- United States

- /

- Medical Equipment

- /

- NYSE:BSX

Is Boston Scientific’s Recent Regulatory Wins Enough to Support Its Rising Share Price?

Reviewed by Bailey Pemberton

- Wondering if Boston Scientific is a hidden value pick, an overrated star, or something in between? You are in the right place for a straightforward take on what the numbers are really saying.

- The stock has caught attention lately, surging 5.3% in the last week and boasting gains of 17.3% over the past year. This adds to an impressive 203.9% five-year run.

- This momentum follows news of new regulatory approvals for key products and fresh partnership announcements. Both developments have investors optimistic about Boston Scientific’s growth prospects. The company’s recent expansion into new markets has also been a talking point among analysts tracking healthcare innovation.

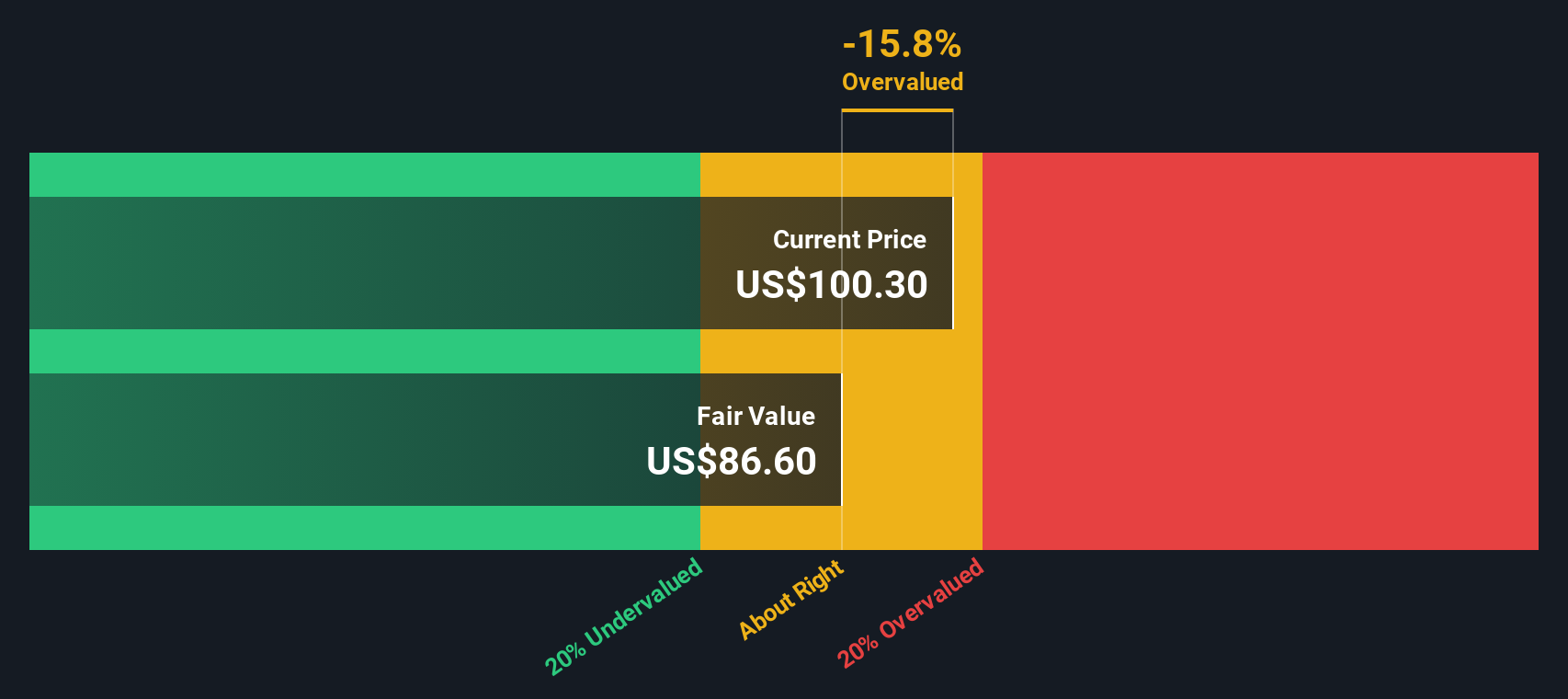

- Even with this positive backdrop, Boston Scientific scores just 1/6 on our value checks for being undervalued, so there is more to uncover about how it is currently priced. Let’s break down the valuation methods typically used for stocks like Boston Scientific and explore what these approaches might be missing.

Boston Scientific scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Boston Scientific Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to their present value. This approach tries to answer the question: what are Boston Scientific’s future cash flows worth in today’s dollars?

Boston Scientific's reported Free Cash Flow over the last twelve months was $3.77 billion. Analysts provide growth forecasts for the next five years and, beyond that point, Simply Wall St extrapolates further expectations. For example, projected Free Cash Flow reaches $6.26 billion in 2035, showing persistent growth year over year according to these forecasts. Notably, analyst-driven projections suggest a jump to $4.46 billion by 2027, with more modest, extrapolated gains in the following years.

Based on this two-stage Free Cash Flow to Equity DCF model, the estimated intrinsic value per share is $66.94. However, comparing this to Boston Scientific’s current share price reveals a significant disconnect; the DCF suggests the stock is about 55.6% overvalued at today's pricing.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boston Scientific may be overvalued by 55.6%. Discover 865 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Boston Scientific Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Boston Scientific. It helps investors gauge how much they are paying for each dollar of the company’s earnings, making it especially useful for businesses with steady profits.

Growth expectations and risk can greatly influence what is considered a “normal” or “fair” PE ratio. Companies with strong growth forecasts or lower perceived risks often trade at higher PE multiples. Those with uncertain outlooks or more volatility tend to have lower ratios.

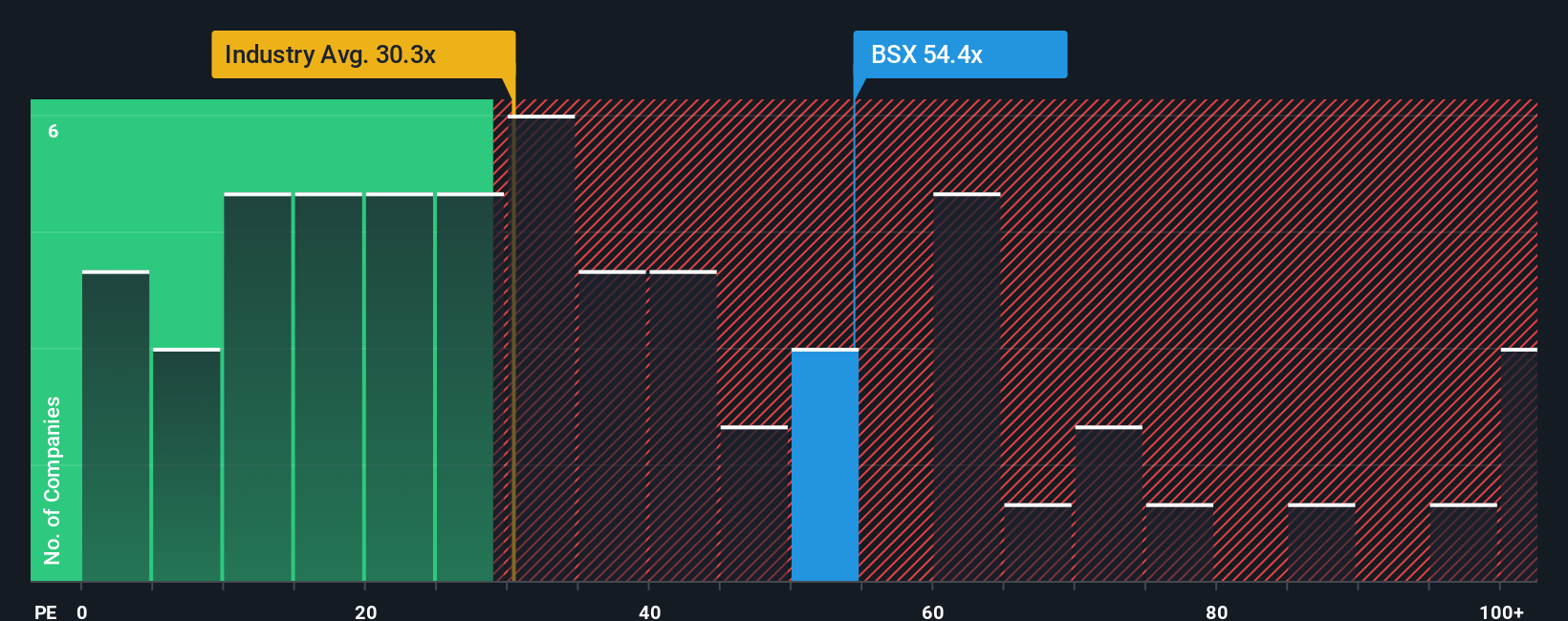

Boston Scientific currently trades on a PE ratio of 55.3x. For context, this is well above the Medical Equipment industry average of 28.1x, and also higher than the average of its closest peers at 41.0x. This suggests the market is pricing in faster growth or lower risk for Boston Scientific compared to its sector and peers.

To provide more tailored context, Simply Wall St’s “Fair Ratio” estimates what PE multiple is justified for Boston Scientific right now by factoring in elements like earnings growth, profit margins, industry standards, company size, and business risks. This approach is more precise than simply looking at peers or the industry because companies often have unique strengths or challenges that averages can miss.

Boston Scientific’s Fair Ratio is calculated at 38.9x. With the actual PE at 55.3x, the stock is significantly above its Fair Ratio, suggesting it is overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1370 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Boston Scientific Narrative

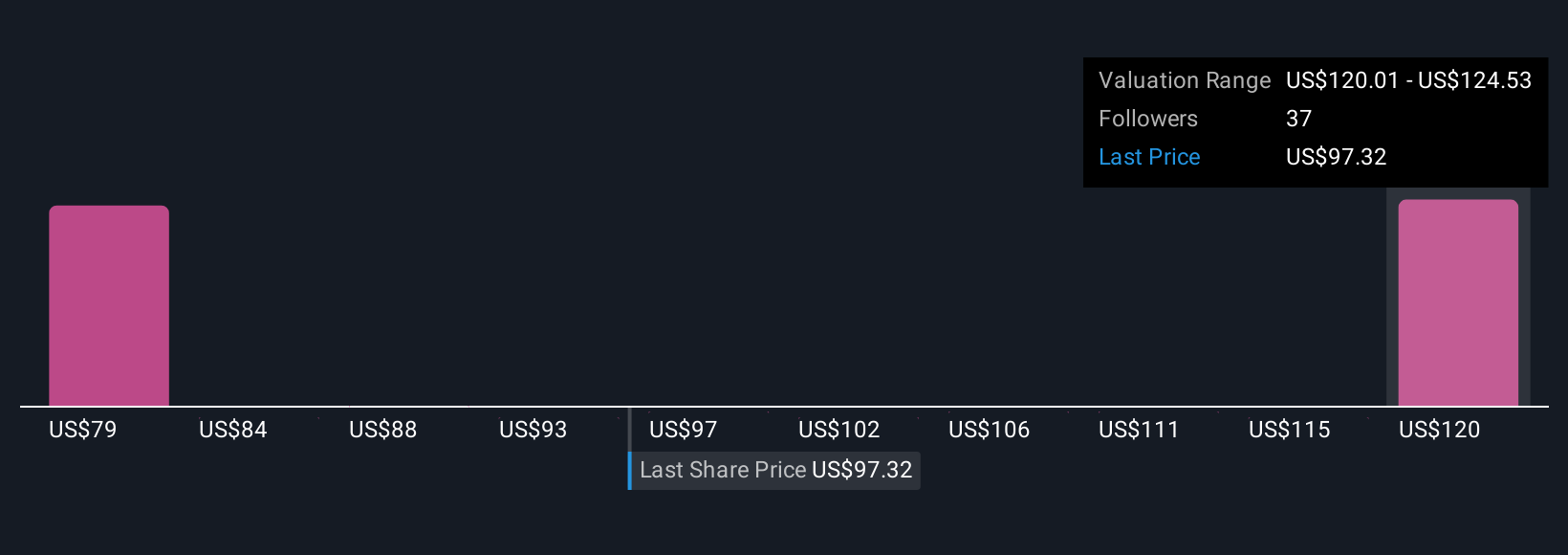

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your personalized investment story that ties together your perspective on Boston Scientific’s future, including how you think revenue, earnings, and profit margins will evolve, with a fair value that reflects your own assumptions and reasoning.

Narratives link the company's story, such as new product launches or regulatory risks, with financial forecasts and a calculated fair value. This connection makes investment decisions more meaningful and actionable. This tool is available to everyone on Simply Wall St’s platform, right within the Community page used by millions of investors.

With Narratives, you can instantly see whether Boston Scientific’s current price is attractive based on your scenario. This can help you decide when it might be time to buy or sell. Narratives are automatically refreshed as soon as new news or earnings are released, ensuring your view stays current and relevant.

For example, two investors might review Boston Scientific. One, seeing upside from acquisitions and innovation, might forecast earnings of $4.8 billion by 2028 and a fair value near $140 per share. Another, focused on margin risks and competitive threats, could estimate just $3.6 billion in 2028 earnings and a fair value closer to $99 per share.

Do you think there's more to the story for Boston Scientific? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives