- United States

- /

- Medical Equipment

- /

- NYSE:BFLY

Butterfly Network (BFLY) Is Up 28.3% After Exclusive Midjourney AI Licensing Deal and Compass AI Launch Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- On November 17, 2025, Butterfly Network, Inc. announced it entered a five-year, exclusive co-development and licensing agreement with Midjourney, granting access to its semiconductor-based ultrasound technology for a US$15 million upfront payment, ongoing US$10 million annual license fees, milestone payments, and revenue sharing.

- This agreement, combined with Butterfly Network's launch of Compass AI, an artificial intelligence-powered platform designed to drastically improve point-of-care ultrasound workflow efficiency and compliance, signals a substantial acceleration in technology commercialization and enterprise software capabilities for the company.

- We'll explore how Butterfly Network’s US$15 million upfront licensing deal with Midjourney contributes to its evolving investment narrative and digital health ambitions.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Butterfly Network Investment Narrative Recap

To be a Butterfly Network shareholder, you need conviction in the company’s ability to commercialize its point-of-care ultrasound technology and shift a growing share of medical imaging workflows onto its digital and AI-powered platforms. The recent five-year, US$15 million upfront licensing agreement with Midjourney offers near-term revenue benefits, but it does not materially address Butterfly’s biggest near-term catalyst, accelerating large enterprise and medical school deals, nor does it mitigate the most pressing risk: persistent delays and slow enterprise sales cycles. Compass AI, recently launched by Butterfly, is likely the announcement most relevant to the Midjourney deal. By showcasing robust, AI-powered workflow enhancements for healthcare institutions, Compass AI may directly influence hospital and enterprise adoption, and is positioned as a catalyst for improved software subscription revenues and higher documentation compliance across client sites. However, investors should also be aware that while new partnerships and product launches may help boost revenue, the challenge of delayed sales cycles and slow enterprise deal-closing remains a real risk...

Read the full narrative on Butterfly Network (it's free!)

Butterfly Network's outlook anticipates $135.9 million in revenue and $17.0 million in earnings by 2028. Achieving this would require a 15.8% annual revenue growth rate and an earnings increase of $79.8 million from current earnings of -$62.8 million.

Uncover how Butterfly Network's forecasts yield a $3.58 fair value, a 16% upside to its current price.

Exploring Other Perspectives

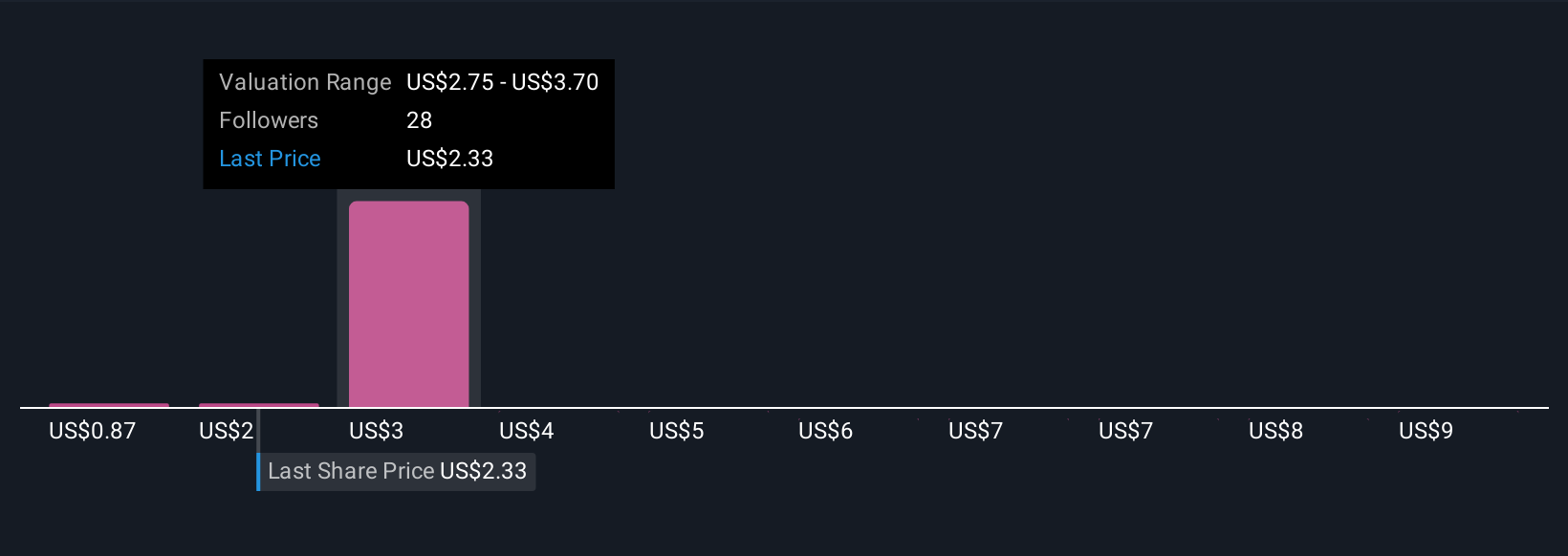

Ten fair value estimates from the Simply Wall St Community range from US$0.87 to US$10.29 per share. While enterprise deal acceleration remains the key catalyst, you may want to compare these varied views alongside your own expectations for sales momentum and revenue growth.

Explore 10 other fair value estimates on Butterfly Network - why the stock might be worth over 3x more than the current price!

Build Your Own Butterfly Network Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Butterfly Network research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Butterfly Network research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Butterfly Network's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Butterfly Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFLY

Butterfly Network

Develops, manufactures, and commercializes ultrasound imaging solutions in the United States and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success