- United States

- /

- Healthtech

- /

- NasdaqGS:WAY

Waystar (WAY): Evaluating Valuation After Strong Q3 Earnings Beat and Upgraded Full-Year Guidance

Reviewed by Simply Wall St

Waystar Holding (WAY) just delivered third-quarter results that exceeded Wall Street’s forecasts, reporting a 12% jump in revenue compared to last year. The company also raised its full-year guidance, which caught investors’ attention.

See our latest analysis for Waystar Holding.

Waystar’s upbeat report and raised guidance have clearly caught the market’s attention, fueling steady momentum in recent weeks. With a one-year total shareholder return of 38.7% and a share price up over 10% year-to-date, the stock continues to build on its positive run as confidence in the company’s growth trajectory grows.

If Waystar’s momentum has you rethinking your portfolio, this could be a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With shares up over 10% this year and new guidance boosting expectations, investors are left to wonder whether Waystar is still undervalued or if the market has already priced in all the future growth.

Most Popular Narrative: 21.4% Undervalued

With the most widely followed narrative assigning a value well above Waystar’s last close, bulls are watching how growth drivers play out against market expectations.

The acquisition of Iodine Software, a leading provider of AI-powered clinical intelligence, will expand Waystar's total addressable market by over 15%, accelerate its product roadmap, and immediately boost gross margins and adjusted EBITDA margins. This sets up compounding, long-term revenue and earnings growth.

Want to know what could supercharge Waystar's profits? The centerpiece of this narrative is a combination of powerful margin expansion and a future profit multiple fit for high-growth stars. The hidden drivers behind this ambitious valuation might surprise you. Dive in to uncover the numbers fueling this bold price target.

Result: Fair Value of $50.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained high leverage following acquisitions and any slowdown in patient healthcare utilization could threaten Waystar’s optimistic growth projections.

Find out about the key risks to this Waystar Holding narrative.

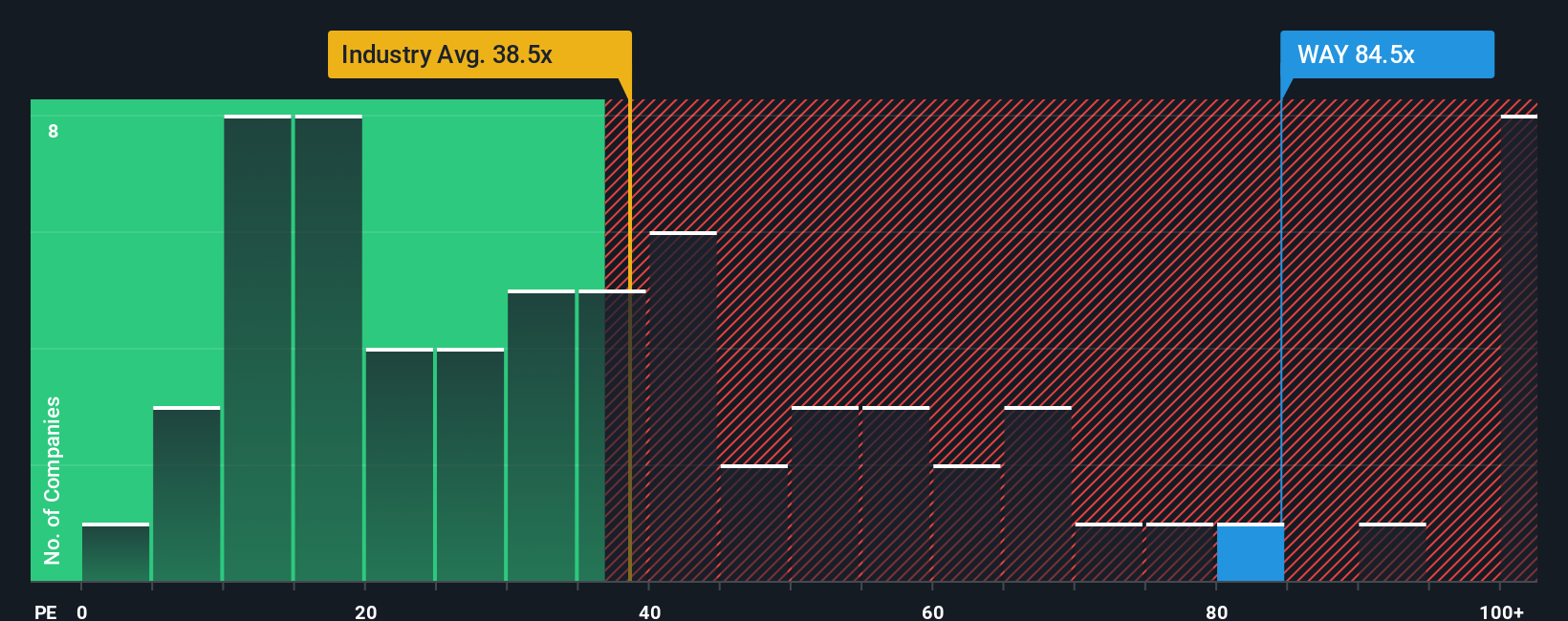

Another View: Multiples Tell a Different Story

While the most popular narrative signals Waystar is undervalued, a look at the price-to-earnings ratio offers a stark contrast. Shares currently trade at 88 times earnings, almost double the average for industry peers and well above the fair ratio of 34.8. That premium suggests investors are pricing in lofty growth, but is it already too much?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waystar Holding Narrative

If you see things differently or want to put your own perspective to the test, it takes less than three minutes to build your own view: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Waystar Holding.

Looking for Your Next Winning Stock?

Smart investing means always staying one step ahead. Supercharge your portfolio by tapping into tomorrow’s top-performing stocks before everyone else catches on.

- Find opportunities that traditional investors often overlook by checking out these 853 undervalued stocks based on cash flows, which highlights strong potential based on real cash flow analysis.

- Discover companies benefiting from the AI trend and see which leaders stand out with these 26 AI penny stocks.

- Enhance your passive income with quarterly payouts from companies offering stable yields over 3%, all found via these 21 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waystar Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAY

Waystar Holding

Develops a cloud-based software solution for healthcare payments.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives