- United States

- /

- Medical Equipment

- /

- NYSE:BSX

How Investors May Respond To Boston Scientific (BSX) Securing Exclusive U.S. and Japan Rights for Siemens Catheter

Reviewed by Sasha Jovanovic

- Boston Scientific recently announced a catheter development and commercialization agreement with Siemens Healthineers for the AcuNav 4D intracardiac echocardiography catheter, granting Boston Scientific exclusive distribution rights in the U.S. and Japan.

- This partnership is expected to support key Boston Scientific platforms such as Watchman and Farapulse by expanding procedural adoption and enhancing workflow efficiency.

- We'll examine how the Siemens Healthineers distribution agreement could influence Boston Scientific's growth narrative and product expansion strategies.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Boston Scientific Investment Narrative Recap

To be a shareholder in Boston Scientific, you need to believe in the company’s ability to deliver above-market growth by driving adoption of advanced therapies like FARAPULSE and WATCHMAN, while countering rising cost pressures and regulatory uncertainties. The Siemens Healthineers agreement aligns with efforts to expand procedural platforms, but unless this partnership demonstrably accelerates adoption or offsets tariff and reimbursement headwinds, its impact on short-term catalysts or risks may not be material just yet.

Among recent announcements, the FDA approval of FARAPULSE for atrial fibrillation treatment stands out as a key catalyst that directly supports Boston Scientific’s growth thesis, especially as the Siemens Healthineers partnership is expected to broaden procedural uptake for this platform. Expanding product offerings and clinical adoption are crucial to counterbalance ongoing cost challenges and regulatory pressures, which remain significant risks in the near term.

On the other hand, with increased innovation comes greater reliance on successful integration and execution, a factor investors should consider...

Read the full narrative on Boston Scientific (it's free!)

Boston Scientific's narrative projects $25.4 billion revenue and $4.8 billion earnings by 2028. This requires 11.1% yearly revenue growth and a $2.3 billion earnings increase from $2.5 billion today.

Uncover how Boston Scientific's forecasts yield a $126.48 fair value, a 24% upside to its current price.

Exploring Other Perspectives

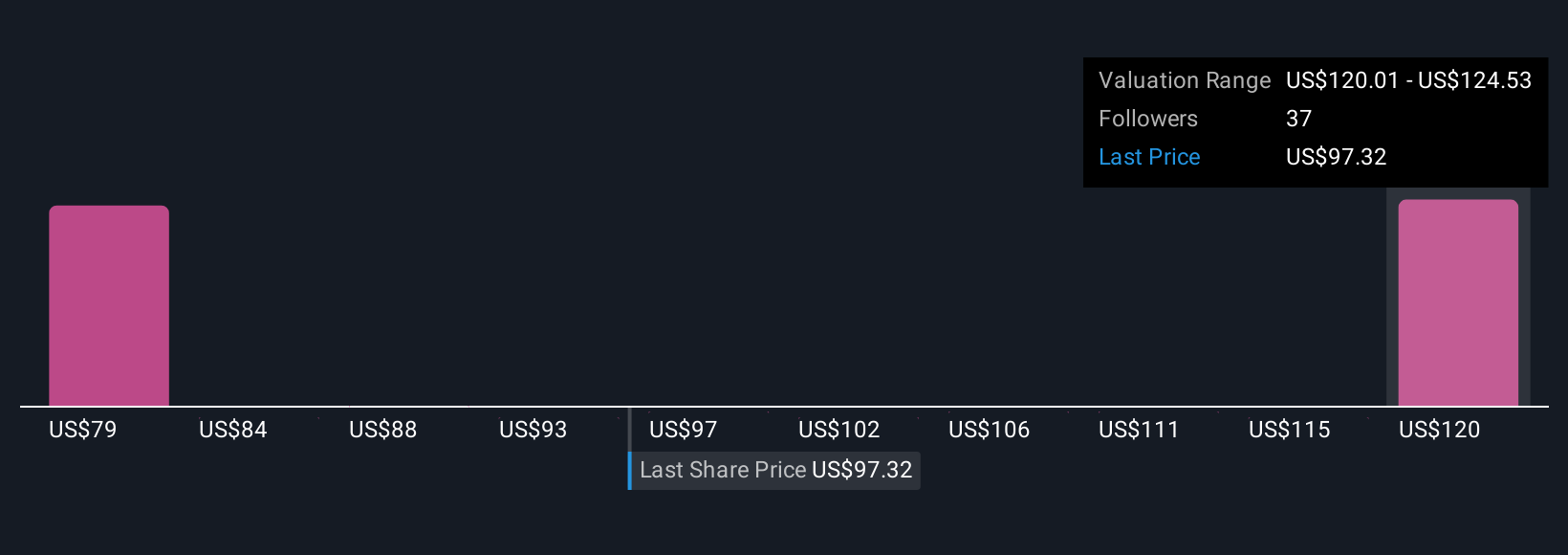

Fair value estimates from seven members of the Simply Wall St Community span from US$67.33 to US$126.48 per share, showing sharply different views on the company's outlook. With ongoing regulatory and cost risks highlighted by analysts, exploring several alternative viewpoints is essential before making up your mind.

Explore 7 other fair value estimates on Boston Scientific - why the stock might be worth 34% less than the current price!

Build Your Own Boston Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boston Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boston Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boston Scientific's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives