- United States

- /

- Medical Equipment

- /

- NasdaqCM:UFPT

A Fresh Look at UFP Technologies (UFPT) Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

See our latest analysis for UFP Technologies.

While UFP Technologies’ share price has rebounded 11.3% over the past month, long-term investors are likely more focused on the company’s challenging year, with a 12-month total shareholder return of -26.5%. That pullback stands in contrast to its impressive 376.8% total return over five years. This highlights how momentum has softened from previous highs as the market reassesses growth prospects and risk.

If you’re weighing what else might be gaining traction in the healthcare sector, it’s a great time to explore See the full list for free.

With shares trading well below their price target and strong multi-year gains in the rearview, the question now is whether UFP Technologies is temporarily undervalued or if the current market price fully reflects its future prospects.

Most Popular Narrative: 33.4% Undervalued

With a narrative fair value set at $329.50, UFP Technologies is trading well below what analysts believe it could be worth, given its last close of $219.57. The current gap between the share price and projected valuation has many reviewing the key drivers behind these numbers.

The expansion of manufacturing capacity and product development centers in the Dominican Republic, along with new program launches for robotic-assisted surgery customers, sets the stage for sustained revenue growth tied to increased demand for sophisticated medical device components and packaging solutions. Robust growth in multiple medical end markets, including patient services, interventional, surgical, and wound care, reflects the tailwind from a growing, aging population and rising prevalence of chronic diseases. These factors are likely to accelerate top-line growth as channel inventory destocking is now behind the company.

Curious how ambitious expansion, a focus on efficiency, and next-level product launches fuel this price target? This narrative is built on bold assumptions about growth, margins, and market leadership. Find out which strategic moves make analysts confident the upside is real.

Result: Fair Value of $329.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few major customers and ongoing operational hiccups could limit gains if new contracts or process improvements do not meet expectations.

Find out about the key risks to this UFP Technologies narrative.

Another View: Is the Market's Price Justified?

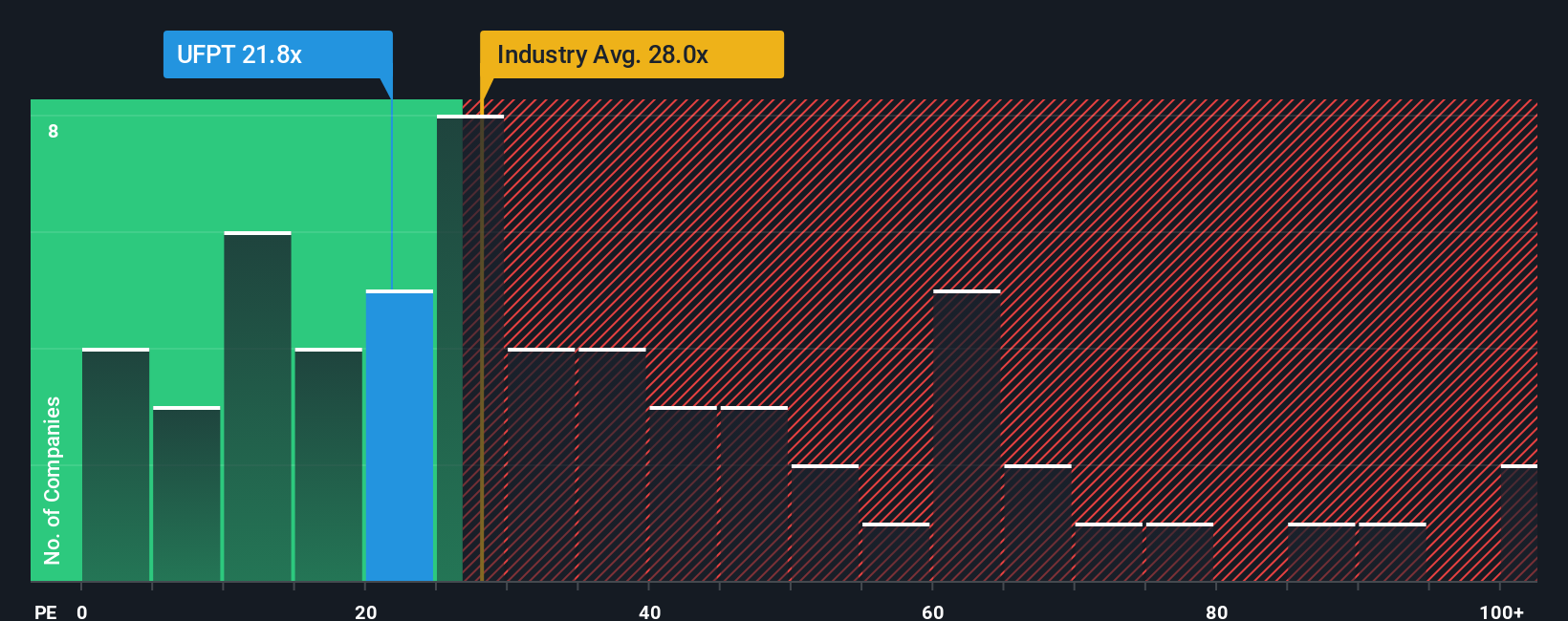

Looking from another angle, UFPT’s price-to-earnings ratio stands at 25.2x. This is higher than both the peer average of 23.4x and the fair ratio of 20.6x, but lower than the broader US Medical Equipment industry average of 27.5x. This gap hints at possible valuation risk if expectations for future growth soften, or it may reflect perceived quality. Could the current premium be maintained, or is a correction likely?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UFP Technologies Narrative

If you'd like to take a fresh look at the numbers and build your perspective from the ground up, you can do so quickly yourself. Do it your way

A great starting point for your UFP Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Want an edge this market cycle? Use the Simply Wall Street Screener to spot fresh opportunities before everyone else. The next big winner could be one click away.

- Capture high yields now by checking out these 15 dividend stocks with yields > 3% with annual returns over 3% and strong payout histories.

- Tap into early-stage innovation by reviewing these 26 AI penny stocks that are harnessing artificial intelligence for explosive potential.

- Strengthen your portfolio by scouting these 908 undervalued stocks based on cash flows that trade below their intrinsic value based on solid cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:UFPT

UFP Technologies

Designs and manufactures solutions for medical devices, sterile packaging, and other engineered custom products in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives