- United States

- /

- Medical Equipment

- /

- NYSE:BSX

Markets React to Boston Scientific Device Milestones Amid Continued Share Price Surge

Reviewed by Bailey Pemberton

Thinking about adding Boston Scientific to your portfolio, trimming your position, or just watching from the sidelines? You are not alone, as this medical technology leader has caught plenty of attention after another stretch of steady share price gains. Over the past year, Boston Scientific stock rallied an impressive 20.8%, and it has surged nearly 200% over the past five years. Just in the last month, the shares climbed 4.3%, hinting that the market still sees reasons for optimism, or perhaps some new risks being priced in.

Recent news has centered on the company’s progress with several innovative cardiac and neurological devices earning regulatory milestones, building on its long-term reputation as a medtech innovator. While these developments have not delivered any single dramatic jump, they have reinforced confidence from investors in Boston Scientific’s ability to invest, execute, and grow, especially as healthcare technology demand rises globally.

When it comes to valuation, however, things get interesting. If you are looking for a simple value play, know that Boston Scientific is currently flagged as undervalued in only 1 out of 6 common checks, giving it a modest value score of 1. So is the stock a bargain, or merely priced for perfection given those growth prospects?

Let’s break down the usual valuation playbook, and then look at a smarter, more holistic way to think about what Boston Scientific is really worth.

Boston Scientific scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Boston Scientific Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the present value of a company by projecting its future cash flows and discounting them back to today. Essentially, it asks: what are all of Boston Scientific's expected future Free Cash Flows really worth in today's dollars?

According to the latest data, Boston Scientific is currently generating approximately $3.48 billion in Free Cash Flow (FCF) each year. Analysts provide concrete forecasts for FCF growth for the next five years, with projections for the subsequent years extrapolated by Simply Wall St. By 2027, the company is expected to generate around $4.46 billion in FCF. The ten-year outlook rises to approximately $8.11 billion, suggesting a robust growth trajectory over the next decade.

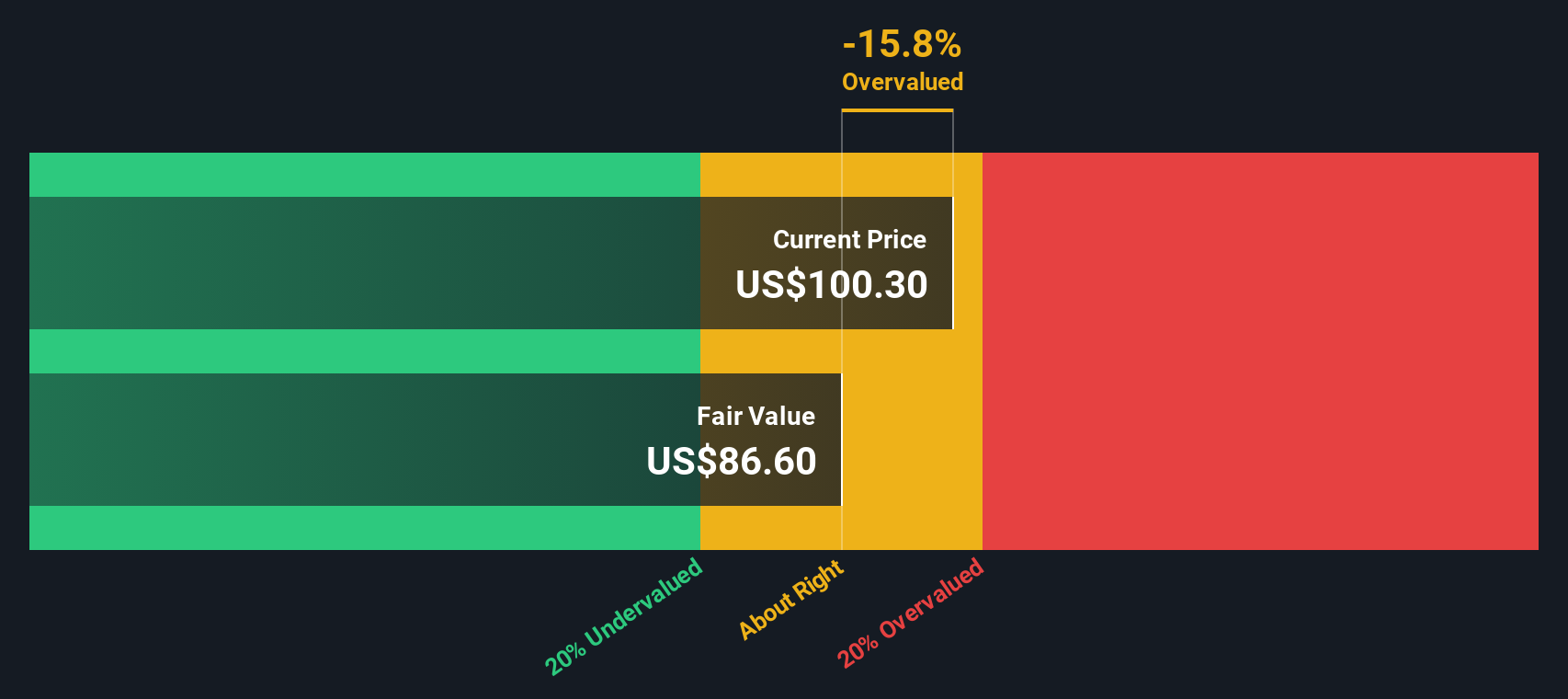

After discounting these cash flows back to the present, the DCF model estimates Boston Scientific’s intrinsic fair value at $86.62 per share. However, based on this methodology, the stock is currently trading at an 18.2% premium to its fair value. This suggests the market is already pricing in a strong future, which leaves little margin for error.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boston Scientific may be overvalued by 18.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Boston Scientific Price vs Earnings

For profitable companies like Boston Scientific, the Price-to-Earnings (PE) ratio is a widely accepted measure for judging whether a stock is sensibly priced. The PE ratio compares the company’s current share price to its earnings per share, making it a quick gauge of how much investors are willing to pay for each dollar of profit. In general, higher growth expectations justify a higher PE ratio, while greater risk or slower growth should pull it lower.

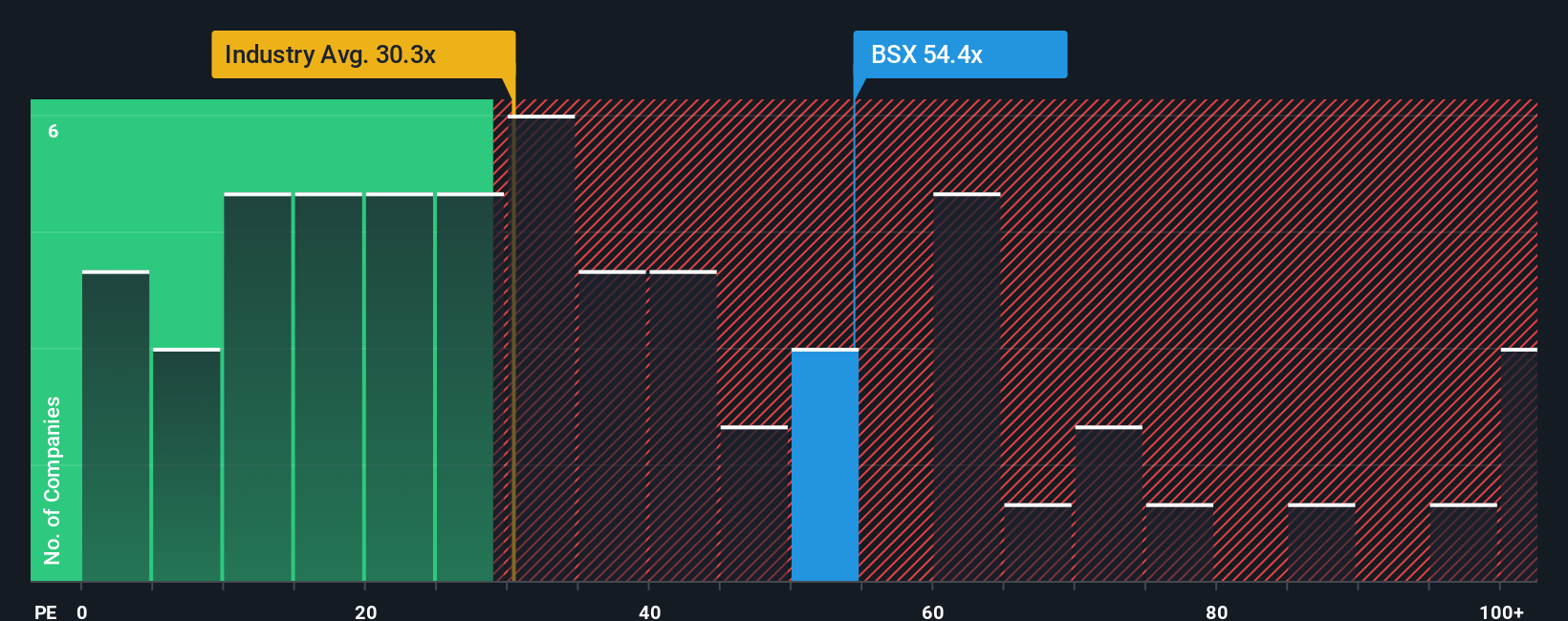

Boston Scientific is currently trading at a PE ratio of 54.4x. When compared to the average PE ratio in the wider Medical Equipment industry of 28.9x and a peer average of 40.9x, the market is clearly assigning Boston Scientific a premium for its growth profile and recent performance. However, relying solely on these broad averages can be misleading because they do not consider company-specific factors that affect fair value.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. The Fair Ratio is designed to reflect what a company’s multiple should be, factoring in not just its industry and size, but also its profit margins, earnings growth, and unique risks. For Boston Scientific, the Fair Ratio is estimated at 35.6x. This is meaningfully lower than its current 54.4x PE, indicating investors may be paying a steep premium at current prices.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Boston Scientific Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story about a company. It gives meaning to the numbers by connecting your views on Boston Scientific’s business prospects to things like future revenue, earnings, and profit margins, and then calculates what you think the fair value should be.

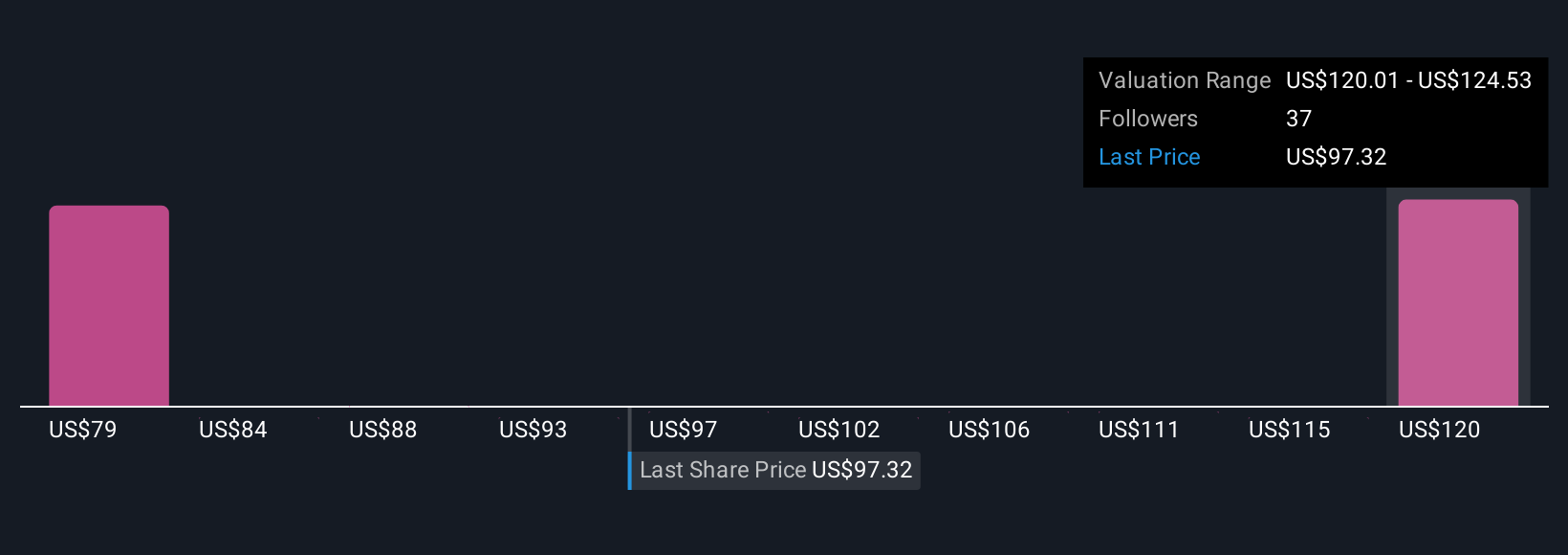

Narratives link a company’s story, its financial forecasts, and a resulting fair value so you can see how your assumptions translate into a buy, hold, or sell decision. Simply Wall St makes this tool accessible for everyone on its Community page, where millions of investors can easily input their views and immediately see a personalized fair value estimate.

With Narratives, your decision-making becomes more dynamic and actionable. They are automatically updated as new information arrives, such as earnings releases or major news. This means you can always compare your fair value to the current share price and decide if it’s time to buy, hold, or sell based on your latest outlook.

For example, some bullish investors might see Boston Scientific justifying a fair value of $140 per share, while more cautious ones may see as little as $99 per share, proving that different stories and assumptions lead to very different conclusions.

Do you think there's more to the story for Boston Scientific? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives