- United States

- /

- Healthcare Services

- /

- NYSE:CHE

Chemed (CHE): Assessing Valuation After Earnings Miss Draws Investor Focus

Reviewed by Simply Wall St

Chemed reported its latest quarterly results, with revenue coming in as expected while earnings lagged behind estimates. This earnings miss has drawn attention from investors and has sent shares down after the announcement.

See our latest analysis for Chemed.

Chemed’s share price has been under pressure lately, with a year-to-date decline of 16.3% and a 12-month total shareholder return of -22.3%. Recent earnings disappointment appears to have reinforced a fading momentum, and longer-term investors have seen muted returns in recent years.

If you’re curious about other corners of the market showing resilience, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With the shares trading at a valuation discount and fundamentals showing mixed signals, investors are left to weigh whether Chemed is undervalued and poised for a rebound, or if the stock’s weak outlook is already reflected in its current price.

Most Popular Narrative: 24.1% Undervalued

With Chemed's last close at $441.74 and the most widely followed narrative putting fair value at $582.25, there is a sizable gap between current price and projected worth. As market attention turns to what could drive Chemed higher, one key driver stands out in the narrative's own words.

The ramp-up of new Certificate of Need (CON) locations in underserved Florida counties (e.g., Pinellas and Marion) is expected to materially expand VITAS's service footprint. This aligns with the continued aging U.S. population and the shift toward home-based care, both key drivers of higher patient volumes and long-term top-line revenue growth.

Want to know what's behind this lofty valuation? The secret sauce is a combination of steady growth assumptions and profit margin improvements projected over the next several years. Discover which future milestones and bold expansion moves make up the backbone of this bullish story.

Result: Fair Value of $582.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing Medicare reimbursement challenges and persistently weak demand at Roto-Rooter could limit Chemed’s margin recovery and stall the anticipated turnaround.

Find out about the key risks to this Chemed narrative.

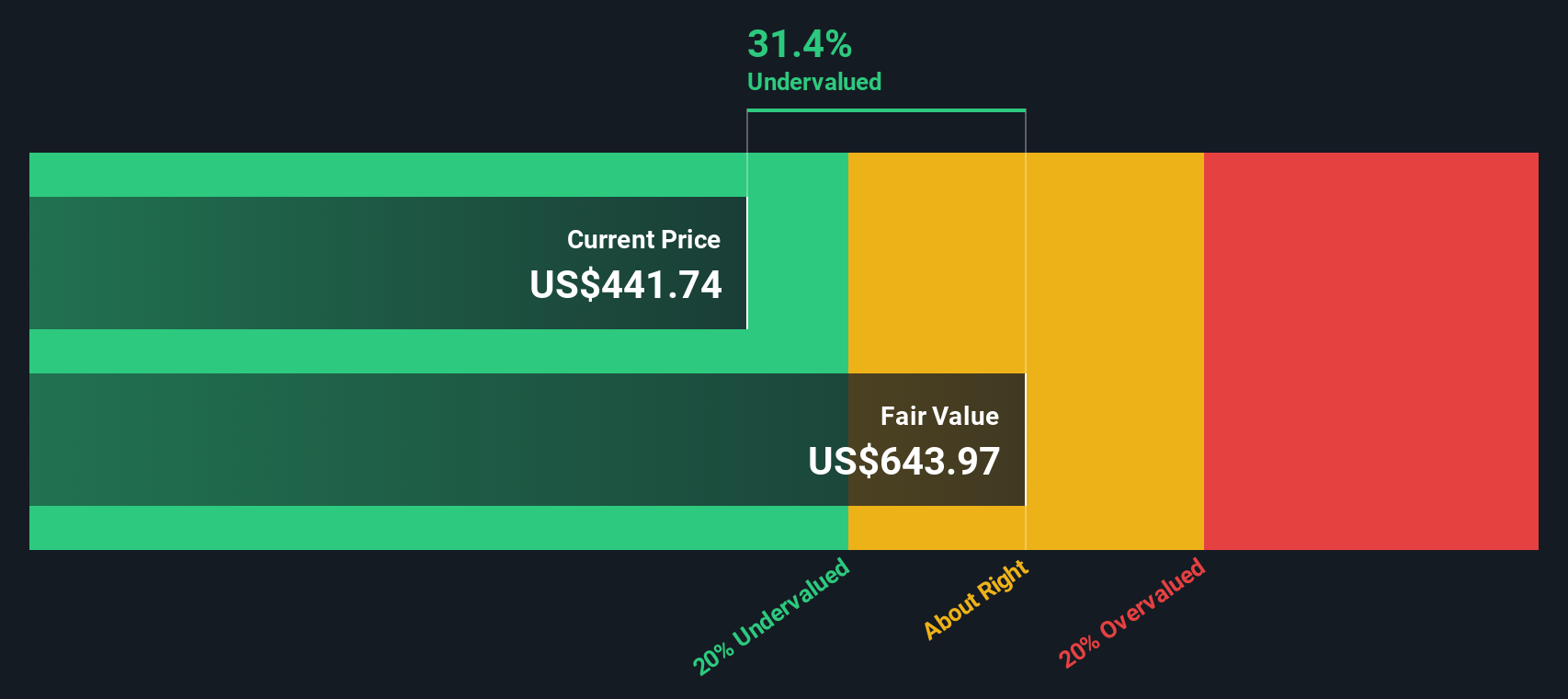

Another View: Testing with Our DCF Model

Looking at Chemed through our SWS DCF model, the story shifts. The DCF approach puts fair value at $643.97, well above the current price. This suggests the shares may be even more undervalued than what the market multiples imply. Could the market be overlooking Chemed’s long-term growth potential, or is there more risk beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Chemed Narrative

If you see things differently or prefer to dive into the numbers on your own terms, you can easily craft your own story in just a few minutes. Do it your way

A great starting point for your Chemed research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Take action now and unlock smart stock picks with the Simply Wall Street Screener. There’s a whole world of potential waiting.

- Boost your portfolio’s income potential by targeting steady payers and high yields with these 17 dividend stocks with yields > 3%.

- Power up your watchlist by backing innovators in artificial intelligence. See what’s moving markets with these 25 AI penny stocks.

- Catalyze your returns by zeroing in on the market’s most attractively priced investments with these 918 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHE

Chemed

Provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives