- United States

- /

- Healthcare Services

- /

- NYSE:COR

Cencora (COR): Is There Further Upside After Recent Share Price Gains? A Fresh Look at Valuation

Reviewed by Simply Wall St

Cencora (COR) shares have seen some movement lately, drawing attention as investors look for fresh reasons behind the action. With trading dynamics at play, many are considering the company’s recent performance and what the numbers might suggest going forward.

See our latest analysis for Cencora.

Cencora’s share price has been powering higher lately, notching a 10.5% gain over the past month and surging almost 25% across the last 90 days. This momentum builds on an impressive run, with a year-to-date share price return of nearly 63% and a 1-year total shareholder return of 50%. Clearly, investors are warming to the company’s growth prospects and shifting risk perceptions.

Curious to see what other fast growers with strong insider conviction are out there? Now's the perfect time to discover fast growing stocks with high insider ownership

With shares hitting new highs, the key question is whether Cencora’s strong run leaves room for further gains, or if the market has already factored in its expected growth. Is there still a buying opportunity here?

Most Popular Narrative: 4.3% Undervalued

Based on the prevailing narrative, Cencora’s fair value estimate sits just above the current closing price. This puts the spotlight on how aggressive growth and margin assumptions shape the upside case.

Cencora's ongoing investment in digital infrastructure and advanced analytics positions the company to capitalize on the accelerating digitization of healthcare and regulatory requirements like the Drug Supply Chain Security Act. These efforts improve supply chain efficiency and transparency, which should drive higher net margins and operating income over time.

Want to know what powers this optimistic valuation? One key input is an ambitious leap in profitability tied to new tech and earnings expansion. Curious how the numbers add up, and what future PE multiple justifies this target? The answer is deeper than it looks.

Result: Fair Value of $382.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower profitability from high-volume drugs or ongoing international headwinds may quickly test the optimism around Cencora’s current fair value outlook.

Find out about the key risks to this Cencora narrative.

Another View: High Market Multiples Raise Questions

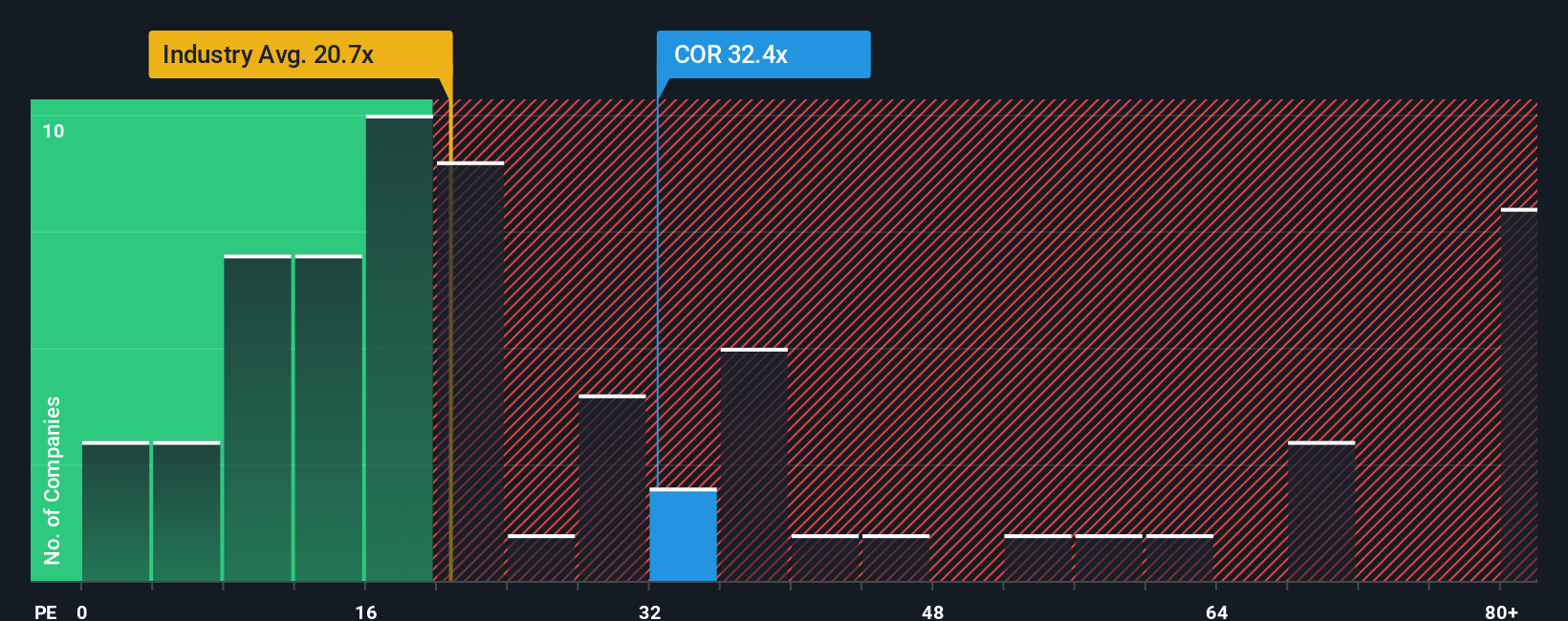

While the first valuation leans on future earnings growth, comparing current market pricing to other healthcare stocks tells a different story. Cencora trades at a much higher price-to-earnings ratio of 45.6x than both the industry average (21.7x) and its peers (23.2x), and even well above its fair ratio of 33.5x. This means investors are paying a substantial premium for growth. Could this gap signal future risk, or is the market right in its optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cencora Narrative

If you'd like to dig into the numbers yourself or form your own perspective, it's easy to craft your own view of Cencora's story in just a few minutes, so why not Do it your way

A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop with just one opportunity when the market is packed with other high-potential stocks? Get ahead of the curve and set yourself up for smarter investing. These ideas are too good to pass by.

- Capture next-level growth by seeing which cutting-edge tech firms are making waves in artificial intelligence through these 25 AI penny stocks.

- Secure reliable income streams by reviewing these 17 dividend stocks with yields > 3% featuring companies with yields over 3% and a proven commitment to shareholders.

- Capitalize on overlooked opportunities by checking out these 917 undervalued stocks based on cash flows packed with stocks trading below their intrinsic value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COR

Cencora

Cencora, Inc. sources and distributes pharmaceutical products in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives