- United States

- /

- Healthcare Services

- /

- NYSE:CI

Cigna (CI) Profit Margin Rise Confirms Bull Case Despite Balance Sheet Concerns

Reviewed by Simply Wall St

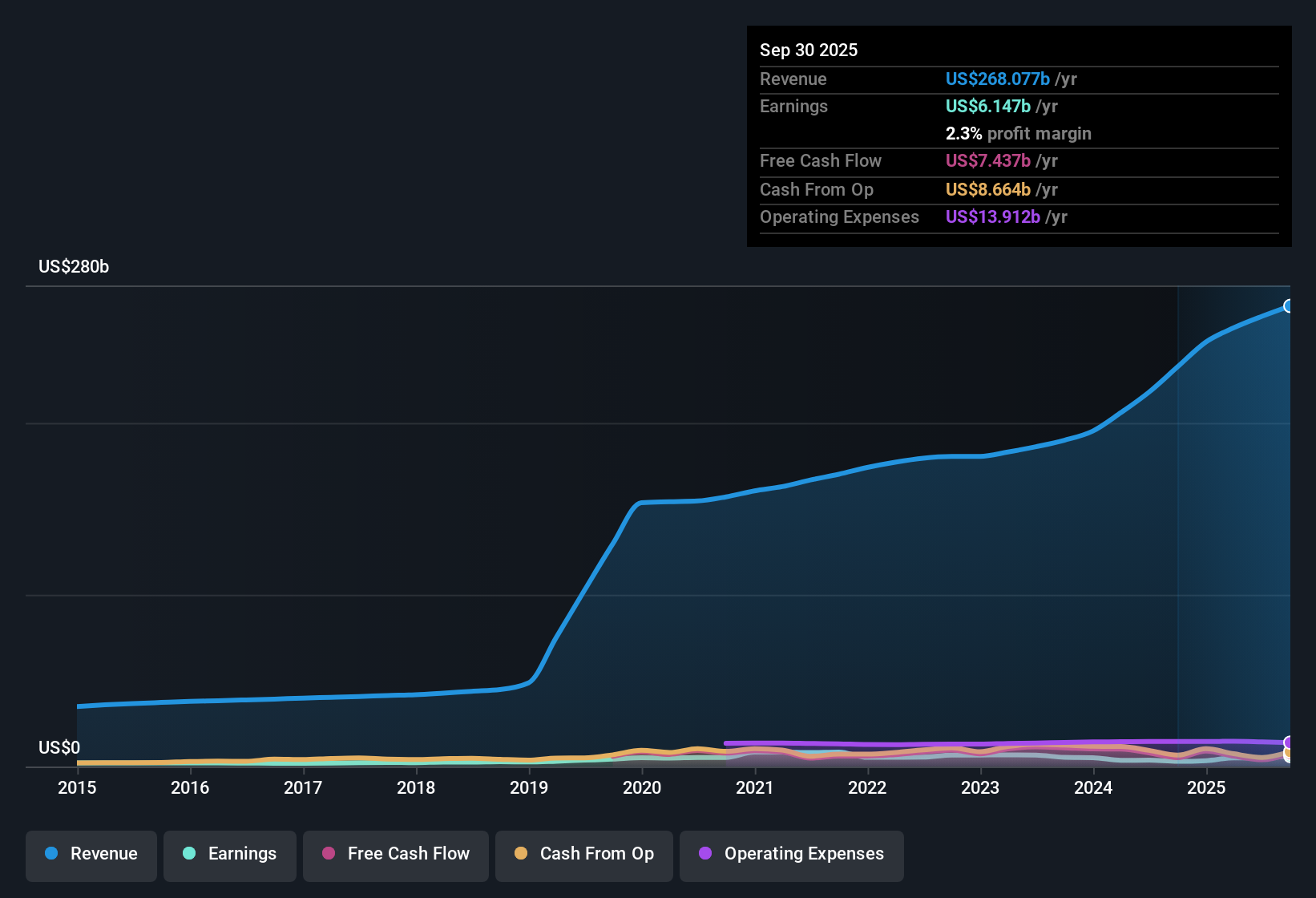

Cigna Group (CI) reported a net profit margin of 1.9%, a step up from last year’s 1.7%, with earnings growth over the past year reaching 35.3%. This marks a sharp turnaround from its five-year average decline of 14.2% per year. Shares are trading at $247.1, well below analyst estimates of fair value and at a Price-to-Earnings Ratio of 13.1x, which stands out versus industry and peer averages. Despite forecasts for slower earnings growth of 7.2% per year and revenue growth of 4.5% per year compared to broader US market expectations, Cigna’s strong value signals and widening profitability margins have set the stage for fresh investor interest.

See our full analysis for Cigna Group.Next, we’ll see how this round of results matches up to the most widely held narratives about Cigna, revealing where consensus is confirmed and where the numbers push back.

See what the community is saying about Cigna Group

Margins Forecasted to Hit 2.6% Within Three Years

- Analysts project Cigna's net profit margin will rise from 1.9% to 2.6% by 2027, a notable gain for a company previously facing multi-year profit declines.

- Consensus narrative sees expanding specialty pharmacy, digital health innovation, and a strategic focus on higher-margin segments as central to this margin boost.

- Growth in CuraScript and Accredo supports Cigna's push into the specialty space, aiming for double-digit revenue expansion and stronger long-term earnings.

- Ongoing digital initiatives, including AI-driven care coordination, are expected to keep cost increases in check and sustainably lift net margins.

Share Count Shrink Expected to Amplify EPS

- The number of Cigna shares outstanding is set to fall by 4.04% per year over the next three years, which means investors could see an extra lift in earnings per share (EPS) even if profit growth moderates.

- According to analysts' consensus view, this material share count reduction plays a direct role in forecasts showing EPS reaching $32.1 by 2028, up from current levels.

- This effect helps bridge the gap between slower forecasted earnings growth rates and stronger per-share performance for investors holding the stock.

- Still, the consensus narrative warns that the benefits depend on Cigna delivering on revenue expansion and maintaining its operating efficiency, as increased leverage or lower profitability could offset EPS gains.

Valuation: Steep Discount to DCF Fair Value and Peer PE

- Shares trade at $247.10, significantly below the DCF fair value of $1,113.67 and at just 13.1x earnings, much cheaper than the US healthcare industry average (21.9x) or peer average (29.3x).

- Consensus narrative highlights that Cigna's discounted valuation, attractive dividend profile, and recent reversal in profitability trends could draw positive attention, if investors are convinced the financial risks are manageable.

- While future growth rates trail the broader market, the strong value signals may provide a margin of safety not seen in pricier healthcare stocks.

- That said, analysts flag ongoing concerns around Cigna's balance sheet health; stabilization here is key to sustaining this positive valuation sentiment.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cigna Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Wondering if the numbers tell a different story? Share your view and shape your own take in just a few minutes. Do it your way

A great starting point for your Cigna Group research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Cigna's improving profitability and upbeat valuation, analysts remain concerned about the company's balance sheet health and its need for greater financial stability.

If you want to steer clear of these balance sheet uncertainties, discover companies with stronger fundamentals and robust finances by starting your search with solid balance sheet and fundamentals stocks screener (1984 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CI

Cigna Group

Provides insurance and related products and services in the United States.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives