- United States

- /

- Medical Equipment

- /

- NYSE:BAX

Weighing Baxter Stock After Restructuring as Shares Drop 34.5% in Past Year

Reviewed by Bailey Pemberton

If you’ve followed Baxter International lately, you’re probably wondering if now is the right moment to reconsider the stock or if it’s best left on the watchlist. After all, with Baxter’s share price closing at $23.02, most of us can’t help but notice the rollercoaster the stock’s been riding. The last 30 days have brought a modest 2.0% gain, but that hardly makes up for the tougher long-term picture. Year-to-date, Baxter is down 21.3%, and over the past year, the stock has fallen an eye-opening 34.5%. Stretch that view back three and five years, and the drops become even more dramatic. The stock is down 54.7% over three years and a staggering 66.9% over five years.

What’s sparked all this movement? Recently, the company’s restructuring initiatives and the streamlining of its operations have caught investor attention. While these steps signal a push towards efficiency and future growth, the market seems torn between skepticism over short-term disruption and optimism about long-term potential. It is a classic case of shifting risk perception, with shares reacting as strategies unfold and results remain just over the horizon.

But here’s the key thing that has value-focused investors intrigued: on our six-point valuation checklist, Baxter hits five. That’s a value score of 5, which suggests the company might be significantly undervalued by most traditional metrics.

So, how does Baxter stack up against different valuation approaches? Let’s break down what this score actually means. There is an even better way to look at valuation that we’ll cover at the end.

Why Baxter International is lagging behind its peers

Approach 1: Baxter International Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them to reflect today’s value. For Baxter International, the model starts by assessing the latest twelve months’ Free Cash Flow, which stands at $278 million. Analysts forecast significant growth, with cash flow expected to increase to $1.12 billion by 2027. Further projections rise steadily to $1.56 billion by 2035. While near-term estimates are supplied by analysts, projections beyond five years are calculated using generalized growth rates.

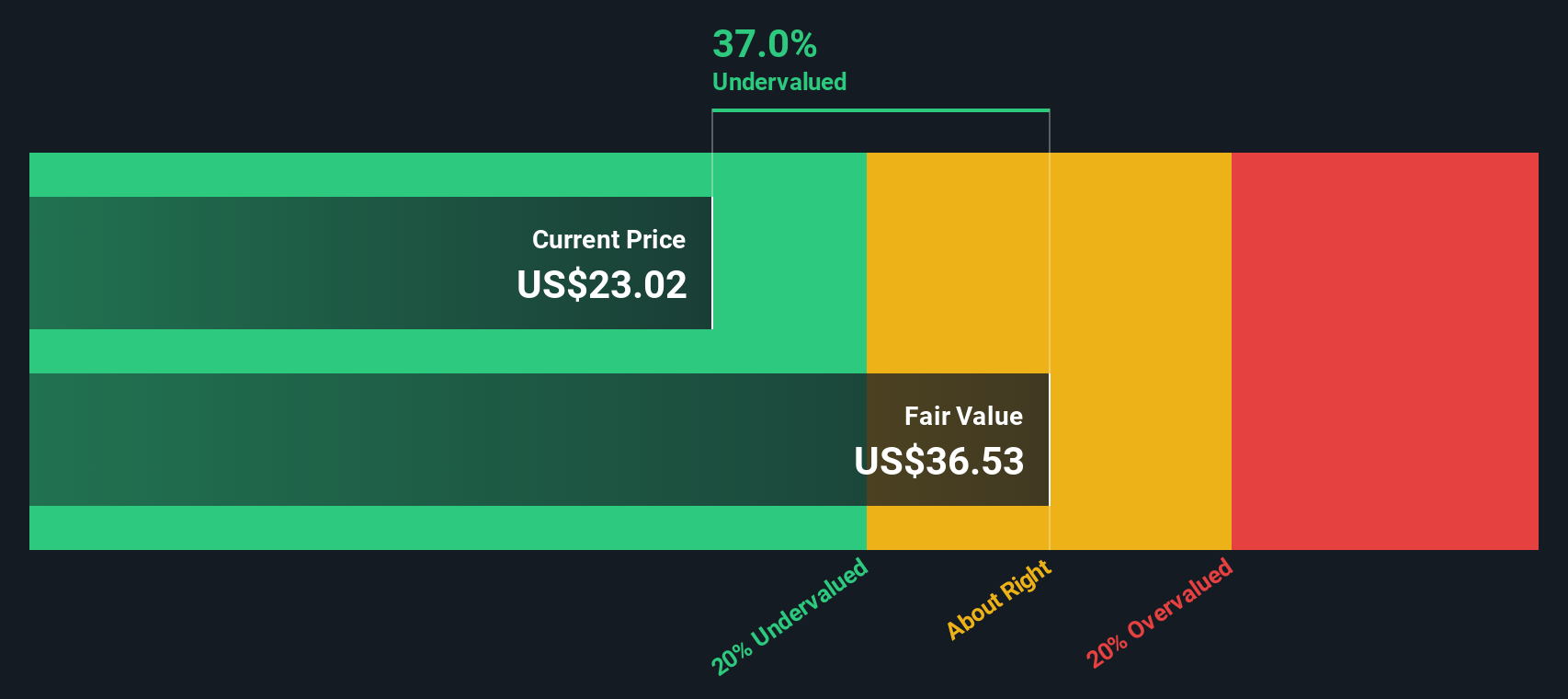

Based on these forecasts, the DCF model determines a fair value of $36.50 per share. This is 36.9% higher than Baxter’s current share price of $23.02, indicating that the stock is substantially undervalued by the market according to cash flow expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Baxter International is undervalued by 36.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Baxter International Price vs Sales

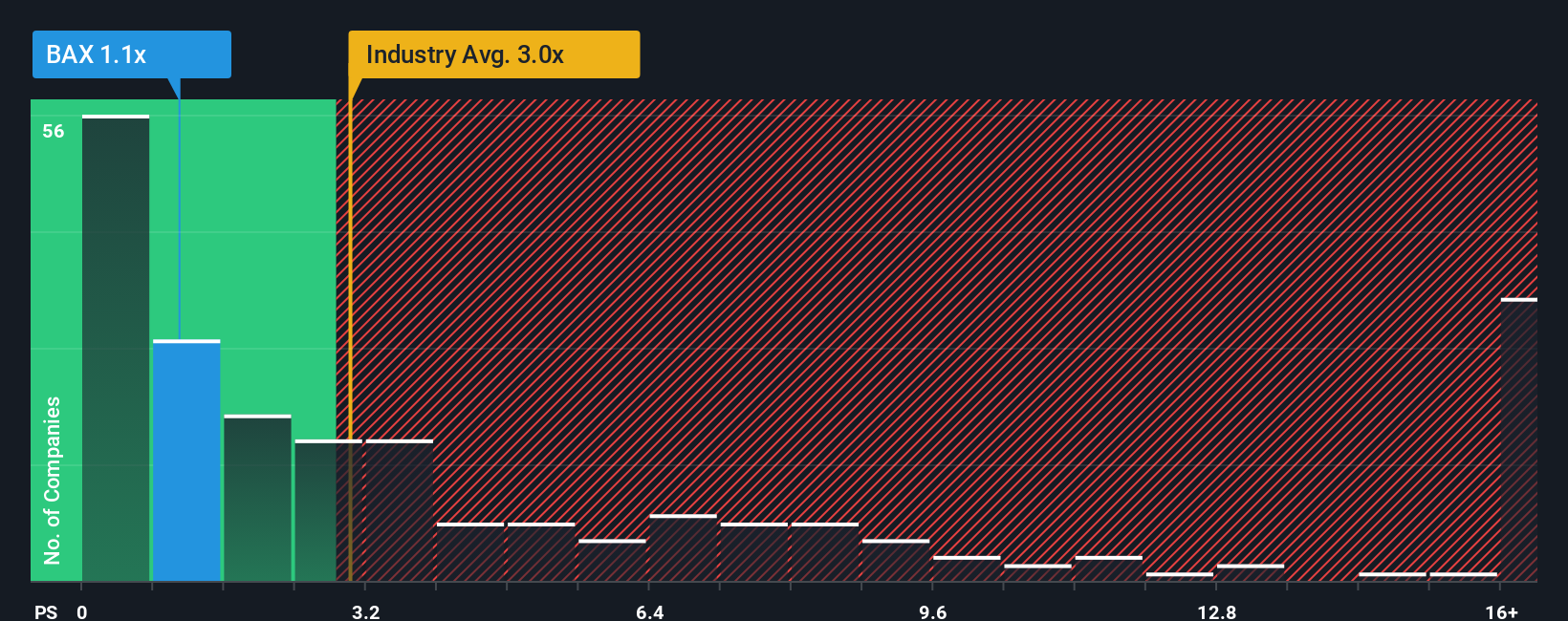

For a company like Baxter International, which has struggled with profitability in recent periods, the Price-to-Sales (P/S) ratio is a practical metric for valuation. Unlike P/E, the P/S ratio does not depend on positive earnings, making it a useful tool for analyzing companies facing short-term pressures but still generating significant revenues. Growth expectations and risks play a big role in what counts as a “fair” multiple. Companies with higher growth or lower perceived risk are typically valued with higher P/S ratios by the market.

Baxter’s current P/S ratio stands at 1.09x. To put this in context, the industry average for medical equipment companies is 3.00x, and peers are trading at an average of 4.53x. Both benchmarks are considerably higher than Baxter’s current valuation, which suggests the market remains cautious about its near-term prospects.

The Simply Wall St “Fair Ratio” goes a step further by calculating what the multiple should be, after accounting for Baxter’s specific growth outlook, profit margins, industry profile, risk factors, and market cap. This makes it more insightful than simply comparing the company with its peers or the broader industry, as it builds in the nuances and unique circumstances facing Baxter right now. The Fair Ratio for Baxter is 1.50x, which is only slightly above its current P/S ratio of 1.09x.

Given this relatively small difference, Baxter’s valuation by this metric looks about right, neither deeply undervalued nor overvalued versus what its fundamentals and outlook suggest.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Baxter International Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a simple yet powerful tool that let you capture the story behind a company—your view on its future revenues, margins, and fair value—and then connect that big picture directly to financial forecasts.

A Narrative links what you know about Baxter International, such as new leadership, evolving hospital trends, or innovation in connected healthcare, to a financial roadmap and an estimate of fair value. With Narratives, creating and updating these perspectives is easy, all within the Simply Wall St Community page, where millions of investors share ideas.

Narratives help you see quickly if Baxter is a buy or sell based on how your fair value compares to today’s share price. Plus, as news or earnings updates hit the market, Narratives are dynamically refreshed, so your analysis can always reflect the latest information.

For example, one investor’s narrative for Baxter might focus on digital healthcare innovation and forecast a fair value as high as $47 per share, while another, more cautious, narrative could point to lingering quality or margin concerns and estimate fair value at just $19. Narratives capture both optimism and caution, empowering you to define your investment decisions more clearly and adapt as the story evolves.

Do you think there's more to the story for Baxter International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baxter International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAX

Baxter International

Through its subsidiaries, provides a portfolio of healthcare products in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives