- United States

- /

- Medical Equipment

- /

- NYSE:BSX

Boston Scientific (BSX) Profit Margin Improvement Challenges Bearish Narratives on Growth Sustainability

Reviewed by Simply Wall St

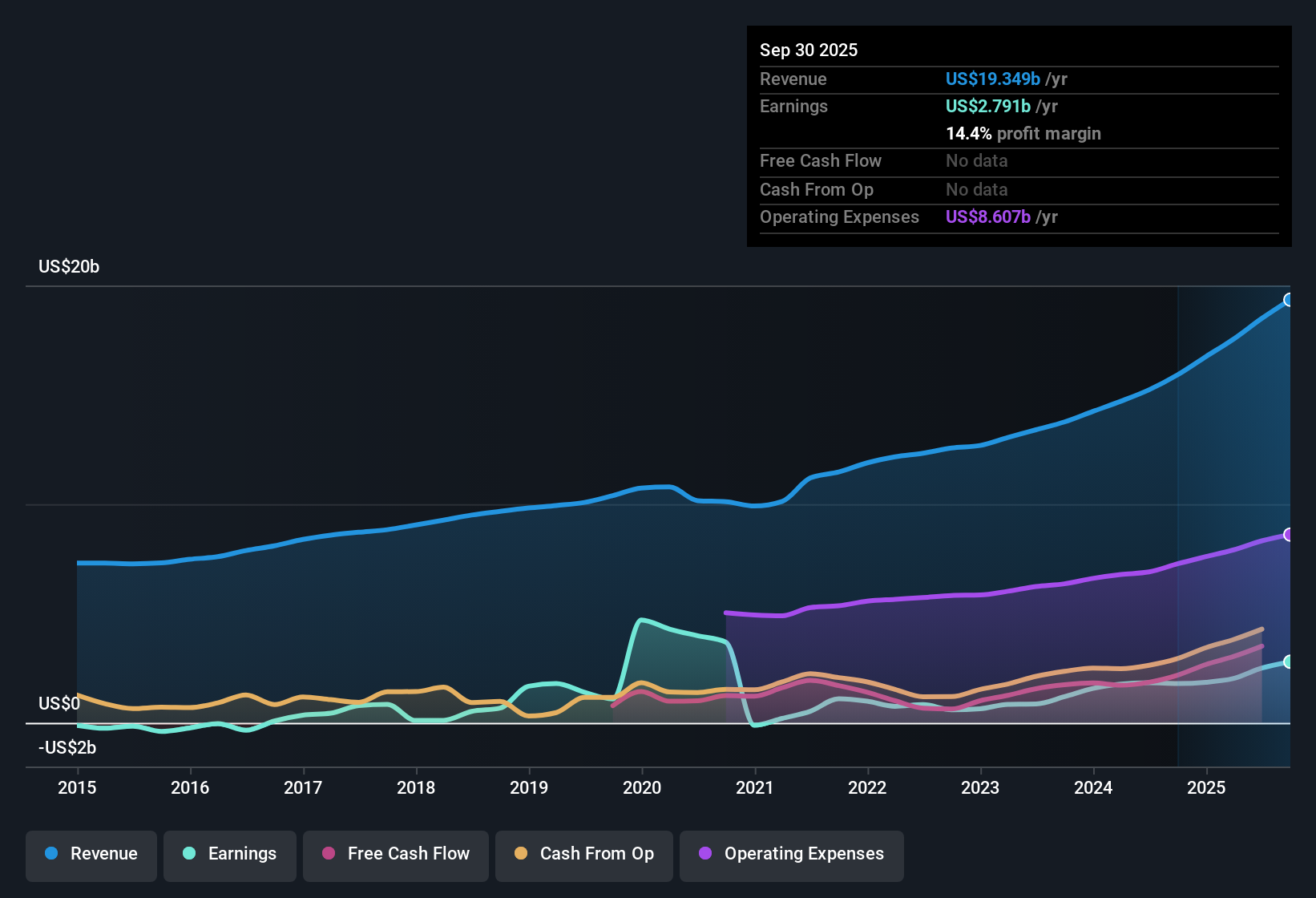

Boston Scientific (BSX) delivered a net profit margin of 14.4%, an improvement over last year’s 11.3%, and achieved earnings growth of 55.7% year-over-year compared to its five-year average of 20.9% per year. Shares currently trade at $102.39, well above the estimated fair value of $87.13, with a Price-To-Earnings ratio of 54.4x that outpaces both peer and industry averages. While the company is forecast to grow revenue and earnings at solid rates in line with or ahead of the US market, its premium valuation and lack of a notably strong financial flag give investors plenty to consider as they interpret the latest results.

See our full analysis for Boston Scientific.Next, we put these headline results into perspective by comparing them with the market narratives to see where the current story holds true and where it might be challenged.

See what the community is saying about Boston Scientific

Profit Margin Expected to Rise to 18.7%

- Analysts estimate that Boston Scientific's profit margin will climb from the current 14.4% to 18.7% within three years, marking a meaningful jump in profitability beyond today’s levels.

- According to analysts' consensus view, ongoing efficiency drives and a growing mix of high-value therapies are seen as levers for margin expansion,

- Synergies from recent acquisitions and global expansion, especially in Asia Pacific, are expected to support these gains.

- However, persistent cost pressures, including new tariffs forecast to cost $100 million in 2025, may limit how much margin can actually be realized.

- What stands out about these projections is how they depend on execution. If Boston Scientific fails to integrate its acquisitions or sees costs exceed forecasts, anticipated margin gains could fall short.

- If you want to see just how these mixed signals, such as rising efficiency but possible cost headwinds, play out in analysts' broader view, the full consensus narrative is a must-read. 📊 Read the full Boston Scientific Consensus Narrative.

Advanced Therapies Fuel Market Reach

- Boston Scientific’s addressable market is expanding due largely to the adoption of disruptive therapies like FARAPULSE and WATCHMAN, both of which are supported by strong clinical trends and physician uptake, especially in key global markets.

- Consensus narrative notes that, by scaling up these next-generation offerings and broadening their presence in ambulatory surgery centers,

- The company has the potential to generate recurring revenue and offset possible slowdowns in traditional regions through double-digit growth in Asia Pacific.

- Regulatory changes and greater capacity in minimally invasive procedures are direct catalysts for recurring revenue streams going forward.

Premium Valuation Outpaces Peers and Industry

- Boston Scientific’s current Price-To-Earnings ratio is 54.4x, running well above the peer average of 40.8x and the US medical equipment industry’s 30.2x benchmark. The share price of $102.39 remains about 17% below the analyst target of $126.14.

- Analysts' consensus view highlights that, for this premium to hold up, investors will need to believe that Boston Scientific will deliver $4.8 billion in earnings on $25.4 billion in 2028 revenue and maintain a future P/E of 49.1x, which is still higher than today’s industry average.

- Despite the valuation stretch, ongoing innovation and growing market share give some credibility to these expectations, but show little margin for error if growth projections are missed.

- DCF fair value is $87.13, placing the current price at a substantial premium, which could heighten sensitivity to any stumbles in growth or profitability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Boston Scientific on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the numbers tell a different story to you? Share your point of view in just a few minutes and shape the conversation: Do it your way

A great starting point for your Boston Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Boston Scientific’s lofty valuation and dependence on margin expansion leave little room for error if growth targets are missed or profitability falls short.

If you’re looking for opportunities trading closer to intrinsic value, consider these 876 undervalued stocks based on cash flows to identify companies where market optimism has not already driven prices to a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives