- United States

- /

- Medical Equipment

- /

- NYSE:BDX

Becton Dickinson (BDX) Margin Decline Reinforces Bearish Revenue Growth Narrative in FY2025

Reviewed by Simply Wall St

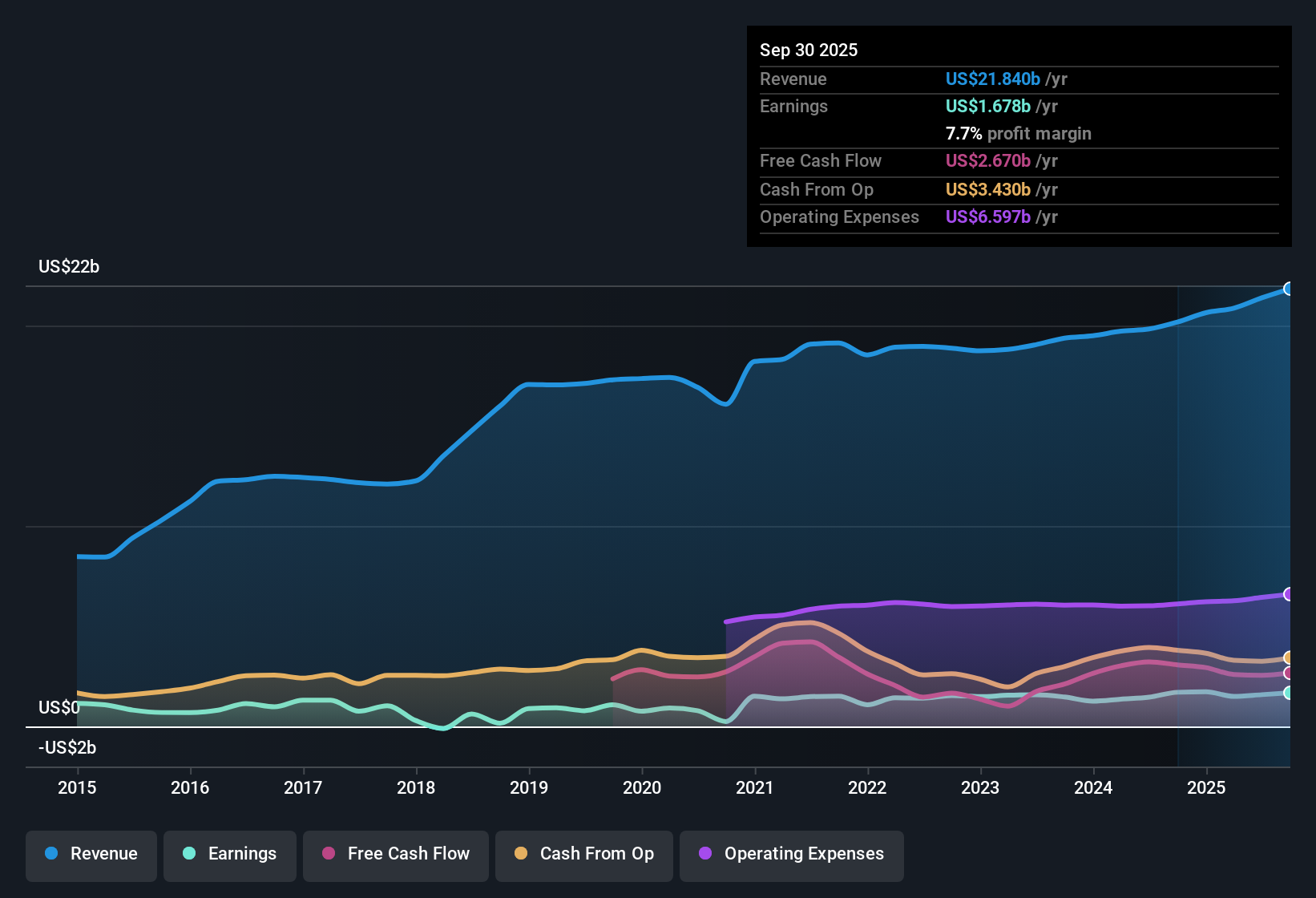

Becton Dickinson (BDX) just posted its FY 2025 Q4 results, turning in revenue of $5.9 billion and net income of $493 million, with EPS at $1.72. Over the past year, the company has seen revenue climb from $20.2 billion to $21.8 billion, an increase of 2.9%, while EPS for the trailing twelve months stands at $5.83. Margins compressed during the period due to a one-off loss and continued pressure on net profits, giving investors plenty to weigh as they digest the latest headline results.

See our full analysis for Becton Dickinson.Now that we have the headline numbers in hand, it is time to put them to the test against the prevailing market story. Let’s see where the facts back up expectations and where they might trigger a rethink.

See what the community is saying about Becton Dickinson

Margin Pressure from One-Off Loss

- Becton Dickinson’s net profit margin slipped to 7.7% for the past twelve months, down from 8.4% the year before. This shift was driven in part by a sizable $1.3 billion non-recurring loss that impacted headline earnings quality.

- According to the consensus narrative, analysts acknowledge the margin compression but believe that operational efficiency gains and business transformation initiatives are expected to enhance future margins and stabilize cash flow.

- Analysts expect profit margins to rise from 7.4% today to 11.3% by 2028, despite near-term weakness.

- The consensus view suggests that while the loss weighs on recent results, the company’s long-term plans are designed to generate improvement over the next few years.

- Consensus narrative notes that innovative product launches and business transformation could offset margin pressure and support future gains.

📊 Read the full Becton Dickinson Consensus Narrative.

Valuation Discount versus DCF Fair Value

- Shares currently trade at $193.90, which is around 39.8% below the DCF fair value estimate of $322.28, despite a relatively high price-to-earnings ratio of 33x compared to the industry.

- The consensus narrative points out that even with compressed margins and muted recent top-line growth, Becton Dickinson’s valuation now sits at a notable discount. The share price remains in line with peers but is below fair value on a cash flow basis.

- This discount may make the stock appealing to long-term investors if future earnings growth and margin improvements materialize as expected.

- However, the market seems to be waiting for firmer evidence of consistent, above-industry revenue growth before pricing in more upside.

Slow Revenue Growth Trails Industry Pace

- Revenue increased by 2.9% over the past year, notably slower than the 10.5% growth rate seen across the broader US market for the same period.

- From the consensus narrative, analysts are divided. Some highlight strong product pipelines and expansion into emerging markets as future growth drivers, while others caution that global trade headwinds and persistent procurement challenges in segments like pharma delivery systems could limit the pace of organic growth going forward.

- Forecasts anticipate annual revenue growth of 4.9% over the next three years, but the current trajectory lags behind both sector momentum and consensus targets.

- What is notable is that despite these growth headwinds, Becton Dickinson maintains a solid dividend yield of 2.17% and a forecasted annual earnings growth rate of 14.8%, which could provide a cushion for patient investors watching for an inflection point.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Becton Dickinson on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the data others might have missed? Share your point of view and shape your own outlook in just a few minutes by participating – Do it your way.

A great starting point for your Becton Dickinson research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Becton Dickinson’s revenue growth has lagged behind broader market trends and industry peers, with only modest improvement expected over the next few years.

If you want to focus on companies delivering steadier expansion, use stable growth stocks screener (2075 results) to find those consistently posting reliable revenue and earnings growth across changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success