- United States

- /

- Healthcare Services

- /

- NYSE:COR

Assessing Cencora (COR) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Cencora (COR) has seen its stock price move slightly this week, catching the eye of investors who are tracking healthcare sector performance. With a steady climb over the past month, the company’s trends invite a closer look at recent results.

See our latest analysis for Cencora.

Cencora’s strong 13.8% one-month share price return builds on steady gains this year, pushing its latest close to $344.53 and bringing the company’s year-to-date share price return to over 53%. Long-term investors have also enjoyed impressive compounding, with a 48% total shareholder return over the past year and more than 230% total return in five years. This signals ongoing momentum and growing market confidence in the business.

Looking to spot other healthcare companies gaining traction? See the full list for free with our dedicated healthcare stocks screener: See the full list for free.

But with shares now trading close to analysts’ targets, the question arises: is Cencora undervalued after its rapid run, or has the market already priced in next year’s expected growth, leaving little room for a fresh buying opportunity?

Most Popular Narrative: 2% Overvalued

With Cencora's last close price sitting just above the narrative's fair value estimate, market enthusiasm has outpaced the latest analyst consensus. The tension now centers on whether the company’s progress can justify this recent push past fair value.

Cencora’s ongoing investment in digital infrastructure and advanced analytics positions the company to capitalize on the accelerating digitization of healthcare and regulatory requirements like the Drug Supply Chain Security Act, improving supply chain efficiency and transparency, which should drive higher net margins and operating income over time.

Want the full playbook behind this premium price? There is a bold set of assumptions at work: future profits, expanding margins, and a punchy earnings multiple. Don’t miss which key financial forecasts are driving this upbeat target. The real details are inside.

Result: Fair Value of $338.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, margin pressure from rising generics and ongoing regulatory scrutiny could pose real threats to Cencora's optimistic growth story in the future.

Find out about the key risks to this Cencora narrative.

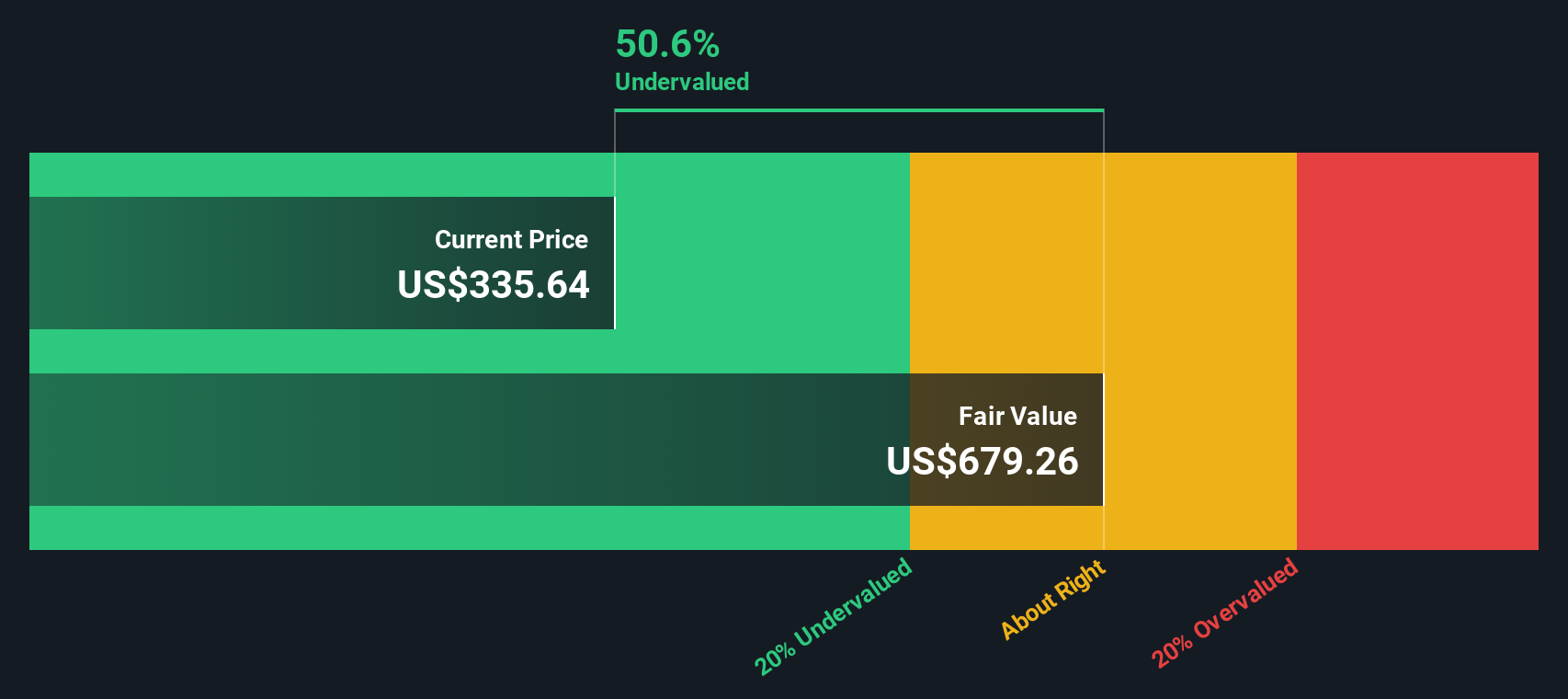

Another View: DCF Model Suggests Undervaluation

While the market may see Cencora as fully valued or even pricey by traditional measures, our DCF model tells a different story. It estimates Cencora is actually trading well below its intrinsic value and suggests hidden upside others might be missing. Could this point to a longer-term bargain?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cencora for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cencora Narrative

If you have a different perspective or want to explore the underlying numbers on your own terms, you can quickly shape your own narrative in just a few minutes. Do it your way

A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve by trying proven strategies to uncover stocks most investors will wish they had found sooner. Don’t settle for missed opportunities. Take action now and upgrade your watchlist.

- Unlock the potential for rapid growth by targeting these 3616 penny stocks with strong financials with strong financials and untapped market opportunities.

- Tap into tomorrow’s breakthroughs by tracking these 26 AI penny stocks poised to transform industries with artificial intelligence innovations.

- Secure attractive entry points by focusing on these 840 undervalued stocks based on cash flows that stand out through their robust cash flows and appealing valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COR

Cencora

Cencora, Inc. sources and distributes pharmaceutical products in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives