- United States

- /

- Healthtech

- /

- NasdaqGS:WAY

Waystar (WAY): Assessing Valuation After UBS Initiates Coverage With a Buy Rating

Reviewed by Simply Wall St

Waystar Holding (WAY) just picked up fresh attention after UBS initiated coverage with a buy rating, putting the healthcare payments software provider back on the radar for growth focused investors.

See our latest analysis for Waystar Holding.

With the share price around $32.84, Waystar’s short term share price returns have been choppy, and its 1 year total shareholder return of about negative 11 percent suggests momentum has been fading despite solid underlying growth.

If this UBS call has you rethinking your healthcare exposure, it might be worth exploring other specialised names in the space through healthcare stocks to spot similar or stronger trends.

With revenue and earnings still growing double digits and the share price trading at a sizeable discount to analyst targets, is Waystar quietly undervalued today, or is the market already baking in all that future growth?

Most Popular Narrative: 32.6% Undervalued

With Waystar trading at $32.84 against a narrative fair value near $48.74, the implied upside leans heavily on sustained growth and margin expansion.

The acquisition of Iodine Software, a leading provider of AI powered clinical intelligence, will expand Waystar's total addressable market by over 15%, accelerate its product roadmap, and immediately boost gross margins and adjusted EBITDA margins, setting up compounding, long term revenue and earnings growth.

Curious how bigger margins, steady revenue gains, and a rich future earnings multiple can still line up as attractive at today’s price? The narrative spells out the growth math, the profitability jump, and the valuation bridge that turn this gap into a potential opportunity. The full breakdown shows exactly how those moving parts work together to support that higher fair value.

Result: Fair Value of $48.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated leverage from the Iodine deal and intensifying competition in AI driven RCM tools could quickly undercut today’s optimistic growth and margin assumptions.

Find out about the key risks to this Waystar Holding narrative.

Another Angle on Valuation

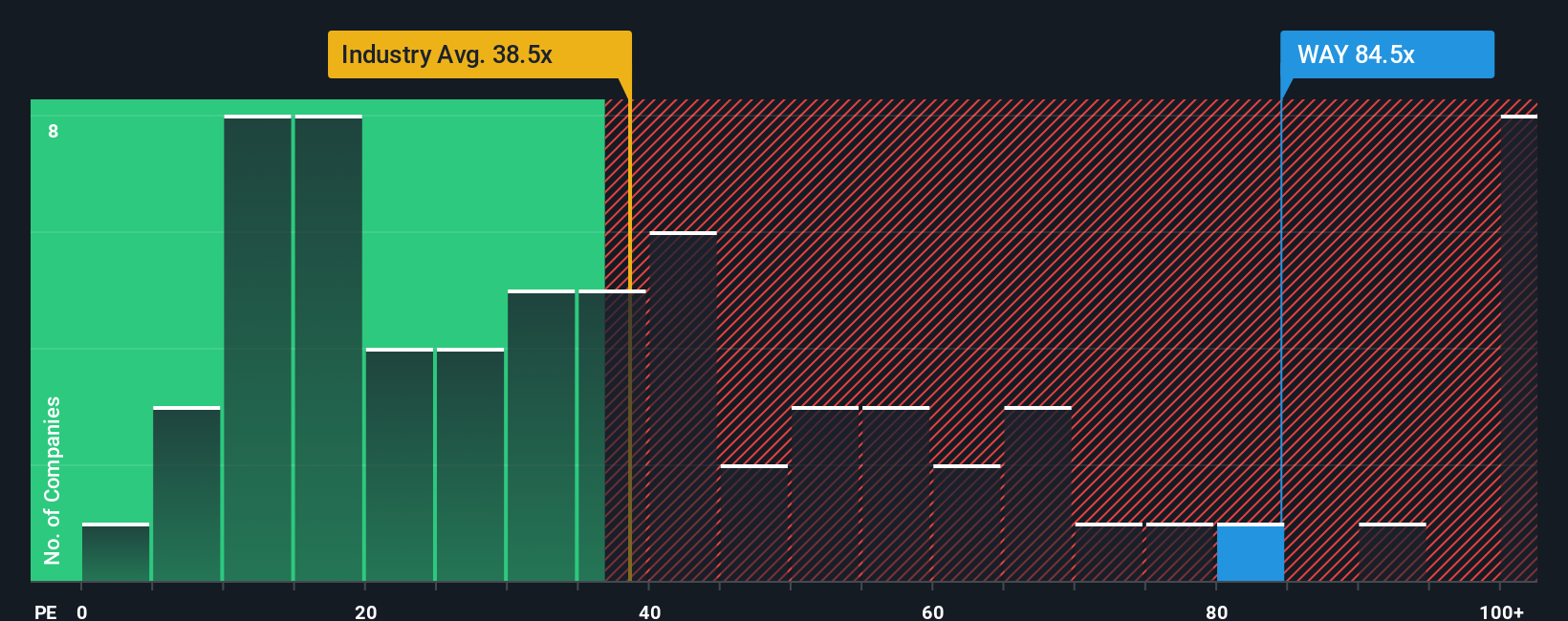

While the narrative fair value points to upside, the earnings multiple tells a tougher story. Waystar trades on a 56.5x P/E, richer than the global Healthcare Services average of 31.9x and above a fair ratio of 32x, which suggests meaningful de rating risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waystar Holding Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Waystar Holding.

Ready for your next investing move?

Do not stop at a single opportunity; use Simply Wall Street's powerful screener to uncover fresh ideas and position your portfolio ahead of the crowd.

- Target reliable cash generators by scanning these 13 dividend stocks with yields > 3% that can support income focused strategies through changing market cycles.

- Seize high potential growth stories by tracking these 914 undervalued stocks based on cash flows where current prices still trail long term cash flow prospects.

- Ride innovation at the frontier by following these 79 cryptocurrency and blockchain stocks that are reshaping payments, settlement, and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Waystar Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAY

Waystar Holding

Develops a cloud-based software solution for healthcare payments.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion