- United States

- /

- Medical Equipment

- /

- NasdaqCM:UFPT

UFP Technologies, Inc.'s (NASDAQ:UFPT) 29% Price Boost Is Out Of Tune With Earnings

UFP Technologies, Inc. (NASDAQ:UFPT) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 83% in the last year.

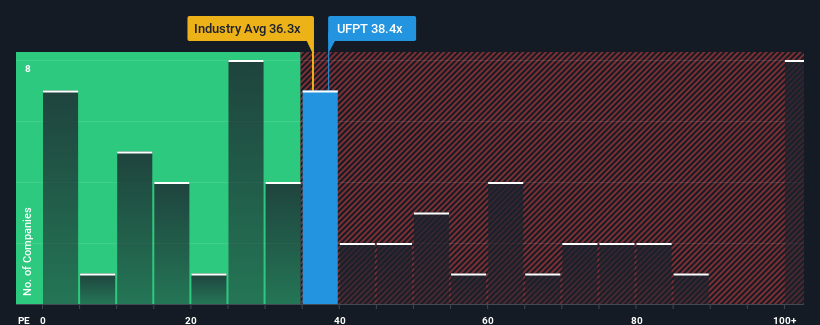

After such a large jump in price, UFP Technologies' price-to-earnings (or "P/E") ratio of 38.4x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 16x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

UFP Technologies certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for UFP Technologies

How Is UFP Technologies' Growth Trending?

UFP Technologies' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 13% last year. This was backed up an excellent period prior to see EPS up by 173% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 11% each year during the coming three years according to the three analysts following the company. With the market predicted to deliver 10% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's curious that UFP Technologies' P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

Shares in UFP Technologies have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that UFP Technologies currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with UFP Technologies.

If these risks are making you reconsider your opinion on UFP Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:UFPT

UFP Technologies

Designs and manufactures solutions for medical devices, sterile packaging, and other engineered custom products in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success