- United States

- /

- Medical Equipment

- /

- NYSE:BLCO

Does New Preservative-Free LUMIFY Data Signal a Shift in Bausch + Lomb's (BLCO) Eyecare Strategy?

Reviewed by Simply Wall St

- Bausch + Lomb recently announced that a phase 3 clinical trial showed LUMIFY Preservative Free redness reliever eye drops are statistically non-inferior to the original LUMIFY product in reducing ocular redness, with a comparable safety profile over four weeks of use.

- This positive clinical outcome may support expanded offerings in Bausch + Lomb’s ophthalmology portfolio, highlighting innovation in preservative-free eyecare solutions for adults.

- We’ll explore how these clinical results for a preservative-free product could strengthen Bausch + Lomb’s long-term position in the eyecare market.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Bausch + Lomb's Investment Narrative?

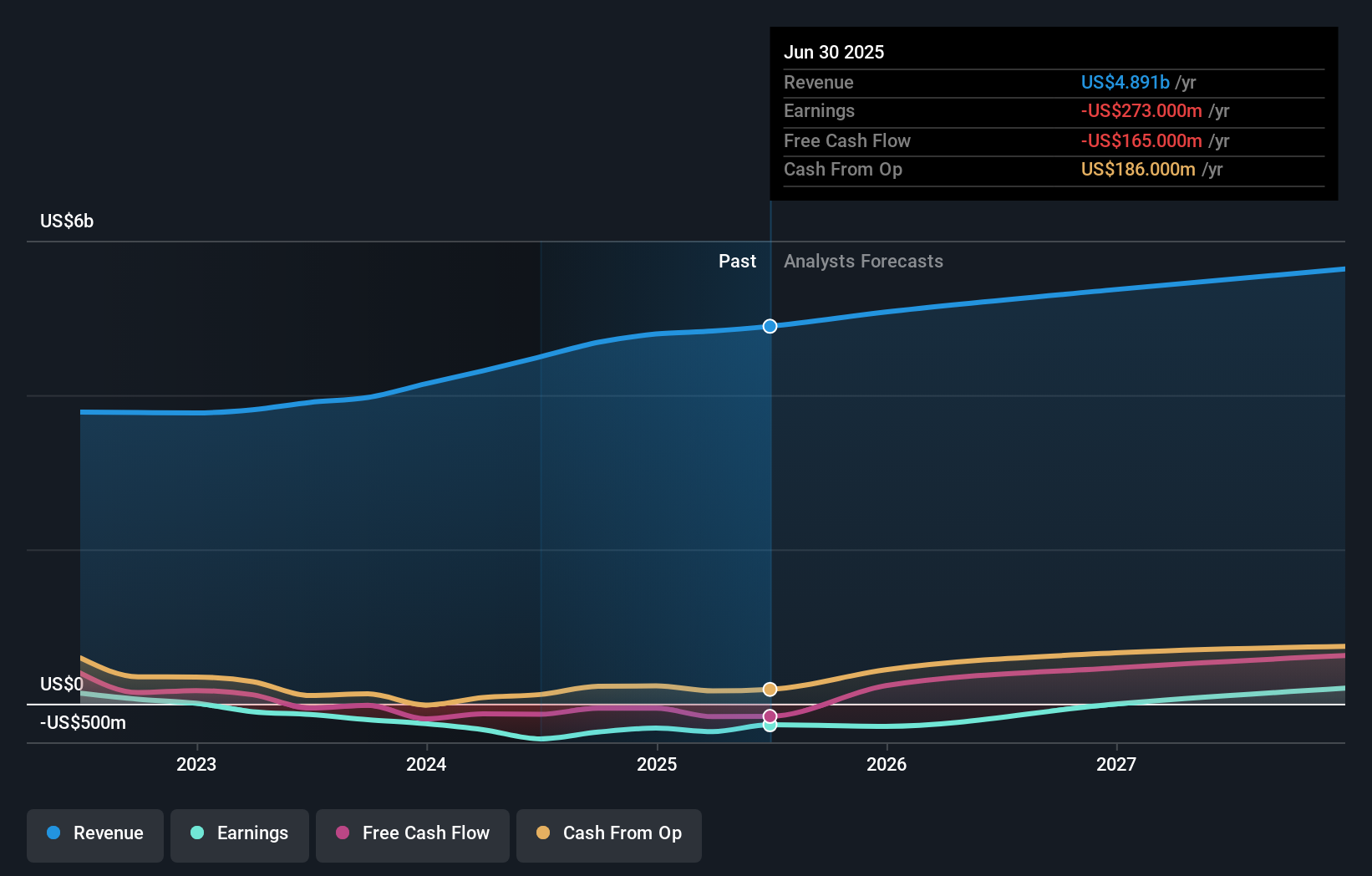

To be a Bausch + Lomb shareholder, you really have to believe in the company’s potential to turn its innovation pipeline into consistent profitability. The recent Phase 3 clinical results for LUMIFY Preservative Free eye drops add a positive, science-backed update to its growing ophthalmology portfolio and may strengthen one of the bigger short-term catalysts: accelerated growth from preservative-free offerings. Whether this is enough to materially shift the narrative for Bausch + Lomb is debatable. The company just raised revenue guidance and recently launched multiple dry eye and vision products, but it remains unprofitable and is navigating continued losses, lagging returns, and a major focus on debt refinancing. The modest rise in the share price after the clinical trial news suggests that, while the results are encouraging, the market might still see larger risks tied to turning innovation into bottom-line gains and achieving sustained industry-beating growth. On the other hand, ongoing operating losses might catch some by surprise as optimism builds.

Bausch + Lomb's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Bausch + Lomb - why the stock might be worth over 2x more than the current price!

Build Your Own Bausch + Lomb Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch + Lomb research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Bausch + Lomb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch + Lomb's overall financial health at a glance.

No Opportunity In Bausch + Lomb?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch + Lomb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLCO

Bausch + Lomb

Operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives