- United States

- /

- Healthcare Services

- /

- NYSE:COR

How a Fourth Quarter Earnings Beat At Cencora (COR) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Cencora recently reported strong fiscal fourth quarter earnings that exceeded analysts' expectations, prompting several firms to raise their assessments of the company.

- While the company's President and CEO sold US$1.86 million worth of stock under a pre-arranged plan, analysts remain focused on Cencora's operating performance and future potential in the Medical Services industry.

- Let's explore how Cencora's latest earnings beat could influence its investment case and reinforce analyst confidence in future growth.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Cencora Investment Narrative Recap

To invest in Cencora, you need to feel confident in the company’s ability to maintain margin growth and benefit from healthcare’s tilt toward specialty pharmaceuticals and innovation. While the recent Q4 earnings beat has reinforced short-term optimism and attracted positive analyst sentiment, it does not materially change the most pressing risk: ongoing margin pressure from the shift toward lower-fee generics and biosimilars, which continues to challenge revenue growth and profitability.

Among recent announcements, Cencora’s move to increase its quarterly dividend by 9% stands out, reflecting management’s ongoing commitment to returning value to shareholders. This aligns with the short-term catalyst of healthy cash generation, but also emphasizes the importance of sustaining earnings momentum in an industry grappling with regulatory and margin pressures.

However, looking past the excitement of an earnings beat, investors should keep an eye on the impact of steadily moderating margins from generics and biosimilars, especially as…

Read the full narrative on Cencora (it's free!)

Cencora's outlook anticipates $385.4 billion in revenue and $3.3 billion in earnings by 2028. This is based on analysts forecasting 6.8% annual revenue growth and a $1.4 billion increase in earnings from the current $1.9 billion.

Uncover how Cencora's forecasts yield a $382.07 fair value, a 4% upside to its current price.

Exploring Other Perspectives

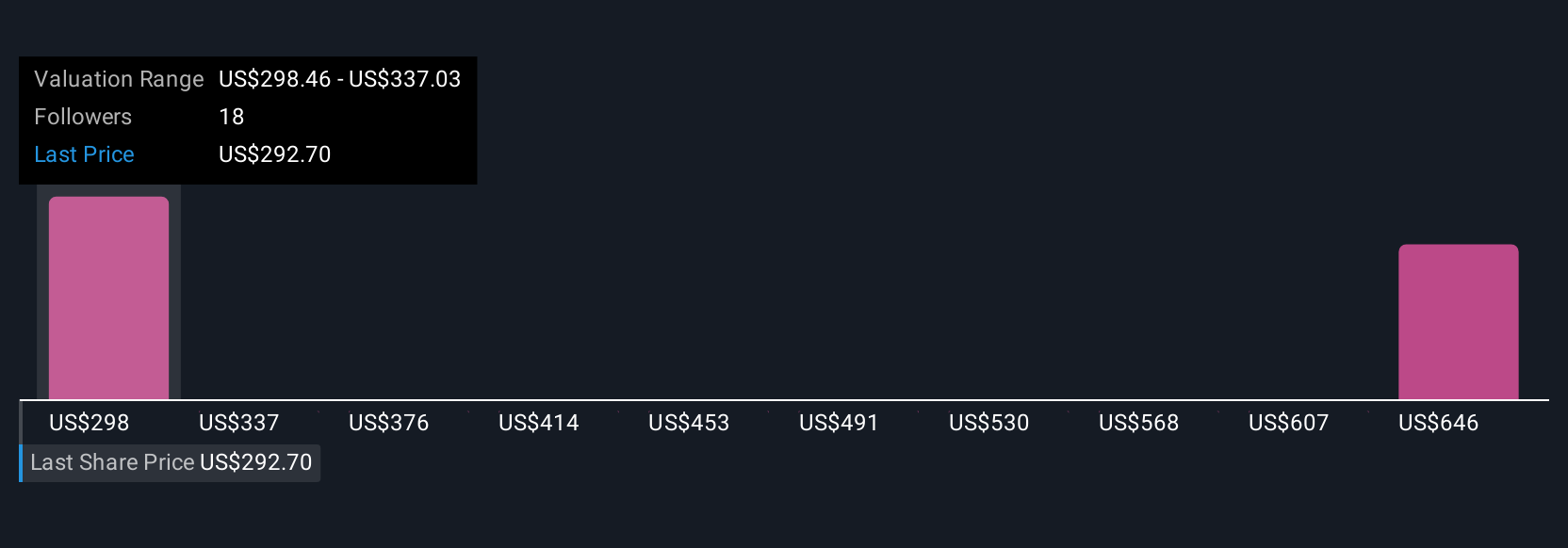

Simply Wall St Community members have shared four different fair value estimates for Cencora, ranging from US$298 to US$863 per share. In light of analysts’ continued focus on margin compression from generics and biosimilars, you may want to explore several contrasting viewpoints on Cencora’s long-term earnings outlook.

Explore 4 other fair value estimates on Cencora - why the stock might be worth 18% less than the current price!

Build Your Own Cencora Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cencora research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cencora's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COR

Cencora

Cencora, Inc. sources and distributes pharmaceutical products in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives