- United States

- /

- Medical Equipment

- /

- NasdaqGS:ZYXI

More Unpleasant Surprises Could Be In Store For Zynex, Inc.'s (NASDAQ:ZYXI) Shares After Tumbling 66%

The Zynex, Inc. (NASDAQ:ZYXI) share price has fared very poorly over the last month, falling by a substantial 66%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 80% loss during that time.

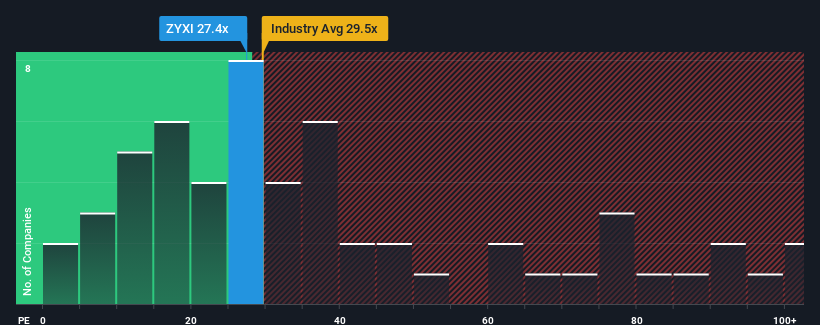

Although its price has dipped substantially, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may still consider Zynex as a stock to avoid entirely with its 27.4x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Zynex hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Zynex

Is There Enough Growth For Zynex?

The only time you'd be truly comfortable seeing a P/E as steep as Zynex's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 66% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 79% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

The Bottom Line On Zynex's P/E

A significant share price dive has done very little to deflate Zynex's very lofty P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

It is also worth noting that we have found 4 warning signs for Zynex (1 makes us a bit uncomfortable!) that you need to take into consideration.

If you're unsure about the strength of Zynex's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zynex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ZYXI

Zynex

Designs, manufactures, and markets medical devices to treat chronic and acute pain, and activate and exercise muscles for rehabilitative purposes with electrical stimulation.

Fair value low.

Market Insights

Community Narratives