- United States

- /

- Healthcare Services

- /

- NYSE:CAH

Did Cardinal Health’s (CAH) Earnings Beat and Japan Expansion Just Shift Its Growth Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Cardinal Health posted its first earnings beat in over a year, with quarterly earnings per share surpassing consensus expectations by more than 16%, while also expanding its market presence in Japan amid anticipated healthcare reforms.

- The strong financial report, combined with several positive analyst ratings, reflects renewed confidence in Cardinal Health’s ability to achieve growth and adapt in a changing healthcare landscape.

- We'll explore how the latest quarterly earnings beat and analyst upgrades could influence Cardinal Health’s future growth outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cardinal Health Investment Narrative Recap

To be a shareholder in Cardinal Health, you need to believe in the company's ability to maintain consistent earnings growth and adapt to shifts in global healthcare demand, especially as pharmaceutical volumes rise and new markets emerge. The recent earnings beat and positive analyst upgrades are encouraging, but in the short term, the biggest catalyst remains the pace of Cardinal Health’s expansion in specialty distribution and international markets, while the greatest risk continues to be tightening regulation and pricing pressure, neither of which is materially changed by the latest news.

Of the recent announcements, Cardinal Health’s opening of new specialty and at-home medical distribution centers in the U.S. stands out. These investments, which support operational efficiency and more reliable supply chains, tie directly to the company's efforts to capture market share and improve margins, key near-term catalysts as competition and customer shifts remain top of mind.

However, investors should carefully watch for one key risk: if regulatory scrutiny and price controls intensify more quickly than expected, it may directly impact Cardinal Health’s margin profile and earnings outlook...

Read the full narrative on Cardinal Health (it's free!)

Cardinal Health's outlook anticipates $288.0 billion in revenue and $2.2 billion in earnings by 2028. This scenario assumes a 9.0% annual revenue growth and a $0.6 billion increase in earnings from current earnings of $1.6 billion.

Uncover how Cardinal Health's forecasts yield a $212.43 fair value, in line with its current price.

Exploring Other Perspectives

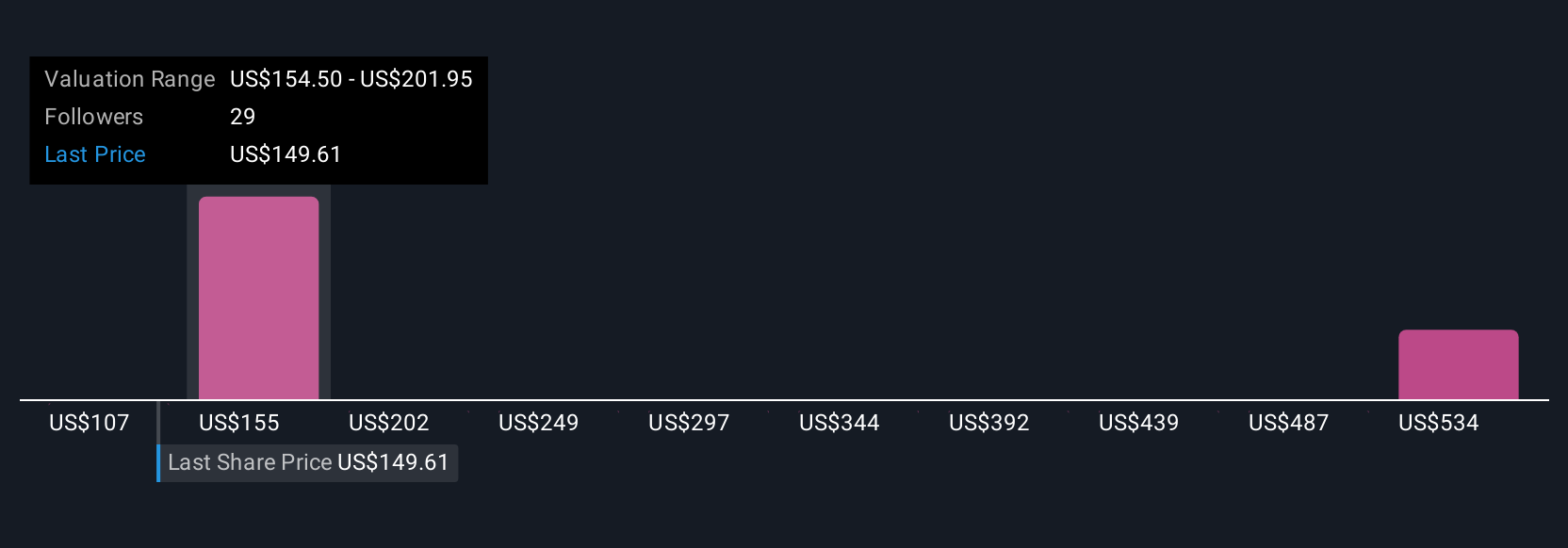

Simply Wall St Community members estimate Cardinal Health’s fair value anywhere between US$168.25 and US$461.80 based on three individual analyses. While specialty expansion and operational improvements remain a strong support for company growth, these wide-ranging views reflect how market participants can interpret risks and opportunities differently.

Explore 3 other fair value estimates on Cardinal Health - why the stock might be worth 20% less than the current price!

Build Your Own Cardinal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cardinal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cardinal Health's overall financial health at a glance.

No Opportunity In Cardinal Health?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAH

Cardinal Health

Operates as a healthcare services and products company in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives