- United States

- /

- Medical Equipment

- /

- NasdaqCM:UFPT

Should UFP Technologies' (UFPT) Strong Sales Growth Withflat Earnings Prompt a Closer Look at Its Margins?

Reviewed by Sasha Jovanovic

- UFP Technologies announced third-quarter 2025 financial results on November 3, reporting sales of US$154.56 million, up from US$145.17 million a year earlier, while net income and earnings per share remained essentially unchanged.

- This illustrates that although the company delivered impressive revenue gains, its profitability metrics held steady over the same period.

- We'll now examine how robust revenue growth alongside flat earnings per share may influence UFP Technologies' investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

UFP Technologies Investment Narrative Recap

To be a shareholder in UFP Technologies, you need to believe in the company's position as a key supplier within the medical device sector, with growth driven by expanding demand for sophisticated components and packaging. The latest quarterly results showed robust sales gains but flat earnings per share, which suggests near-term margin expansion remains the major catalyst to watch, while contract concentration with large customers still stands out as the main business risk. Based on this release, neither the catalyst nor the risk profile has changed in a material way for the short term.

Among recent announcements, UFP Technologies' inclusion in the Russell 2000 Dynamic Index in June 2025 stands out. This event, while primarily increasing exposure among index-tracking funds, reinforces the business's growing profile within the medical device supply chain, a trend that complements the ongoing focus on margin recovery following operational challenges at the AJR facility.

By contrast, investors should be especially attentive to how any changes in major customer relationships could quickly impact revenue concentration risk, as...

Read the full narrative on UFP Technologies (it's free!)

UFP Technologies' narrative projects $694.3 million revenue and $96.3 million earnings by 2028. This requires 5.7% yearly revenue growth and a $29.2 million earnings increase from $67.1 million.

Uncover how UFP Technologies' forecasts yield a $329.50 fair value, a 66% upside to its current price.

Exploring Other Perspectives

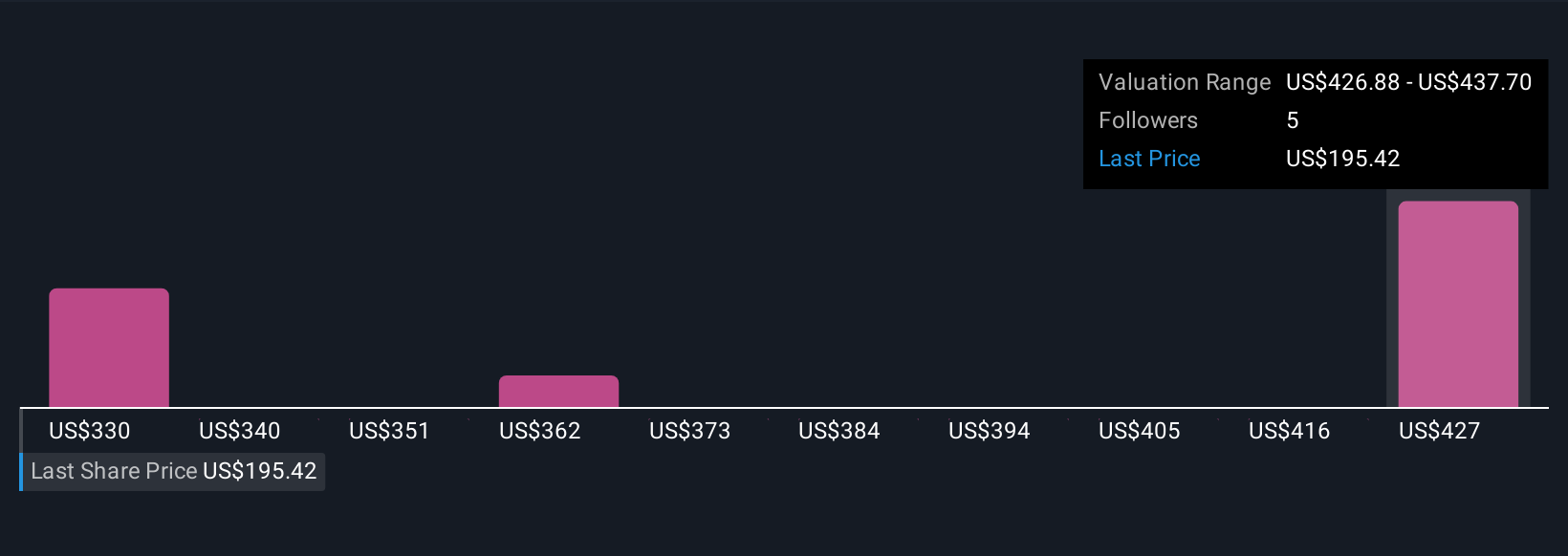

Simply Wall St Community members have posted three fair value estimates for UFP Technologies, ranging from US$329.50 to US$428.97 per share. Several contributors point to recent sales growth as a catalyst, but the flat earnings per share this quarter remind you to look closely at what drives future profitability before forming a view.

Explore 3 other fair value estimates on UFP Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own UFP Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UFP Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UFP Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UFP Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:UFPT

UFP Technologies

Designs and manufactures solutions for medical devices, sterile packaging, and other engineered custom products in the United States.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives