- United States

- /

- Healthcare Services

- /

- NYSE:ARDT

Ardent Health (ARDT): Evaluating Valuation After Accounting Revelations and Guidance Cut

Reviewed by Simply Wall St

Ardent Health (ARDT) found itself under the spotlight after revealing nearly $100 million in adverse accounting adjustments, along with a cut to its 2025 financial guidance. This led to a sharp stock decline and renewed investor scrutiny.

See our latest analysis for Ardent Health.

After news broke of major accounting adjustments and reduced guidance, Ardent Health’s share price slid sharply, with a 1-month share price return of -39.7% and year-to-date losses approaching 48%. Momentum has been fading as recent disclosures shake investor confidence. This has increased risk perception and overshadowed any near-term rebound attempts.

If recent volatility in healthcare has you rethinking your approach, it could be the perfect time to find fresh opportunities through our See the full list for free.

With shares now trading at a deep discount to analyst price targets and sentiment at a low point, the question for investors is clear: Is Ardent Health now undervalued, or has the market already priced in slowing growth and lingering risks?

Most Popular Narrative: 37.1% Undervalued

Ardent Health's most widely followed narrative points to a fair value that is 37.1% higher than the last closing price of $8.78. This sets expectations for substantial upside if forecasted improvements materialize. This optimistic outlook draws on bold assumptions about expanding margins and operational efficiencies, while comparing Ardent’s valuation to broader healthcare benchmarks.

Company investments in expanding the ambulatory and urgent care footprint, with ongoing projects and recent acquisitions, enable access to higher-margin outpatient services and enlarge Ardent's patient base. This drives a sustained increase in net margins and diversified recurring revenues. The accelerated deployment of advanced technology, including AI-enabled scribe tools, virtual nursing, and digital wearables, improves clinical efficiency, reduces labor costs, limits nurse turnover, and streamlines workflow, all of which bolster operational efficiency and EBITDA margins.

Curious what financial leap could justify such a high price target? At the core of this narrative are aggressive growth plans and a margin expansion blueprint that would surprise even the skeptics. Want the growth, margin, and future multiples that anchor this bold calculation? See the details and decide for yourself.

Result: Fair Value of $13.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures or further increases in payer denials could quickly undermine this optimistic scenario and limit upside for Ardent Health investors.

Find out about the key risks to this Ardent Health narrative.

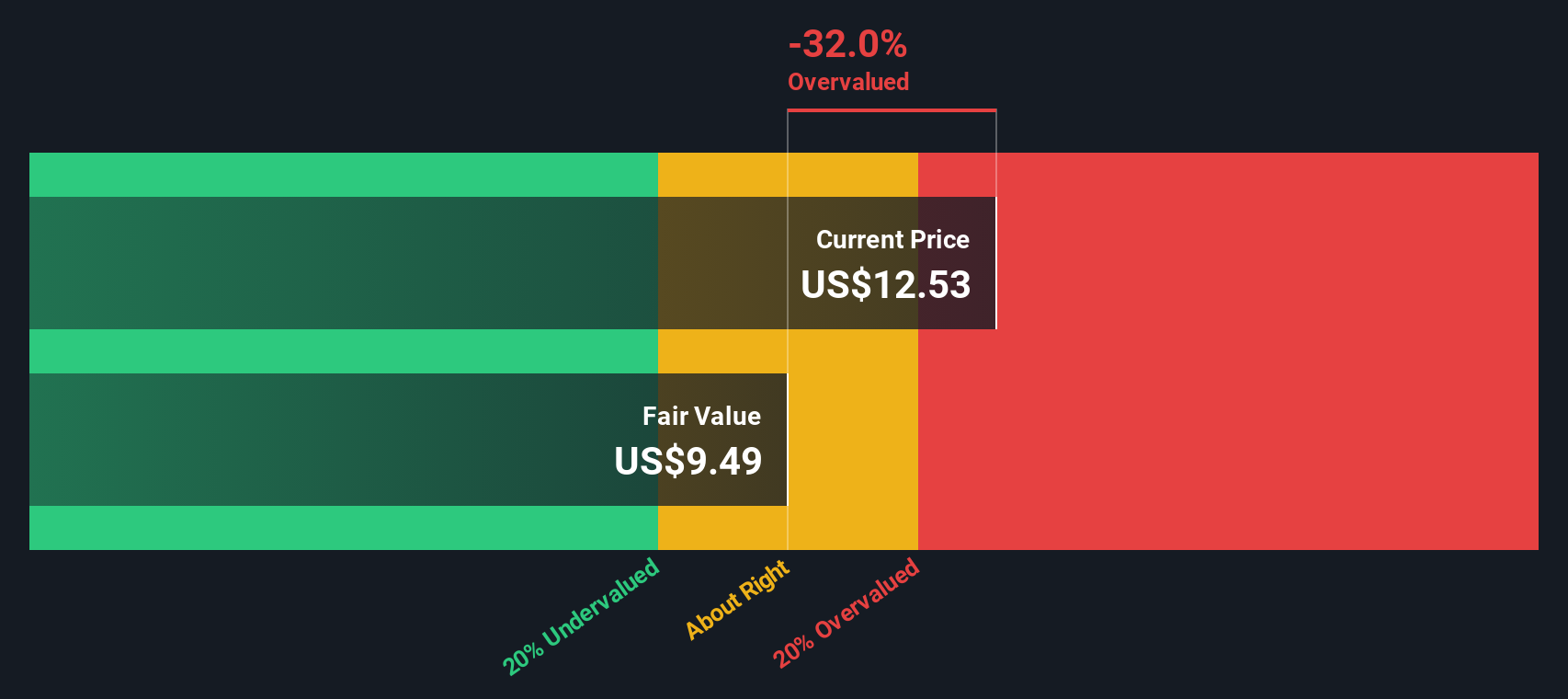

Another View: The SWS DCF Model Tells a Different Story

While the analyst consensus points to significant upside, our DCF model suggests caution. Based on long-term cash flows and a fair value estimate of $7.19, Ardent Health actually trades above our projection. This indicates it may be overvalued by this measure. Does this discrepancy raise red flags or simply highlight market uncertainty?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ardent Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ardent Health Narrative

If you want to reach your own conclusions or dive deeper into the numbers, you can craft a personalized perspective in just a few minutes. Do it your way

A great starting point for your Ardent Health research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on the next big trend. Don’t miss your chance to spot unique opportunities the market hasn’t noticed yet. Let Simply Wall Street’s powerful Screener guide your next move.

- Catch the upside of stocks trading well below their intrinsic value with these 914 undervalued stocks based on cash flows, and position yourself for potential gains before the crowd reacts.

- Tap into the future of medicine by finding breakthrough companies at the intersection of technology and healthcare through these 30 healthcare AI stocks.

- Secure ongoing income streams by searching for these 15 dividend stocks with yields > 3% offering robust yields and consistent shareholder rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARDT

Ardent Health

Owns and operates a network of hospitals and clinics that provides a range of healthcare services in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026