- United States

- /

- Healthcare Services

- /

- NYSE:CAH

Cardinal Health (CAH): Exploring Valuation Following a 30% Share Price Surge

Reviewed by Simply Wall St

Cardinal Health (CAH) shares have steadily advanced over the past month, gaining 30%. Investors are taking a closer look at how the company's fundamentals might be driving this momentum and what it could signal in the future.

See our latest analysis for Cardinal Health.

After a remarkable 30.5% share price return this past month, Cardinal Health’s momentum is tough to ignore. The latest move builds on a robust run, with the stock delivering a 5-year total shareholder return of 339%. Investor confidence in its growth prospects also appears to be accelerating.

If Cardinal’s momentum has you looking for other strong contenders in healthcare, take the next step and check out See the full list for free.

With shares riding high after such substantial gains, investors are weighing whether Cardinal Health remains undervalued or if recent price moves have already accounted for its future growth potential. Is there still a buying opportunity here?

Most Popular Narrative: 60% Undervalued

The most widely followed narrative points to a sizeable gap between Cardinal Health’s current share price and its estimated fair value. With shares recently closing at $211.20 and analysts setting fair value above $212, this backdrop fuels debate on whether the market is giving full credit to future growth.

Efficiency gains from automation and portfolio optimization are expected to improve margins, cash flow, and profit resilience amid ongoing healthcare industry changes. Strategic expansion into higher-margin specialty businesses, including acquisitions in multi-specialty MSO platforms (e.g., Solaris Health), specialty pharma, and biopharma solutions, should accelerate long-term profit growth, diversify revenue streams, and enhance overall earnings resilience.

Behind this eye-catching valuation is a narrative powered by ambitious forecasts. The story hints at bold margin improvements, strategic moves into new healthcare verticals, and projections for stronger earnings. Intrigued by how much optimism is built into this price target? See the underlying assumptions that may surprise even seasoned investors.

Result: Fair Value of $212.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing government pricing scrutiny and the potential loss of major customer contracts could quickly shift the outlook and challenge further upside for Cardinal Health.

Find out about the key risks to this Cardinal Health narrative.

Another View: What Does SWS DCF Say?

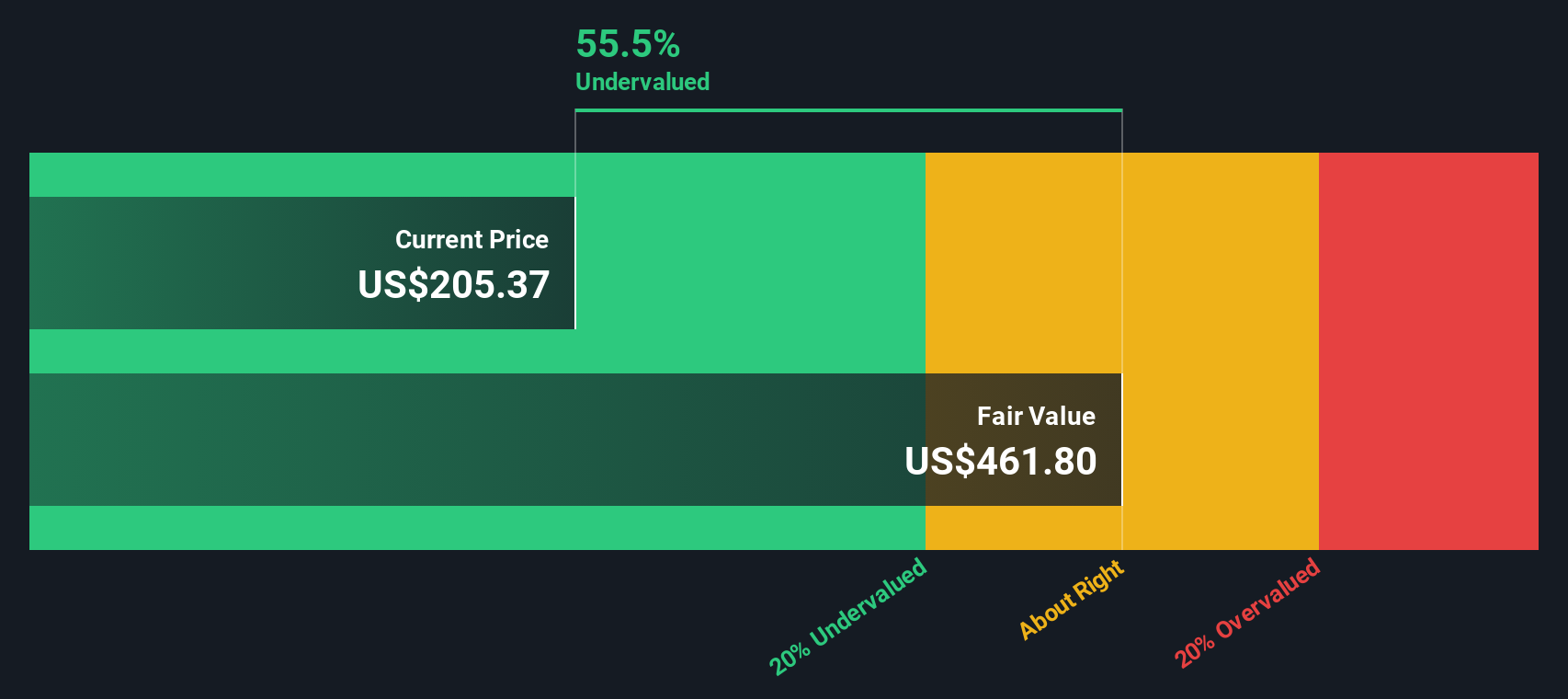

While the market sees Cardinal Health as expensive based on earnings multiples, our DCF model gives a much more bullish result. The SWS DCF model values the shares at $461.80, which is over twice the current price and points to a sizable undervaluation if the model's forward assumptions hold up.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cardinal Health Narrative

If you have a different perspective or want to dig into the numbers yourself, you can shape your own conclusions in just a few minutes. Do it your way

A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity? Unlock more potential winners today with these carefully curated stock lists. They could reveal tomorrow’s leaders, industry disruptors, or hidden gems you do not want to miss.

- Supercharge your search for the next market breakthrough by checking out these 26 AI penny stocks at the forefront of artificial intelligence innovation.

- Harness the power of steady returns by seeking out these 14 dividend stocks with yields > 3% offering consistent yields and resilient financial health.

- Tap into advanced technology trends and see which companies are pushing boundaries within these 26 quantum computing stocks for quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAH

Cardinal Health

Operates as a healthcare services and products company in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success