- United States

- /

- Healthcare Services

- /

- NYSE:CVS

Is CVS Health a Hidden Bargain After 76.6% Rally and New Primary Care Partnerships?

Reviewed by Bailey Pemberton

- Curious if CVS Health is actually a good deal at today's price? Let's dig in and see if there's hidden value or potential caution lurking beneath the surface.

- CVS Health's stock has had a rollercoaster ride. It is up an impressive 76.6% year-to-date and 47.1% over the past year, though the last week was a bit rough with a 5.0% drop.

- Recent headlines have spotlighted CVS's strategic partnerships and accelerated moves into primary care, which are fueling discussions around its future growth and competitive positioning. At the same time, broader market jitters in healthcare have kept volatility front and center for investors.

- The company currently scores 5 out of 6 on our valuation checks, signaling several undervalued aspects that are well worth examining. Next, we'll walk through how value is assessed. Stick around, because there's an even more insightful approach to valuation coming up near the end of this article.

Approach 1: CVS Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a business by projecting its future cash flows and discounting them back to today’s value. This approach focuses on what matters most for long-term shareholders: the actual cash the company is expected to generate, adjusted for the time value of money.

For CVS Health, the latest free cash flow stands at $6.1 Billion for the last twelve months. Analysts forecast a steady increase, with free cash flow projected to reach $13.7 Billion by 2029. While direct analyst estimates typically reach only five years out, further projections beyond that are calculated using extrapolation techniques, drawing on recent growth rates and industry expectations.

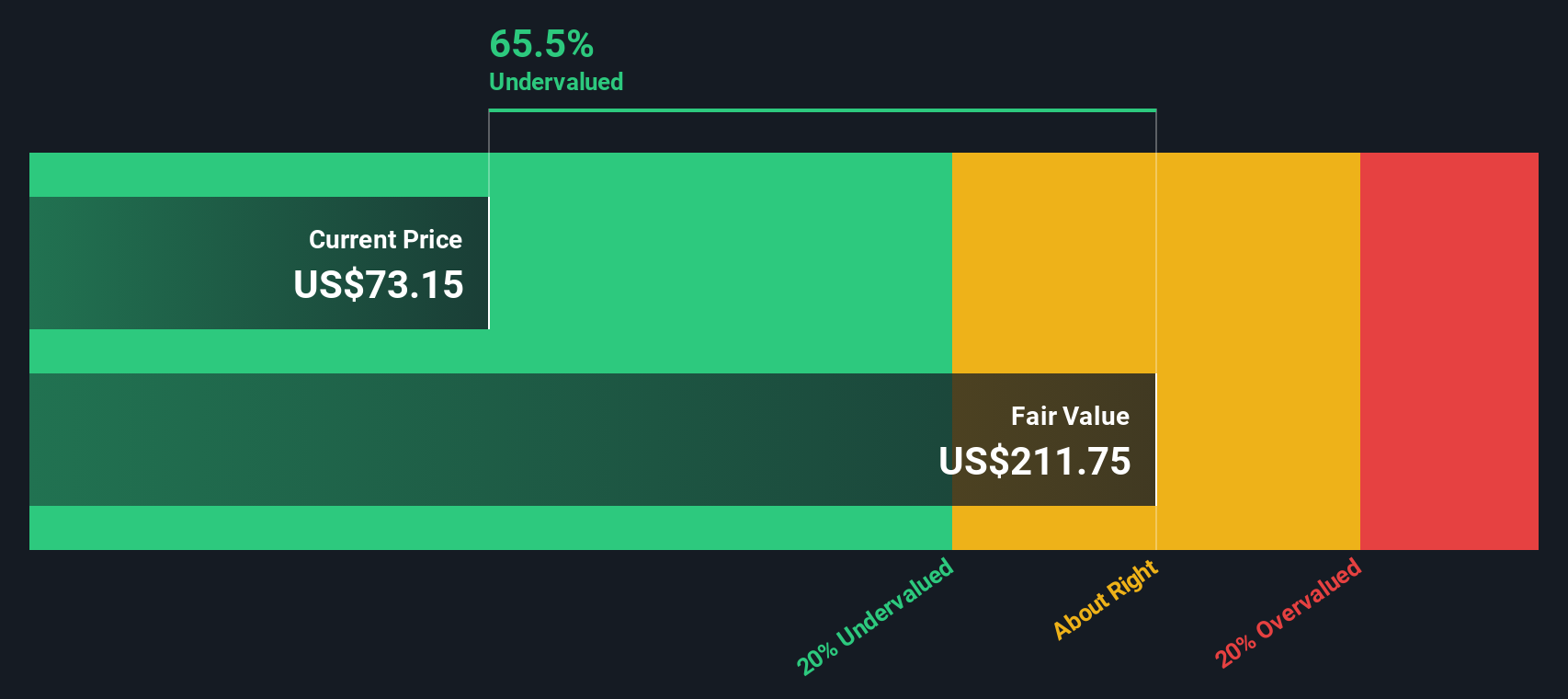

Based on these cash flows and using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value of CVS Health is $305.82 per share. With the stock currently trading at a 74.5% discount to this estimated value, the DCF model suggests CVS Health is significantly undervalued relative to its long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CVS Health is undervalued by 74.5%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: CVS Health Price vs Sales

The Price-to-Sales (P/S) ratio is often a reliable gauge for valuing profitable, large-scale companies like CVS Health, especially in industries where margins may fluctuate but revenue remains a key marker of market position and growth prospects. For companies with steady or growing sales, the P/S ratio offers a straightforward means to compare value, particularly when earnings may be impacted by short-term costs or non-operating items.

The "normal" or fair P/S ratio for any company depends not only on its top-line growth profile, but also on the perceived risk around that growth. Higher growth rates and lower risk typically justify a higher ratio, while slower growth or higher risk should lower valuations drawn from sales multiples.

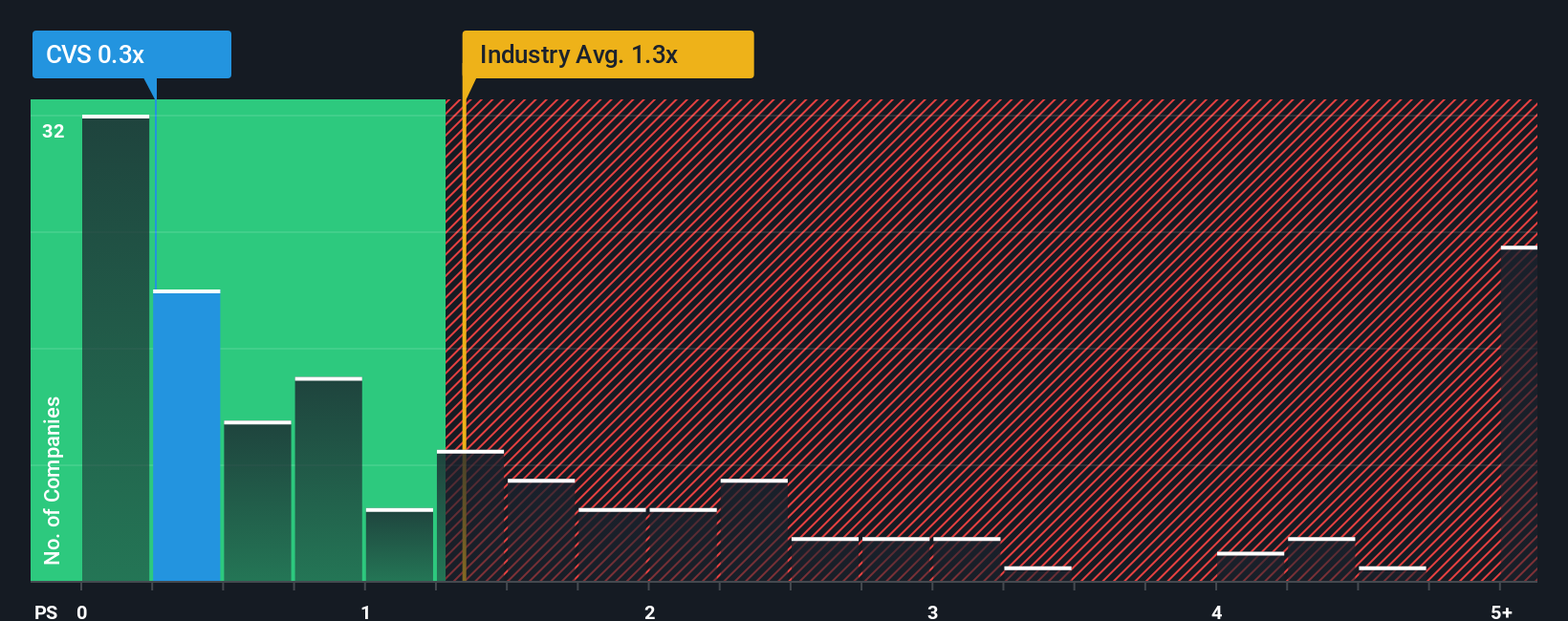

Currently, CVS Health trades at a P/S ratio of just 0.25x. For perspective, the average P/S ratio across healthcare companies stands at 1.23x, while direct peers average roughly 1.06x. This prompts the question: is CVS Health being unfairly discounted, or is there more to the story?

This is where Simply Wall St's Fair Ratio adds a useful layer of insight. The Fair Ratio for CVS Health sits at 1.25x, calculated with consideration for the company’s future growth, profit margins, scale, and the specific risks it faces. Unlike a simple peer or industry comparison, the Fair Ratio is tailored to recognize how CVS Health stacks up on fundamentals and prospects rather than just sector-wide averages.

With the company trading at 0.25x, significantly below its Fair Ratio of 1.25x, this suggests the market is underpricing CVS Health’s revenue stream even after accounting for risk and expected growth.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CVS Health Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a clear and simple story, based on your own perspective about a company’s future, linking your expectations for things like revenue, earnings and profit margins to your estimate of fair value. Instead of just relying on static ratios or analyst targets, Narratives help you combine your reasoning with the numbers, creating a dynamic forecast that’s easy to track and adjust as new information becomes available.

On Simply Wall St’s Community page, millions of investors use Narratives to map out these stories, compare fair value to the current share price, and help answer the crucial question: when should I buy or sell? Because Narratives update automatically with company news or earnings, your view stays relevant with the latest data, making it a smarter, more tailored tool than traditional methods.

For example, some investors build optimistic Narratives for CVS Health, forecasting strong demographic trends and new care models will drive steady earnings growth and push fair value above $99. Others see long-run margin pressures and tougher competition limiting profitability, so their bearish Narrative sits closer to $70. By framing your investment decisions around your own Narrative, you can act confidently, armed with both the story and the numbers behind your target price.

Do you think there's more to the story for CVS Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVS

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives