- United States

- /

- Healthcare Services

- /

- NYSE:CHE

Does Chemed's (CHE) Buyback Commitment Reveal a Strategic Shift in Capital Allocation?

Reviewed by Sasha Jovanovic

- Chemed Corporation recently reported third-quarter 2025 results, showing lower net income year-over-year, reiterated its earnings guidance for the full year, and announced the repurchase of 407,500 shares for US$180.8 million during the quarter.

- An interesting aspect is the company’s commitment to returning capital to shareholders through its ongoing buyback program, with over US$2.44 billion spent repurchasing more than 65% of shares since 2011.

- We’ll now explore how Chemed’s reaffirmed guidance in the face of earnings headwinds may influence its longer-term investment narrative.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Chemed Investment Narrative Recap

To own shares in Chemed, you generally need to believe in its ability to grow hospice and plumbing services by navigating industry changes and improving operational execution. The recent earnings decline did not alter Chemed’s full-year outlook or its most important near-term catalyst, which is ramping new VITAS locations; the key risk remains ongoing pressure on Medicare reimbursement and VITAS margins, which this update does not materially change.

Among recent announcements, the decision to maintain 2025 earnings guidance stands out as an anchoring factor for the narrative. Despite softer quarterly earnings, Chemed’s management reaffirmed confidence in operational strategies, providing a measure of stability against short-term market headwinds and offering clarity while the company addresses sector-specific risks.

However, investors should also be aware that future reimbursement policy changes could emerge quickly and affect VITAS margins if...

Read the full narrative on Chemed (it's free!)

Chemed's outlook forecasts $2.9 billion in revenue and $351.5 million in earnings by 2028. This requires 5.1% annual revenue growth and a $61 million increase in earnings from $290.3 million today.

Uncover how Chemed's forecasts yield a $582.25 fair value, a 35% upside to its current price.

Exploring Other Perspectives

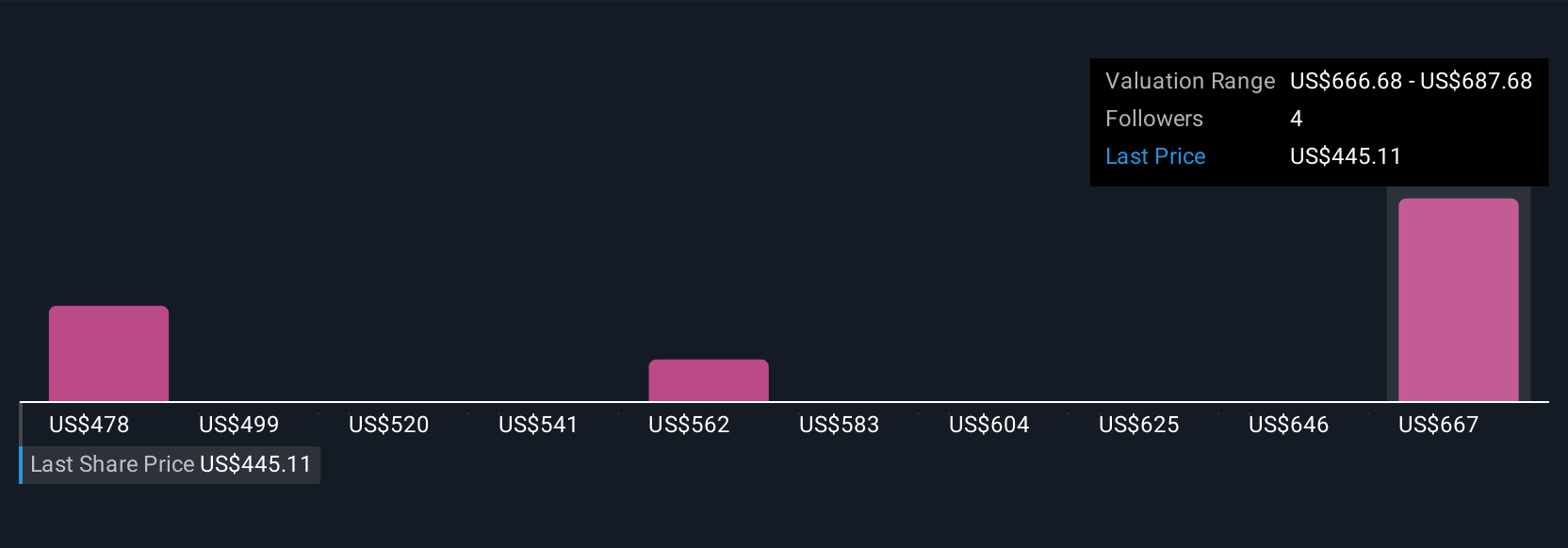

Simply Wall St Community members estimate Chemed’s fair value between US$477.66 and US$646.20, highlighting four different perspectives. Against this diversity of views, ongoing Medicare reimbursement risks may weigh heavily on future earnings and the company’s ability to sustain its operational strengths.

Explore 4 other fair value estimates on Chemed - why the stock might be worth just $477.66!

Build Your Own Chemed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chemed research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chemed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chemed's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHE

Chemed

Provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives