- United States

- /

- Healthcare Services

- /

- NYSE:COR

Cencora (COR): $713 Million One-Off Loss Challenges Premium Growth Narrative

Reviewed by Simply Wall St

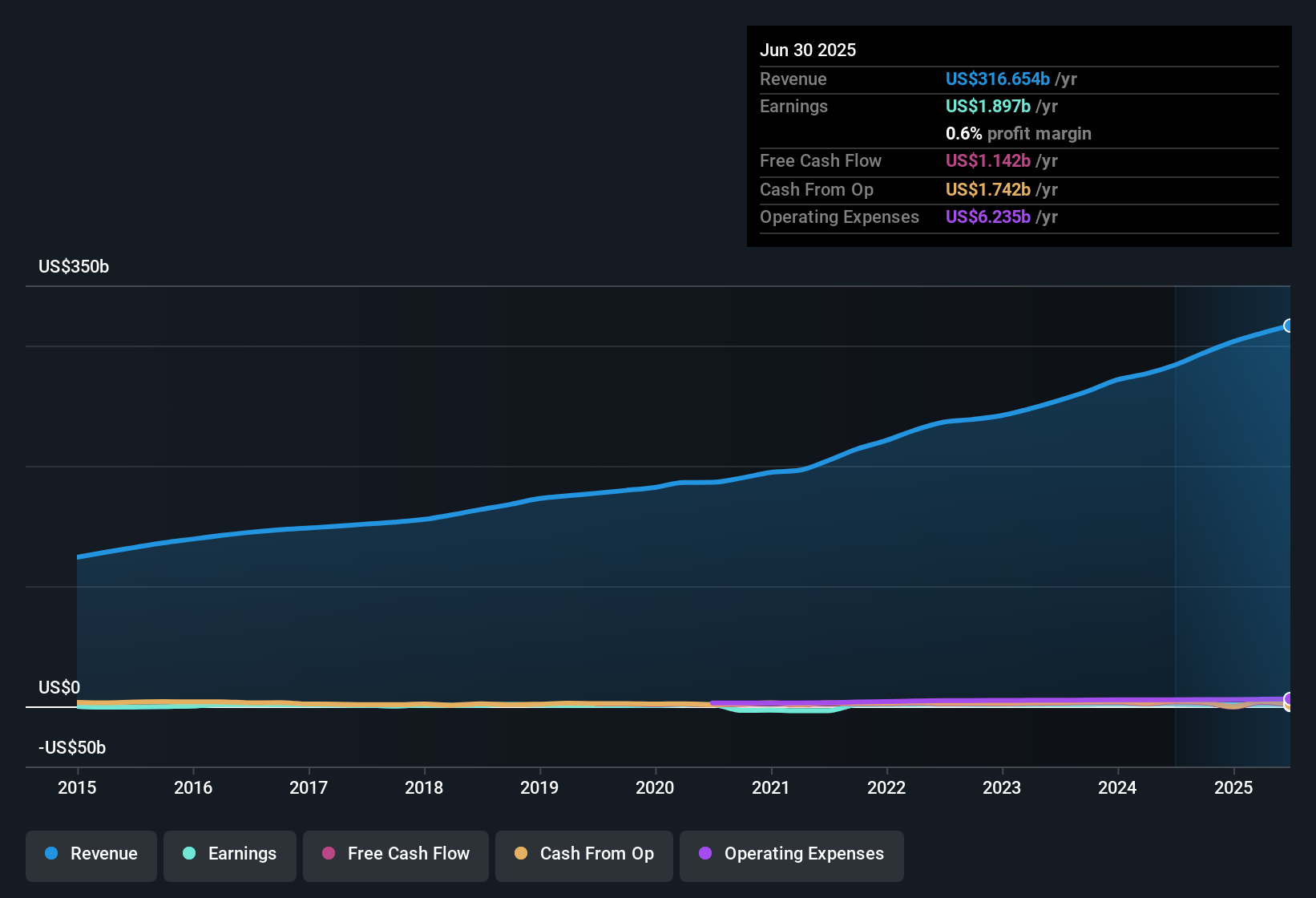

Cencora (COR) grew its earnings by an average 48.8% per year over the past five years, but growth slowed to just 2.2% in the latest year as revenue is projected to expand at 6.7% annually, trailing the broader US market's 10.5% forecast. Net profit margins fell to 0.6%, compared to 0.7% a year ago, with results affected by a one-off $713.2 million loss for the twelve months ending September 30, 2025. While the outlook calls for 11% annual earnings growth, this pace lags behind the US market's 16% expectation. Investors face a mixed picture as ongoing profit and revenue growth is offset by slower momentum and premium valuation multiples.

See our full analysis for Cencora.Now let's see how these figures compare to the widely held narratives about Cencora. We will test where investor stories align and where the numbers shake up expectations.

See what the community is saying about Cencora

Higher PE Ratio Sets a Premium Bar

- Cencora’s price-to-earnings ratio stands at 36.2x, notably above the US healthcare industry average of 21.5x and its peer group at 23.9x. This suggests the market is willing to pay a premium for shares compared to similar companies.

- Analysts' consensus view highlights the tradeoff between ongoing profit growth and slower momentum:

- Consensus expects earnings to grow 11% per year, outpacing many traditional distributors but undershooting the broader US market's 16% expected rate.

- Despite slower bottom-line expansion, strategic digital investments and high-value acquisitions are aimed at supporting future margin gains and giving Cencora an edge as industry demands evolve.

Margin Expansion Hinges on Efficiency

- Net profit margins are expected to improve from 0.6% to 0.9% within three years according to analyst forecasts, reflecting anticipated operational gains after a recent one-off $713.2 million loss weighed on performance.

- The analysts' consensus narrative stresses that competitive advantages are closely tied to improving efficiency and service differentiation:

- Digital infrastructure upgrades and analytics are designed to boost supply chain transparency. This could potentially lift operating income over time as healthcare digitization and regulatory pressures intensify.

- However, rapidly growing high-volume product lines, like biosimilars and GLP-1s, offer little relief to the bottom line. Sustainable margin progress depends on boosting outpatient specialty and value-added segments where fee rates are higher.

DCF Fair Value Doubles Stock Price

- With a discounted cash flow (DCF) fair value of $679.26 per share versus a current market price of $354.00, Cencora appears underpriced through this lens, even as it trades above analyst targets (341.79).

- Based on the consensus narrative, the combination of slower projected revenue growth (6.7%) and a rising share count (0.31% annually) means the current valuation hinges on management delivering long-term margin and capital discipline:

- The DCF signal spotlights an upside not captured in near-term profit forecasts, but peer and industry PE discounts show investors remain concerned about maintaining premium multiples.

- For the consensus case to hold, bulls must believe Cencora’s innovations and global expansion will translate into higher sustainable earnings by 2028, despite regulatory and competitive headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cencora on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Does your view of the figures offer a new angle? You can build your own take and shape the story in just minutes. Do it your way

A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Cencora’s slower growth, reliance on margin gains, and premium valuation mean investors face uncertainty about whether performance can keep up with expectations.

If you want to find companies with steadier revenue and earnings growth, filter for more predictable performers using stable growth stocks screener (2074 results) built to deliver consistency through changing conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COR

Cencora

Cencora, Inc. sources and distributes pharmaceutical products in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives