- United States

- /

- Medical Equipment

- /

- NYSE:BSX

Boston Scientific (BSX): Assessing Fair Value After Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for Boston Scientific.

Despite some short-term pullback, Boston Scientific has delivered a strong year, with its share price up close to 10% year-to-date and a total shareholder return of nearly 10% over the past twelve months. Momentum has cooled from earlier highs; however, long-term performance remains impressive, thanks to consistent growth and positive investor sentiment.

If medtech's volatility has you searching for new ideas, take the next step and discover See the full list for free.

With Boston Scientific’s solid growth and recent price softness, investors must ask if current valuations reflect future upside or if the stock’s reputation for resilience makes now a genuine buying opportunity.

Most Popular Narrative: 22.5% Undervalued

Boston Scientific’s most widely followed narrative signals a fair value estimate of $126.48, which stands well above the most recent close at $98.04. This discrepancy puts a spotlight on some ambitious forecasts that drive the current optimism, setting the stage for the analyst view below.

"Investment in proprietary, high-margin technologies (e.g., next-gen mapping, advanced diagnostic tools, differentiated urology/neuromodulation pipelines) combined with successful integration of recent acquisitions (Axonics, SoniVie, Intera, Silk Road) expands Boston Scientific's addressable market and is likely to drive margin expansion as product mix improves."

Want to know what’s fueling this high-conviction price target? The market is factoring in future growth, bigger margins, and a leap in profitability. The tension is whether Boston Scientific can really deliver on these bold expectations. Find out which aggressive assumptions about the next few years shape this striking valuation.

Result: Fair Value of $126.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost headwinds and tough competition in key markets could quickly undermine Boston Scientific’s upbeat outlook if these challenges intensify.

Find out about the key risks to this Boston Scientific narrative.

Another View: High Market Valuation Signals Caution

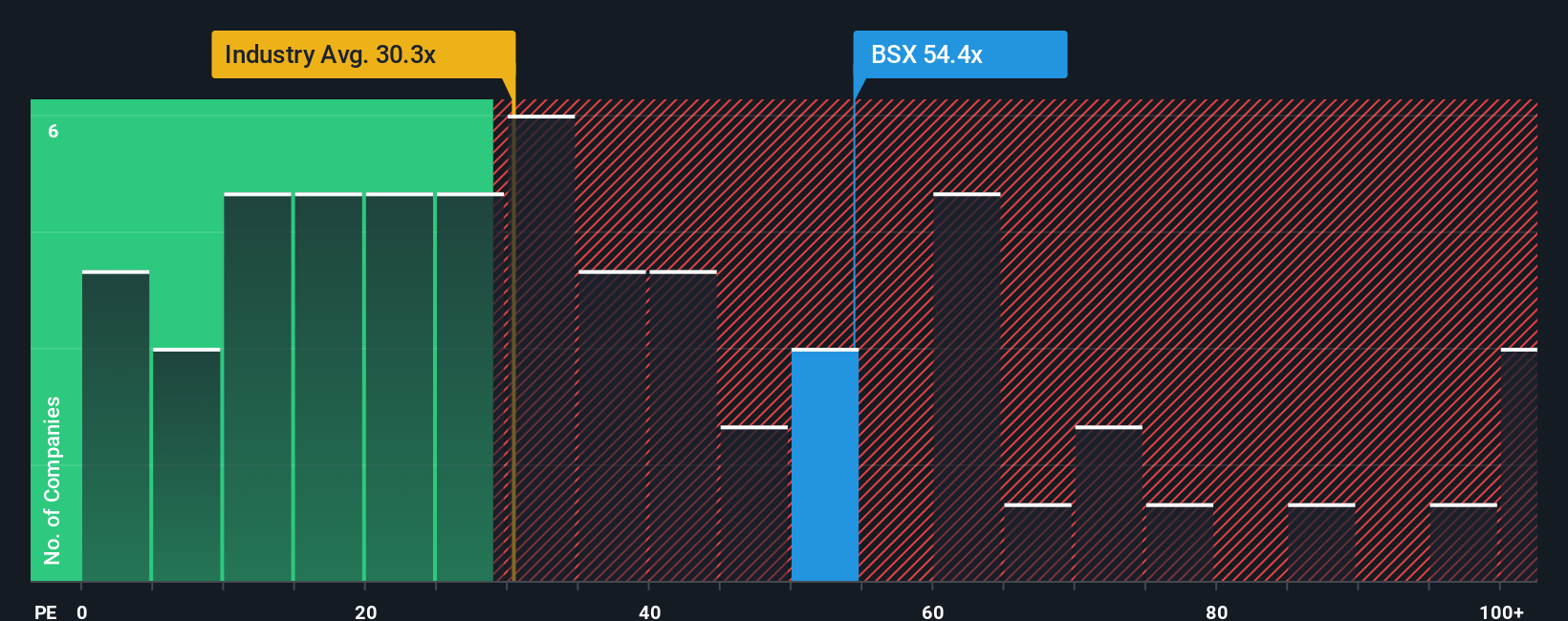

While the consensus suggests Boston Scientific is undervalued, looking at its price-to-earnings ratio paints a different picture. The stock trades at 52.1 times earnings, which is considerably higher than both the US Medical Equipment industry average of 28.2x and its own fair ratio of 38.6x. This sizable gap could mean valuation risk if expectations are not met. Is the market's premium truly justified, or could a shift in sentiment change the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boston Scientific Narrative

If you see the numbers differently or would rather dig into the data on your own, you can quickly craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Boston Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Every smart investor knows that opportunities move fast. Don’t limit yourself; expand your strategy and uncover stocks with untapped potential using these top screeners:

- Boost your long-term returns and secure steady income as you evaluate these 14 dividend stocks with yields > 3% offering yields above 3%.

- Tap into breakthroughs in medicine and artificial intelligence by reviewing these 30 healthcare AI stocks on the cutting edge of healthcare innovation.

- Spot undervalued opportunities and position yourself ahead of the market through these 918 undervalued stocks based on cash flows before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success