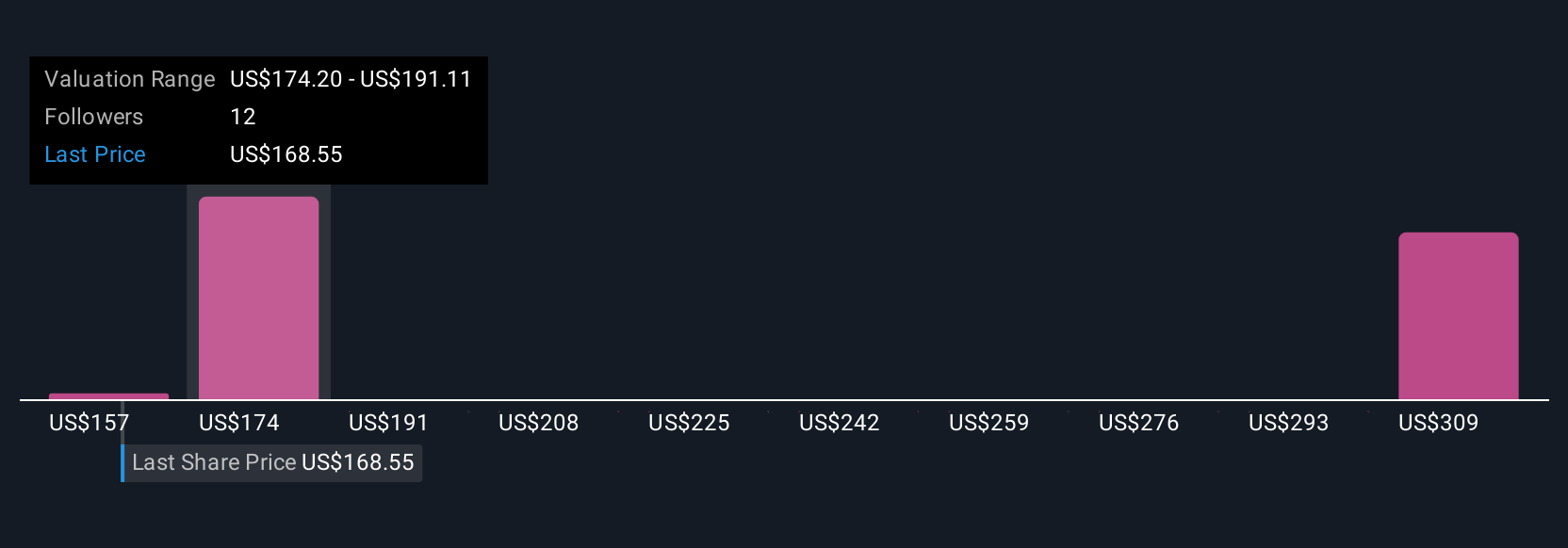

Simply Wall St Community estimates for Quest Diagnostics’ fair value range from US$157.30 to US$288.23, spanning three distinct perspectives. As you consider the importance of evolving payer dynamics and reimbursement risks flagged by analysts, remember that your outlook could differ sharply from others’, explore all viewpoints before making a decision.

Explore 3 other fair value estimates on Quest Diagnostics - why the stock might be worth 8% less than the current price!

Build Your Own Quest Diagnostics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quest Diagnostics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Quest Diagnostics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quest Diagnostics' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quest Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DGX

Quest Diagnostics

Provides diagnostic testing and services in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives