- United States

- /

- Healthcare Services

- /

- NYSE:CAH

Cardinal Health (CAH): Assessing Valuation Following Strong Earnings Growth and Ongoing Buybacks

Reviewed by Simply Wall St

Cardinal Health reported its latest quarterly earnings, delivering double-digit jumps in both revenue and net income compared to a year ago. The company also continued its share repurchase efforts during the quarter.

See our latest analysis for Cardinal Health.

Momentum has been building quickly for Cardinal Health, with the stock achieving a 1-day share price return of 15.43% after robust earnings and a major buyback update. This achievement marks the culmination of a strong run, as total shareholder return stands at 77.45% over the past year and an impressive 306.36% for investors who have held the stock for five years.

If recent gains have you curious about what else might be taking off, why not broaden your radar and discover See the full list for free.

The recent surge has many investors wondering if Cardinal Health stock is poised for even more upside, or if the current price already factors in all the good news and anticipated growth. Is there still a compelling opportunity here, or are future gains fully priced in?

Most Popular Narrative: 0% Overvalued

The most widely tracked narrative pegs Cardinal Health’s fair value nearly in line with the last closing price, setting the backdrop for a tense debate over the true drivers of the company’s current valuation.

Efficiency gains from automation and portfolio optimization are expected to improve margins, cash flow, and profit resilience amid ongoing healthcare industry changes.

Want to know the hidden levers powering this valuation? One small projection about future profitability flips the script. Curious what growth number analysts are betting on to justify today’s price tag? Find out exactly which financial swing could tip this fair value higher or lower, only in the full narrative.

Result: Fair Value of $189.36 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unforeseen regulatory changes or intensified competition could quickly challenge bullish assumptions and lead to a reassessment of Cardinal Health’s growth outlook.

Find out about the key risks to this Cardinal Health narrative.

Another View: The Market's Multiple Tells a Different Story

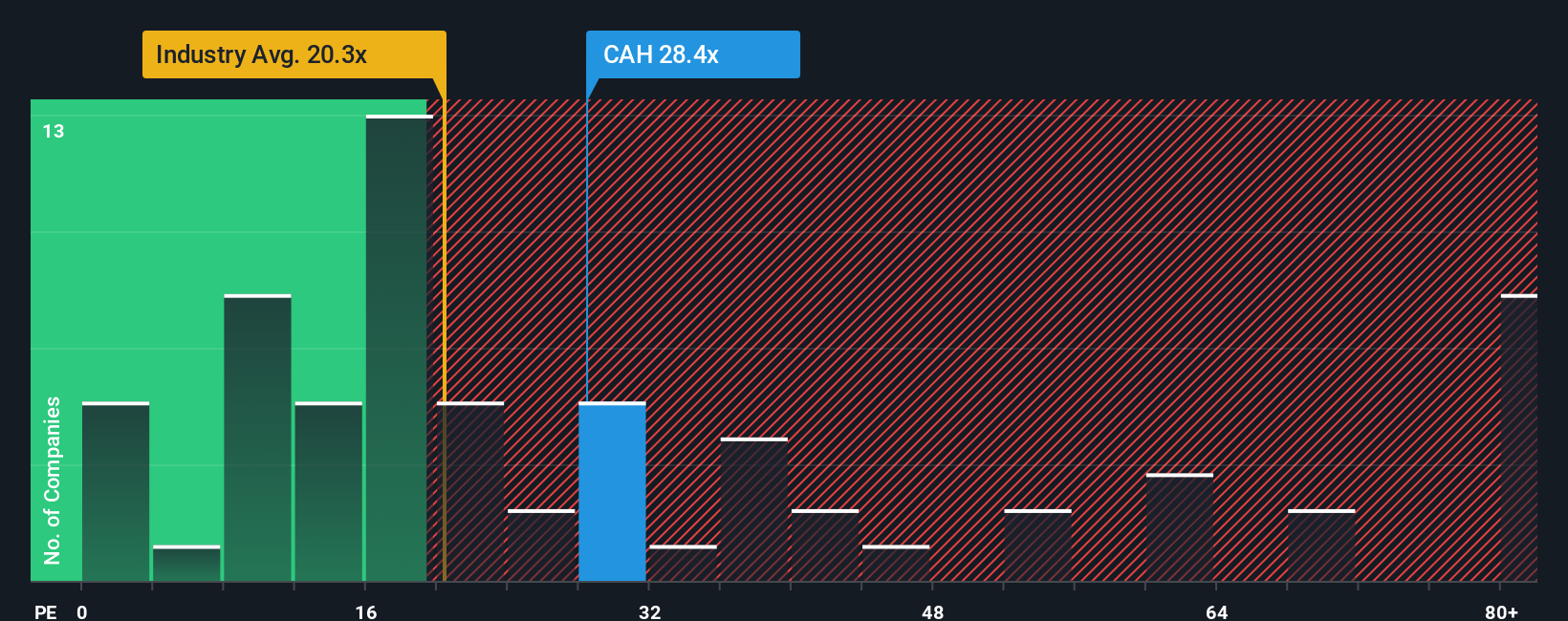

Looking at how Cardinal Health is valued versus its sector, the company's price-to-earnings ratio stands out at 28.9x. This is notably higher than both the US Healthcare industry average of 21.9x and its peer group average of 25.8x, as well as above the fair ratio estimate of 25.1x. In practical terms, this gap points to a higher valuation risk if the market shifts toward more typical pricing. Is the premium justified, or could it signal downside ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cardinal Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cardinal Health Narrative

Prefer to chart your own course? You can dive into the data and assemble your personal take on Cardinal Health's value story, all in just a few minutes. Do it your way

A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let the next breakthrough opportunity pass you by. Step confidently into new markets and strategies with these top picks just waiting to be uncovered:

- Boost your portfolio’s long-term income by targeting high-yield opportunities through these 24 dividend stocks with yields > 3%.

- Get ahead of the curve in artificial intelligence by zeroing in on innovative companies via these 26 AI penny stocks.

- Capitalize on mispriced gems ready for a potential bounce by checking out these 848 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAH

Cardinal Health

Operates as a healthcare services and products company in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives