- United States

- /

- Healthcare Services

- /

- NYSE:CHE

Chemed (CHE): Valuation in Focus After Lower Q3 Earnings and Notable Stake Reduction

Reviewed by Simply Wall St

Chemed (CHE) shares drew focus after the company posted lower earnings for the third quarter. The company cited higher costs in its hospice business and slimmer margins in Roto-Rooter, despite reporting revenue growth.

See our latest analysis for Chemed.

Chemed’s latest update comes after a challenging period for shareholders. While earnings guidance was reaffirmed and a share buyback completed, third-quarter results missed the mark and a major fund trimmed its holdings. Together these factors contributed to mounting negative sentiment. Over the past year, the company’s total shareholder return dropped 19.9%, with year-to-date share price performance also lagging, suggesting momentum has faded and valuation risks are back in focus.

If this shift has you scanning the horizon for new ideas, it might be time to explore See the full list for free.

After turbulent results and a pullback in the share price, the key question for investors is whether Chemed now trades at an attractive discount or if the market has already factored in expectations for its future growth.

Most Popular Narrative: 24.6% Undervalued

Chemed’s closing price still lags well below the narrative’s estimated fair value, hinting at a sizable upside if performance trends hold. The details behind this valuation revolve around company initiatives and industry shifts, which could act as major catalysts for future expansion.

The ramp-up of new Certificate of Need (CON) locations in underserved Florida counties (for example, Pinellas and Marion) is expected to materially expand VITAS's service footprint. This aligns with the continued aging U.S. population and the shift toward home-based care, both key drivers of higher patient volumes and long-term top-line revenue growth.

Curious how bold expansion plans and an age-driven end-market could justify such a bullish valuation? The narrative hinges on aggressive revenue and margin forecasts along with a rising premium multiple. Want to see the exact projections fueling that gap? Dive in to uncover the full storyline and numbers powering this fair value.

Result: Fair Value of $582.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Medicare reimbursement and persistent margin pressure at Roto-Rooter could quickly undermine bullish expectations for Chemed’s future earnings growth.

Find out about the key risks to this Chemed narrative.

Another View: Is the Market Pricing Chemed Fairly?

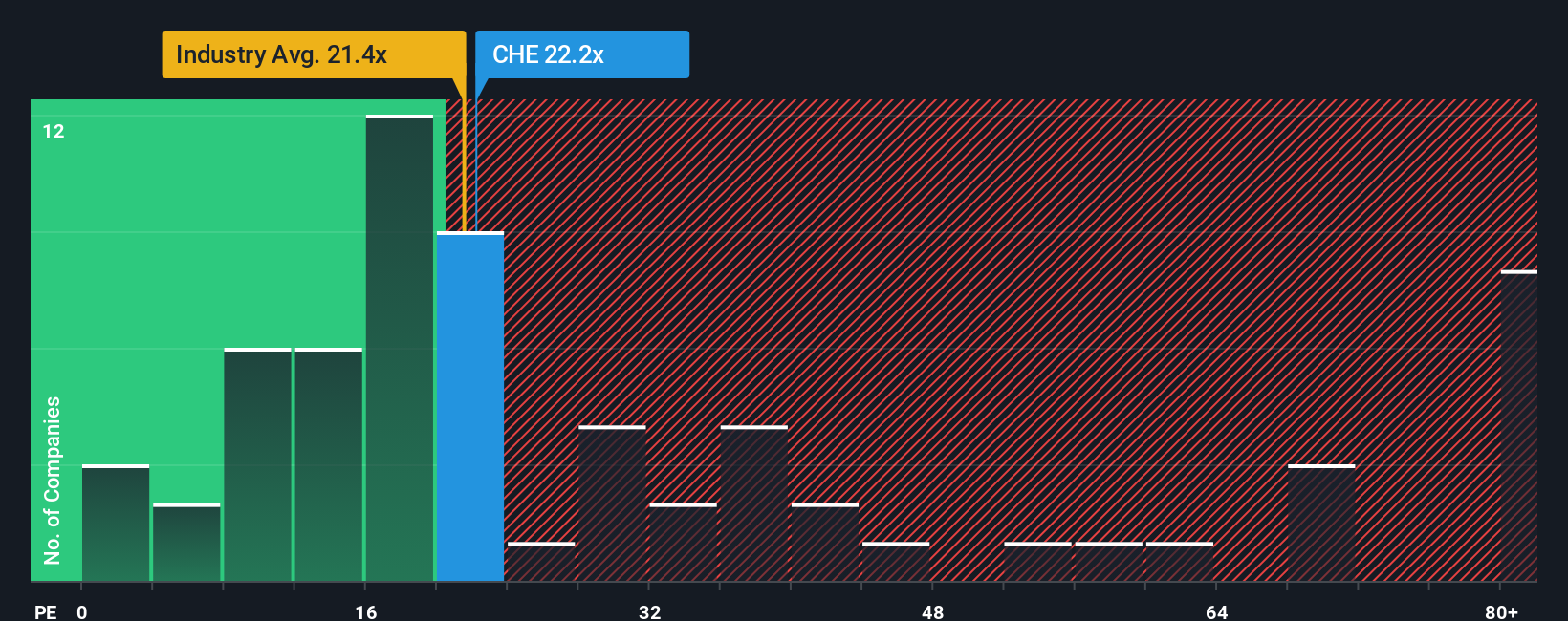

Looking through a price-to-earnings lens, Chemed trades at 22.2x earnings, which is a bit richer than both the US Healthcare industry’s 21.5x average and the “fair ratio” estimate of 21.6x. This small gap suggests investors might be taking on extra valuation risk at current levels. Does this premium mean Chemed is truly worth more, or has sentiment moved ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chemed Narrative

If you see the story differently or want to dig into the details yourself, it’s easy to shape your perspective from the ground up in just a few minutes, so why not Do it your way

A great starting point for your Chemed research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep fresh opportunities on their radar. Give your portfolio an edge by checking out these handpicked ideas, each designed to put you one step ahead of the crowd.

- Tap into market disruptors with these 26 AI penny stocks and stay on top as artificial intelligence transforms global industries.

- Capture big yields for your income strategy by reviewing these 20 dividend stocks with yields > 3% offering reliable payouts above 3%.

- Ride the momentum of digital innovation by seizing early opportunities among these 81 cryptocurrency and blockchain stocks shaping the future of finance and tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHE

Chemed

Provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives