- United States

- /

- Medical Equipment

- /

- NYSE:ABT

Abbott Laboratories (NYSE:ABT) Enhances Diabetes Care And Partners With Abu Dhabi For Pharma Expansion

Reviewed by Simply Wall St

Recent events for Abbott Laboratories (NYSE:ABT) include the integration of Beta Bionics' iLet Bionic Pancreas with Abbott's sensor technology and a partnership with the Department of Health - Abu Dhabi, aiming to localize pharmaceutical manufacturing. Additional FDA approvals for key products and a declared dividend highlight the company's operational momentum. Despite these developments, the broader market impact included mixed U.S. stock performance and geopolitical tensions affecting investor sentiment. Abbott's stock price move of 5% in the last quarter suggests that these developments might have aligned with general market trends, supporting relative stability amid external economic influences.

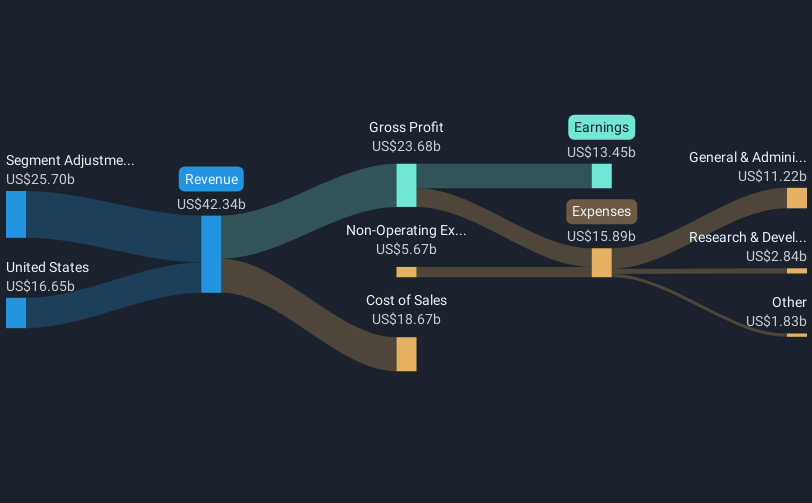

The integration of Beta Bionics' iLet Bionic Pancreas with Abbott's sensor technology and their partnership with the Department of Health - Abu Dhabi could bolster Abbott Laboratories' international capabilities and technological edge, potentially enhancing revenue opportunities. However, with the diagnostics segment facing pressure from China's volume-based procurement programs, the expected revenue growth might be hampered. Analysts project revenues to rise at an annual rate of 7% over the next three years, partly due to tariff impacts anticipated in 2025. The launch of new products and entry into nucleic acid testing are predicted to require considerable investment, which could compress margins before anticipated revenue growth materializes.

Over the past five years, Abbott's total shareholder return, including dividends, has been 63.09%, underscoring long-term resilience. Comparatively, in the past year, Abbott outpaced the US Medical Equipment industry average return of 5.3%, reflecting robust performance despite broader market volatility. Analyst consensus places Abbott’s price target at US$140.41, just 5.2% above the current share price of US$133.06. This suggests a perceived fair valuation, with potential limited upside in share value. Investment in cutting-edge technologies and efficient operational management are seen as pivotal in sustaining earnings, yet analyst forecasts indicate a potential decline in earnings by an average of 6.2% per year over the next three years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives