- United States

- /

- Medical Equipment

- /

- NYSE:ABT

Is Abbott Laboratories Still a Good Value After Recent 17% Share Price Rally in 2025?

Reviewed by Bailey Pemberton

If you hold shares of Abbott Laboratories or are considering diving in, you are probably wondering whether now is a smart time to make a move. After all, the stock has steadily edged upward, gaining 17.5% so far this year and delivering a solid 34.6% return for investors over the last three and five years. Even though the past month has been a bit flat at -0.3%, and the last week showed a tiny boost of 0.2%, long-term holders have been well rewarded for their patience.

Much of this performance comes as Abbott continues to capitalize on steady healthcare demand and new medical technologies, while global market dynamics have kept defensive healthcare names like Abbott in focus. Investors have also become more optimistic about the company's outlook as innovation and consistent execution drive either growth or, at the very least, stability. These are qualities in high demand in uncertain markets.

The big question, of course, is valuation. Is Abbott still trading below its intrinsic worth, or is the share price running ahead of fundamentals? Based on our screening, Abbott scores a 3 out of 6 on our value check, indicating it looks undervalued by half of the six different valuation methods we track. In the next section, we will break down what this score really means and dig into how various valuation models stack up.

Stick around, though. The most insightful approach to valuing Abbott Laboratories might surprise you and will be revealed at the end of this analysis.

Approach 1: Abbott Laboratories Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its expected future cash flows and discounting them back to today’s value. This approach helps investors understand what Abbott Laboratories might be worth if all future growth and risks are taken into account.

For Abbott Laboratories, the current trailing twelve-month Free Cash Flow stands at $6.79 Billion. Analysts forecast growth in these cash flows, projecting an increase to $8.42 Billion by 2029. It is important to note that while analyst estimates typically extend out five years, projections beyond that, including to 2035, are extrapolated by Simply Wall St and suggest steadily rising cash generation.

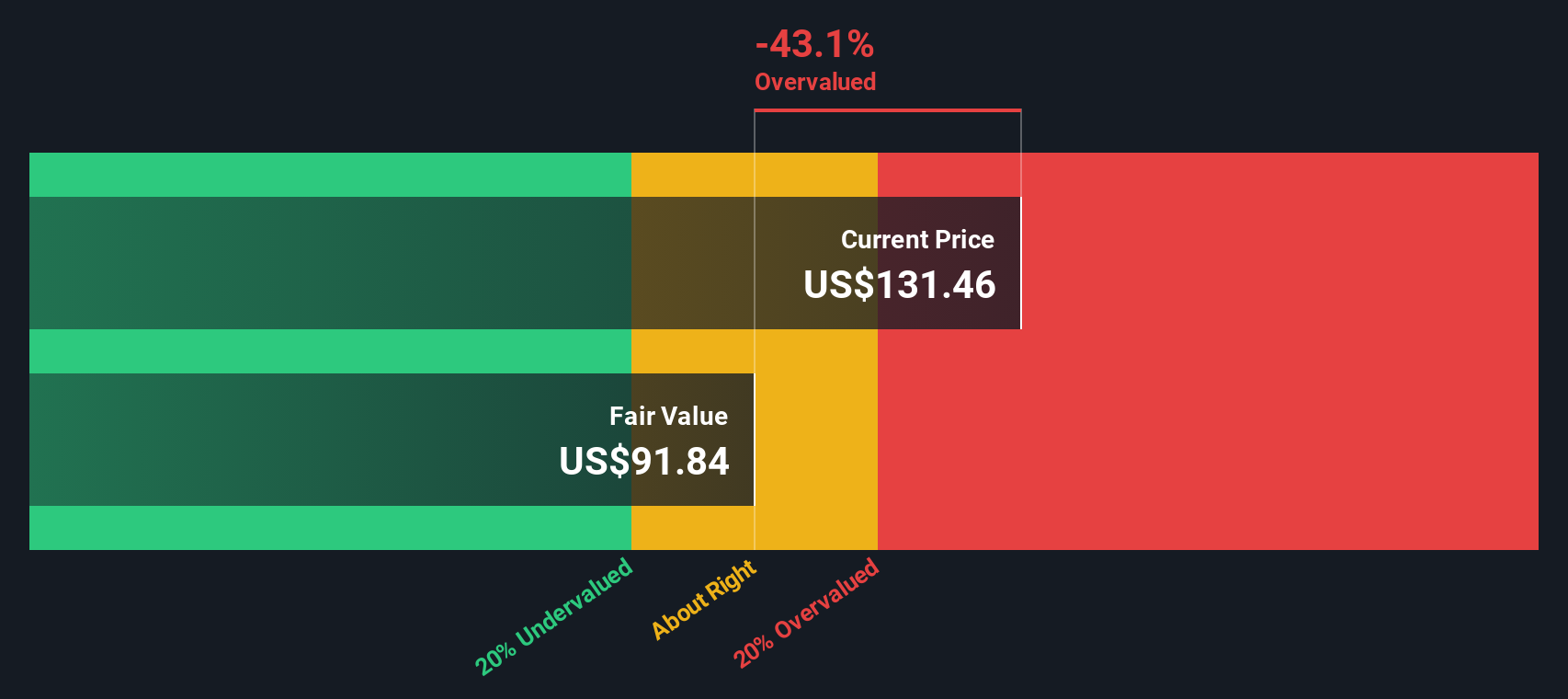

Based on these projections, the DCF model calculates an estimated intrinsic value of $93.82 per share. However, the DCF analysis implies the stock is trading at a 42% premium to its fair value right now, meaning it appears to be significantly overvalued according to this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Abbott Laboratories may be overvalued by 42.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Abbott Laboratories Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Abbott Laboratories because it relates a company’s current share price to its per-share earnings. For investors, the PE ratio offers a quick snapshot of whether a stock is expensive or cheap relative to its ability to generate profits.

The "right" or "fair" PE ratio depends on factors such as how quickly a company is expected to grow, its profitability, and the risks it faces. Companies with higher expected growth or more stable earnings can justify higher PE ratios, while those with more risk or slower growth usually trade at lower multiples.

Abbott Laboratories currently trades at a PE ratio of 16.7x. By comparison, the broader Medical Equipment industry average stands higher at 29.4x, and peer companies average a striking 48.0x. On paper, Abbott looks much cheaper than both peers and its industry. However, rather than relying just on these benchmarks, Simply Wall St’s “Fair Ratio” model weighs unique factors relevant to Abbott, including its growth profile, profit margins, market cap, and risk.

The Fair Ratio for Abbott is calculated at 21.8x. This proprietary valuation provides a more nuanced comparison because it considers not just industry context, but also company-specific metrics and risk factors. This helps avoid potential mispricing that could arise from comparisons with only broad industry or peer averages.

Comparing the Fair Ratio to Abbott’s current PE, the difference is moderate. The company’s PE is 16.7x, while the Fair Ratio is 21.8x. This suggests Abbott Laboratories stock is fairly valued, possibly with a slight tilt toward being undervalued right now.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Abbott Laboratories Narrative

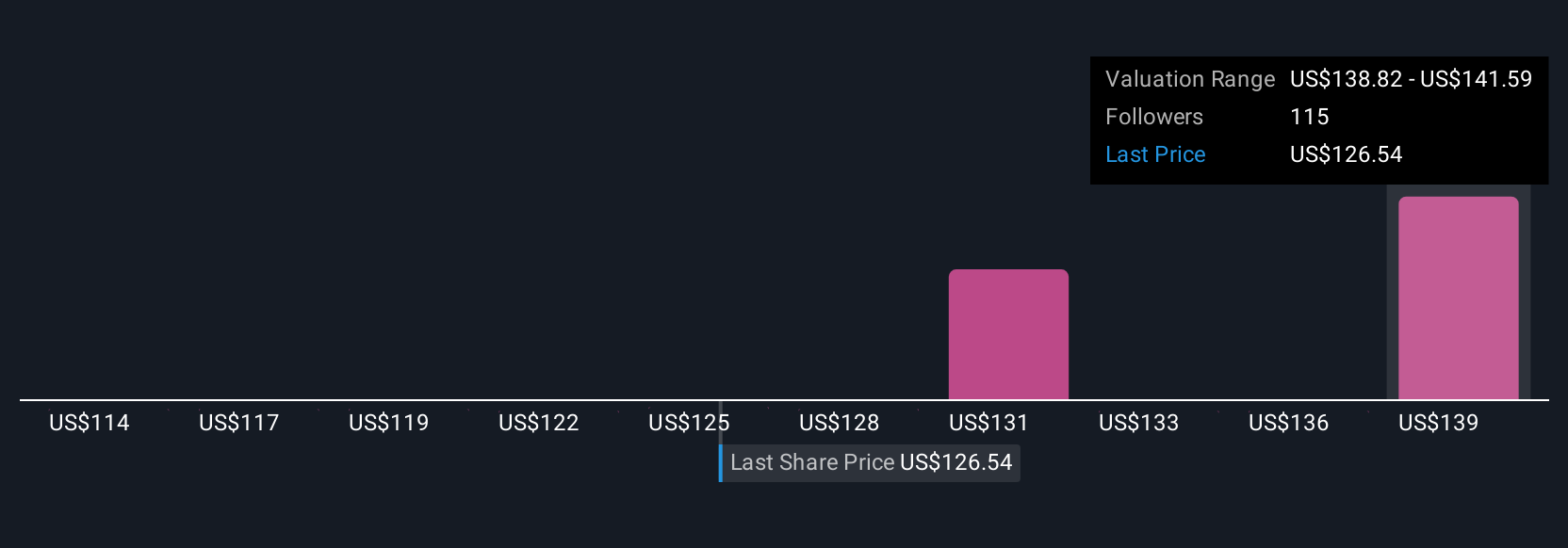

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is the story you create about a company’s future, linking your perspective on its business, key assumptions for revenue and earnings growth, and the fair value you believe it deserves, all in one place.

Instead of relying only on static ratios or analyst estimates, Narratives empower you to combine your unique outlook on Abbott Laboratories with financial forecasts, clearly connecting what you believe will happen with what you think the company is worth. This tool is available and easy to use on Simply Wall St's platform within the Community page, where millions of investors share and compare their views.

Narratives help you decide when to buy or sell by revealing where your calculated Fair Value stacks up against today’s share price. Plus, as news breaks or earnings are announced, Narratives update dynamically, immediately reflecting new information and keeping your investment thesis relevant.

For example, some investors think Abbott Laboratories’ innovation and expansion justify a value as high as $159.00 per share, while others cite competitive and regulatory risks to argue it should be closer to $122.00. Your own Narrative lets you decide which story you believe.

Do you think there's more to the story for Abbott Laboratories? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success