- United States

- /

- Healthcare Services

- /

- NYSE:ARDT

Assessing Ardent Health’s Valuation After Recent Guidance Cut (ARDT)

Reviewed by Simply Wall St

Ardent Health (ARDT) just announced a downward revision to its full-year earnings guidance, adjusting its expectations for net income and diluted earnings per share. For investors, this kind of update often prompts quick reflection on valuation and strategy.

See our latest analysis for Ardent Health.

After a turbulent year, Ardent Health’s recent downward revision has weighed on sentiment, with the year-to-date share price return coming in at -16.62 percent and a 1-year total shareholder return of -17.35 percent. Momentum had been building earlier in the quarter, highlighted by a 12.49 percent gain over 90 days, but this guidance cut suggests that risk perception is shifting again.

If you’re reviewing your healthcare picks after this news, consider exploring See the full list for free. to discover other sector leaders and rising names on Simply Wall St.

With the recent guidance cut and analyst price targets still signaling substantial upside, investors must weigh whether Ardent Health’s recent dip is a value opportunity or if the market has fully factored in future risks and growth potential.

Most Popular Narrative: 26.4% Undervalued

Ardent Health’s most followed valuation narrative sets its fair value at $19.08, a premium to the last close at $14.05. This viewpoint comes from consensus financial forecasts and sector-specific growth expectations. It offers a roadmap that diverges from short-term market swings.

The accelerated deployment of advanced technology, including AI-enabled scribe tools, virtual nursing, and digital wearables, improves clinical efficiency, reduces labor costs, limits nurse turnover, and streamlines workflow. All of these factors bolster operational efficiency and EBITDA margins.

Curious what underpins this bullish estimate? The narrative hinges on aggressive top-line growth, fatter margins, and a payout multiple below industry norms. Want to see exactly how those projections stack up? You’ll need to read the full story.

Result: Fair Value of $19.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty and growing challenges in payer contracts could undermine Ardent Health’s upbeat outlook if not carefully managed.

Find out about the key risks to this Ardent Health narrative.

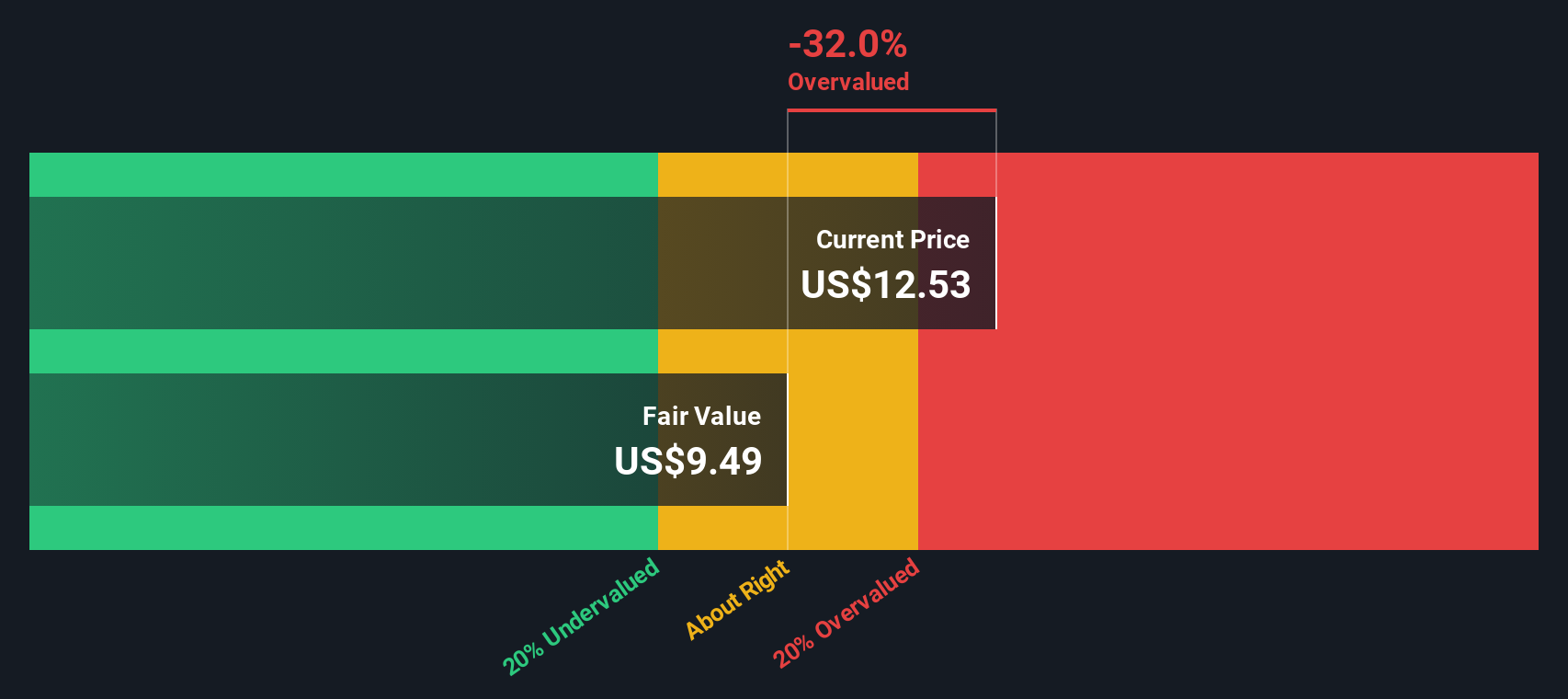

Another View: Discounted Cash Flow Puts a Lower Value

While analysts see Ardent Health as markedly undervalued based on future growth and earnings multiples, the SWS DCF model presents a different perspective. It estimates fair value at just $9.55 per share, which is well below the recent price of $14.05. Could near-term optimism be causing investors to overlook some longer-term risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ardent Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ardent Health Narrative

If you have a different perspective or want to analyze things your way, crafting your own story takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Ardent Health.

Looking for more investment ideas?

This market moves fast, and hidden gems never wait around. Make your next smart move before others catch on by seeing what’s out there using the tools below.

- Uncover high-yield income opportunities by checking out these 14 dividend stocks with yields > 3% that consistently deliver returns above 3 percent.

- Capitalize on rapid innovation in healthcare by exploring these 32 healthcare AI stocks set to transform patient outcomes and streamline care.

- Get ahead of transformative trends with these 82 cryptocurrency and blockchain stocks leading breakthroughs in digital payments and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARDT

Ardent Health

Owns and operates a network of hospitals and clinics that provides a range of healthcare services in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives