- United States

- /

- Medical Equipment

- /

- NasdaqGS:XRAY

Can DENTSPLY SIRONA’s Global Digital Push Reverse Its 41% One Year Slide?

Reviewed by Bailey Pemberton

Thinking about what to do with DENTSPLY SIRONA stock? You are not alone. With sharp moves in its share price—up 4.8% over the last week and still managing a slim 4.9% gain for the month—some investors are sitting up and taking notice. Yet, taking a step back, those positive shifts are set against a challenging longer-term picture: the stock is down 30.1% year-to-date and a sobering 41.4% over the past year. There is no escaping the fact that DENTSPLY SIRONA has shed nearly 70% of its value over five years. That’s a lot of pain for long-term holders, but it also means many are asking, “Is there deep value here, or is this a classic value trap?”

In the last few months, DENTSPLY SIRONA has been in the headlines as it rolled out a new wave of digital dentistry products and announced expanded partnerships with dental clinics globally. These steps speak to ongoing transformation and may explain why the stock saw a burst of investor interest recently. Still, the long-term decline has many wondering how to put these developments in context, especially when it comes to the real worth of the business.

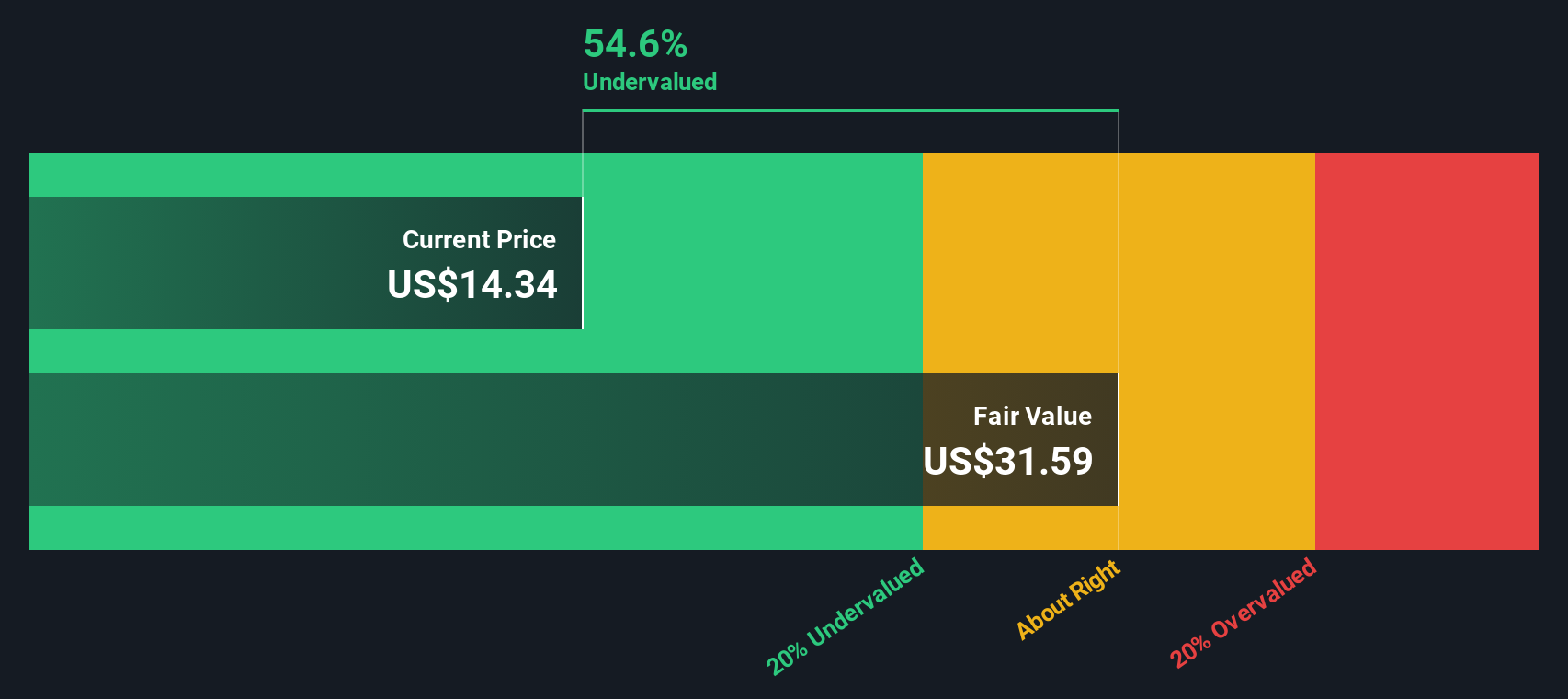

To give you a sense of where things stand, DENTSPLY SIRONA’s valuation score currently sits at 5 out of 6, meaning it comes out as undervalued in five out of six key metrics. But valuation is never as simple as a single number. Here is a look at how those different valuation checks stack up, which may provide perspective if you are considering whether DENTSPLY SIRONA offers real value at this point.

Why DENTSPLY SIRONA is lagging behind its peers

Approach 1: DENTSPLY SIRONA Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and then discounting those estimates back to the present. This approach is widely used because it aims to capture the long-term earning power of a business.

For DENTSPLY SIRONA, the latest reported Free Cash Flow (FCF) stands at $141.3 million. Analyst forecasts expect significant growth in FCF, with projections reaching around $407 million by 2029. While analyst estimates typically only stretch out five years, additional years are extrapolated by Simply Wall St to provide a longer-term perspective. Over the next ten years, free cash flow is forecast to steadily increase, reflecting confidence in the company’s transformation efforts and future profitability.

Based on this two-stage DCF analysis and applying the relevant discount rates, the model calculates an intrinsic fair value of $30.84 per share. This represents a 57.5% discount to the current market price. This indicates that the stock is considered heavily undervalued on a cash flow basis right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DENTSPLY SIRONA is undervalued by 57.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: DENTSPLY SIRONA Price vs Sales (P/S)

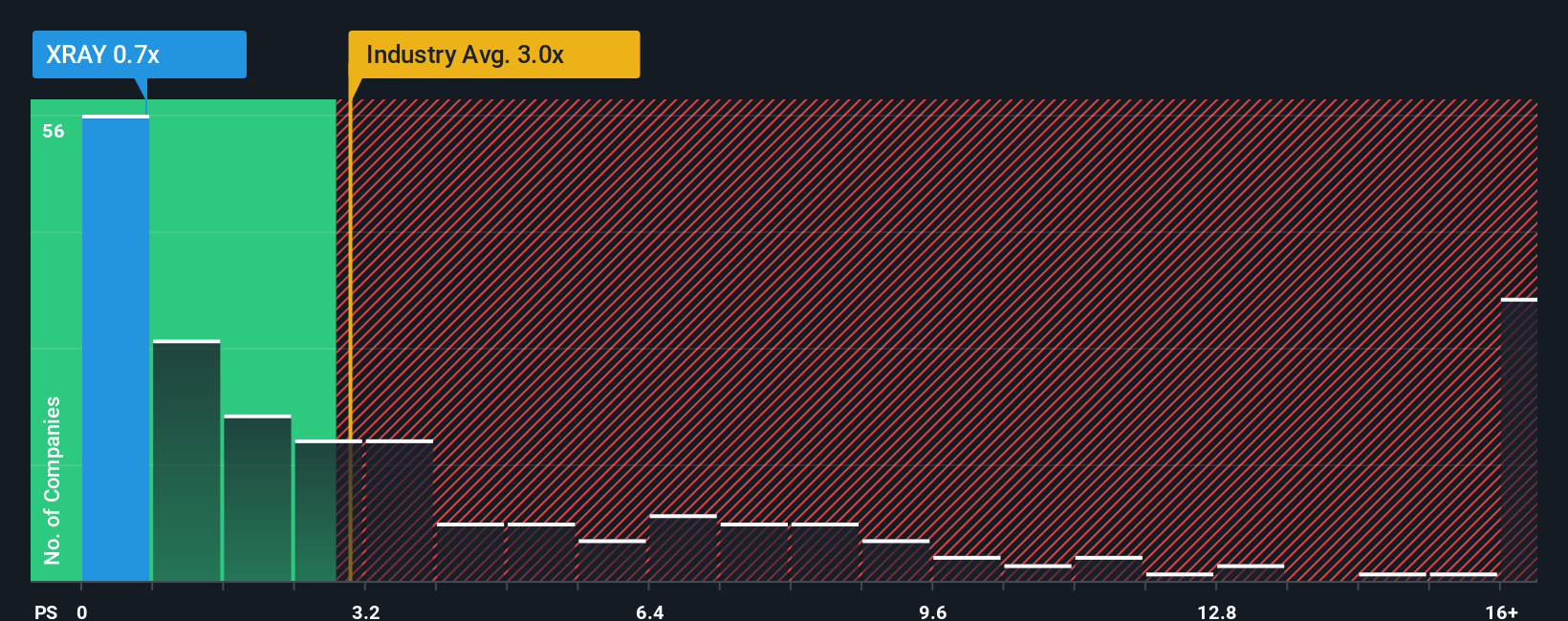

The Price-to-Sales (P/S) ratio is a popular metric for valuing companies like DENTSPLY SIRONA, especially when earnings are volatile or negative because it focuses on the company’s revenue generation. It is particularly useful for firms in sectors such as medical equipment where profit margins can fluctuate but sales provide a consistent snapshot of scale and demand.

Growth expectations and risk profiles play an important role in what constitutes a typical or fair P/S multiple. Companies with strong anticipated growth or lower risk profiles can command higher P/S ratios, while slower-growing or riskier companies generally trade at lower multiples. Comparing DENTSPLY SIRONA’s current P/S ratio of 0.71x against the industry average of 3.00x and a peer group average of 4.23x suggests the market is currently assigning a significant discount to its revenues.

To get a more focused view, Simply Wall St uses a proprietary metric called the “Fair Ratio,” which goes beyond simple comparisons by factoring in DENTSPLY SIRONA’s specific growth prospects, profit margins, industry dynamics, company size and risk factors. In this case, the Fair Ratio for DENTSPLY SIRONA is 1.44x. Given that the actual P/S ratio is 0.71x, which is well below the Fair Ratio, shares appear undervalued relative to revenue potential after accounting for all the right context.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DENTSPLY SIRONA Narrative

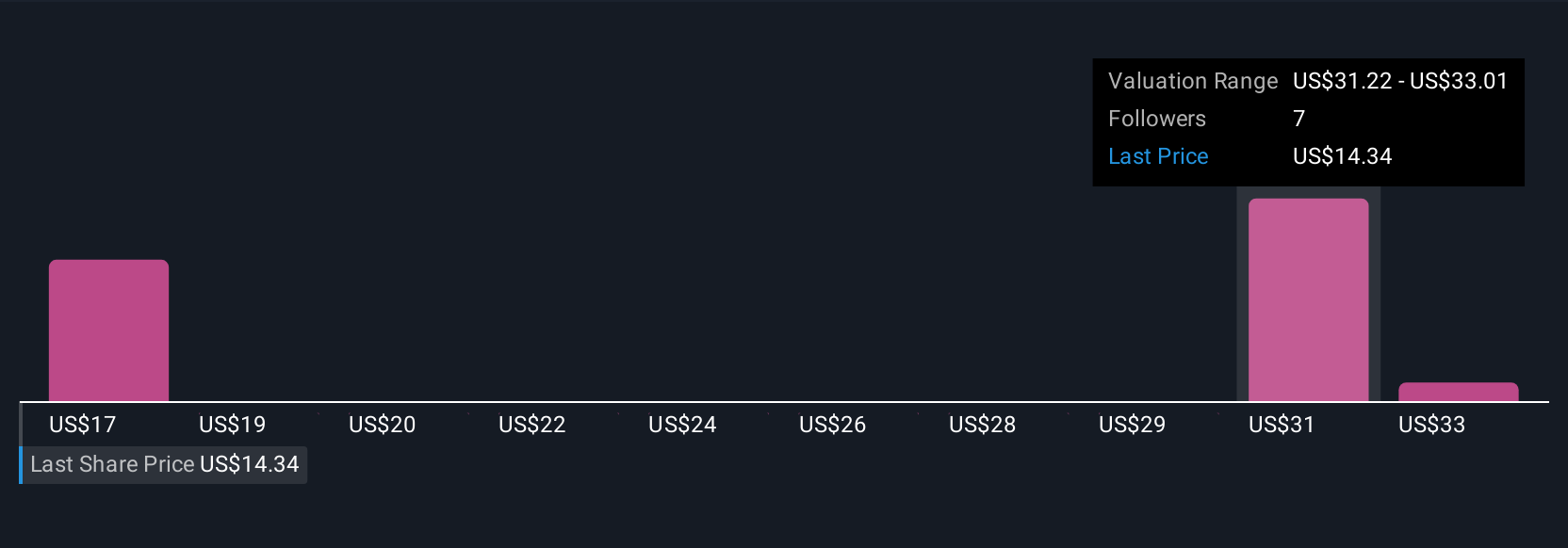

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own perspective or story about DENTSPLY SIRONA, bringing together what you believe about the company’s outlook, its future revenue, earnings, and margins, and translating that into a fair value for the stock. Narratives connect the dots from a company’s story and outlook to specific financial forecasts, ultimately showing what you think the shares are actually worth.

On Simply Wall St’s Community page, which is used by millions of investors, you can easily build and track your own Narrative. This allows you to see how your assumptions would change the fair value versus the current price and helps you decide when to buy, hold, or sell. Best of all, Narratives are dynamic and update automatically as new information or earnings are released, so your investment thesis stays current without any extra effort.

For example, one set of investors may see DENTSPLY SIRONA’s global platform expansion and cost optimization efforts as a durable source of margin growth. They may arrive at a bullish narrative with a fair value as high as $24.00 per share. Others may focus on ongoing sales challenges and competitive headwinds, estimating a bearish fair value closer to $14.00. Narratives empower you to anchor your investment around your own beliefs and real-time updates rather than just someone else’s static target.

Do you think there's more to the story for DENTSPLY SIRONA? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XRAY

DENTSPLY SIRONA

Develops, manufactures, and markets dental equipment supported by cloud-enabled solutions, dental products, and healthcare consumable products in urology and enterology worldwide.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives