- United States

- /

- Medical Equipment

- /

- NYSE:BDX

Becton Dickinson (BDX): Assessing Valuation Following Mixed Earnings and Evolving Investor Sentiment

Reviewed by Simply Wall St

Becton Dickinson (BDX) just released a quarterly earnings report that is getting a lot of attention from investors, especially those weighing what to do next with the stock. The headline number came in a bit soft, as revenue missed expectations, mainly because global research spending fell and tariffs pinched its research instruments and diagnostics divisions. On the other hand, BDX posted healthy year-over-year growth and kept its commitment to shareholders through buybacks and dividends. The market can sometimes be quick to judge, but these crosscurrents make the situation less straightforward than it first appears.

In the bigger picture, Becton Dickinson’s overall performance this year has been mixed. The stock saw a decline over the past year, yet it rebounded around 14% in the past three months as momentum picked up, possibly boosted by optimism around operating resilience and continued shareholder returns. Results like these, combined with active options trading and some cautious analyst revisions, indicate that investor sentiment is still in flux, with risk and opportunity both on the table.

After the upswing of recent weeks and with the latest earnings results on the table, the question now is whether Becton Dickinson’s current valuation is a bargain or if investors are already factoring in its future growth.

Most Popular Narrative: 7.2% Undervalued

According to community narrative, Becton Dickinson is currently viewed as undervalued, with a consensus price target indicating potential upside for investors. This perspective is built on constructive assumptions about growth and profitability over the next several years.

The pending separation of the Biosciences and Diagnostic Solutions business will transform BD into a pure-play medical technology leader with a portfolio that is heavily weighted toward consumables (more than 90% of revenue). This change is expected to enable higher cash flow predictability and margin improvement. Additionally, anticipated aggressive share buybacks are seen as directly supporting EPS growth.

Craving the inside story behind this 7.2% undervalued call? The central point: It relies on impressive revenue growth, stronger profit margins, and a significant business transformation that few anticipated. The main driver of this valuation is found in a handful of bold financial estimates. Will you agree with what analysts are projecting for the next three years?

Result: Fair Value of $208.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent tariff pressures and looming execution risks from the planned business separation could undermine Becton Dickinson’s growth outlook in the coming years.

Find out about the key risks to this Becton Dickinson narrative.Another View: A Different Take on Valuation

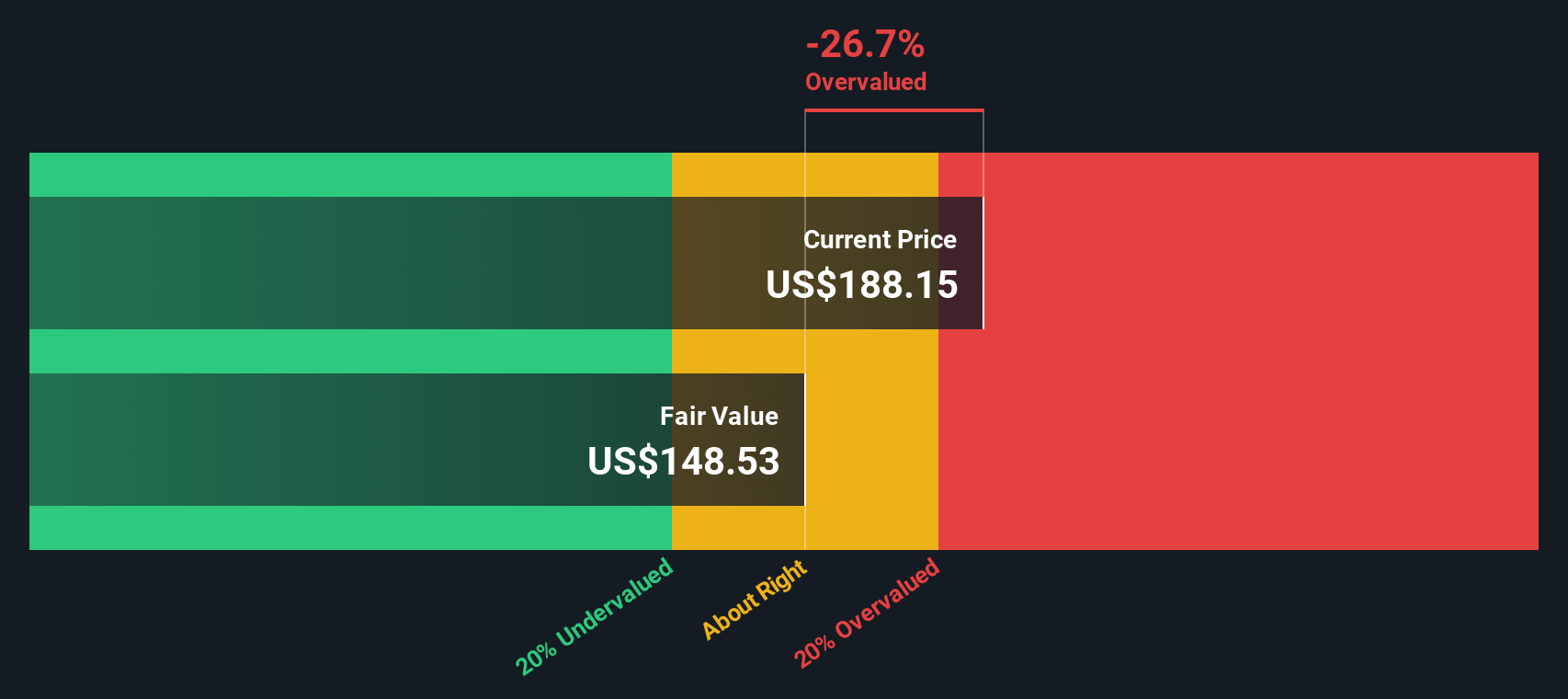

While many investors point to Becton Dickinson’s future earnings potential to justify its current price, our DCF model suggests a more cautious outlook. This analysis indicates the shares may actually be trading above fair value. Could fundamentals be telling a different story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Becton Dickinson for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Becton Dickinson Narrative

If you are unconvinced by the current narratives or enjoy digging into the data yourself, you can shape your own story in just a few minutes. Do it your way.

A great starting point for your Becton Dickinson research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for Even More Smart Investment Ideas?

Don’t limit your potential. Expand your horizons with fresh opportunities you may be overlooking. The Simply Wall Street Screener gives you the edge to spot hidden value and game-changers across the markets. Check out these handpicked options and put your money where the momentum is going:

- Target higher returns by tapping into companies with impressive shareholder payouts and steady yields through dividend stocks with yields > 3%.

- Unleash the power of the next tech wave by joining trendsetters in artificial intelligence with AI penny stocks.

- Get a head start on tomorrow’s bargains by tracking stocks trading below their true value using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives