- United States

- /

- Medical Equipment

- /

- NYSE:BDX

Becton Dickinson (BDX): Revisiting Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

Becton Dickinson (BDX) has quietly outperformed the broader healthcare space over the past 3 months, even as its share price is still down year to date, which creates an interesting setup for long term investors.

See our latest analysis for Becton Dickinson.

With the share price now around $195.59, Becton Dickinson’s 90 day share price return of 4.85% contrasts with a weak year to date share price return of minus 13.64%. Its five year total shareholder return of minus 12.32% shows that momentum is only just starting to rebuild after a long, grinding reset in expectations.

If this kind of slow turning momentum appeals to you, it is also worth exploring other quality names in the space via healthcare stocks to see what else is setting up for a similar move.

Yet with earnings still growing, a modest discount to analyst targets, and a far steeper implied discount to intrinsic value, investors face a key question: Is Becton Dickinson a mispriced compounder or already priced for its next leg of growth?

Most Popular Narrative Narrative: 3.4% Undervalued

Compared to Becton Dickinson’s last close of $195.59, the most followed narrative points to a modestly higher fair value anchored in long term fundamentals.

The fair value estimate has risen slightly to about 202.58 dollars per share from roughly 201.49 dollars, reflecting marginally stronger long term fundamentals. The future P/E has declined modestly to roughly 25.98 times from about 26.29 times, implying a small contraction in the valuation multiple applied to forward earnings.

Curious how slow revenue growth, rising margins, and a lower future earnings multiple can still support a higher fair value? Explore the full playbook behind this reset.

Result: Fair Value of $202.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade headwinds and execution risks around the 2026 business separation could derail margin expansion and dampen confidence in the reset growth story.

Find out about the key risks to this Becton Dickinson narrative.

Another Angle on Valuation

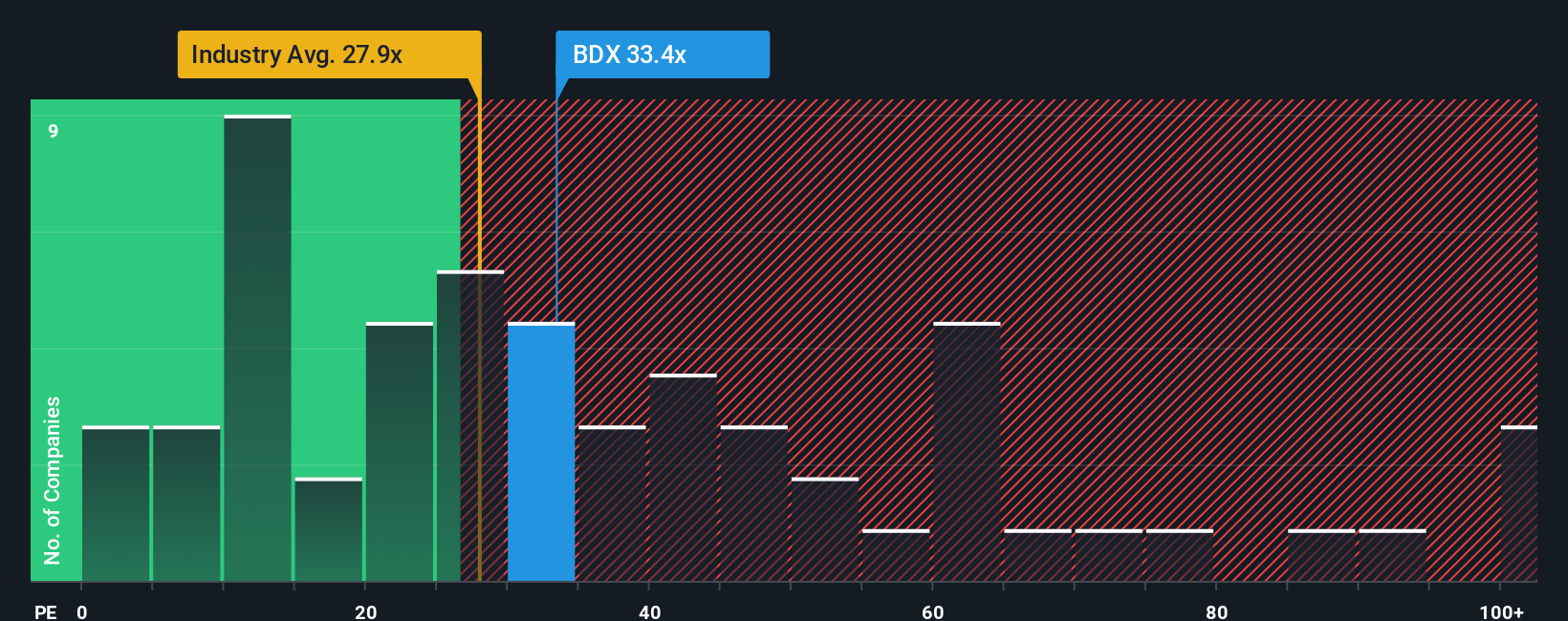

On simple earnings comparisons, Becton Dickinson does not look like a bargain, trading at about 33.2 times earnings versus a fair ratio of 32.8 times and an industry average of 29.7 times. That gap hints at limited margin of safety. What, then, is the market paying up for in this case?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Becton Dickinson Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Becton Dickinson research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover stocks that match your strategy before the market fully catches on.

- Capitalize on potential mispricings by reviewing these 914 undervalued stocks based on cash flows that strong cash flow analysis suggests the market is overlooking.

- Position yourself early in the next tech shift by targeting these 24 AI penny stocks shaping automation, analytics, and intelligent products.

- Lock in dependable cash returns by scanning these 12 dividend stocks with yields > 3% that can support long term income goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion